- Rate Of Interest in AI and also ChatGPT has actually enhanced over the previous couple of months.

- Yet, after a troubled 2022 and also the hideaway in February, capitalists continue to be careful.

- In this short article, we will certainly check out the 5 phases of an economic bubble, recommending AI might currently be going into stage 2.

Considering that ChatGPT happened, a brand-new subject has actually controlled the discussions of techies and also capitalists: expert system.

Searches on Google around the world for the term “AI” (expert system) are up around 30 percent because the start of the year.

Resource: Google

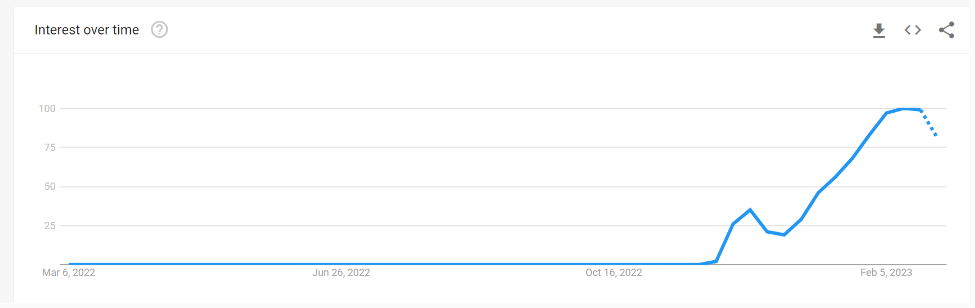

There has actually additionally been a rapid rise in look for the term ChatGPT over the last number of months.

Resource: Google

We have all, somehow, experimented with a device to see what this innovation can do.

On the financial investment side, however, we have actually not yet seen any kind of unique exhilaration. Financiers are still careful after the sharp decrease in 2022, and also the retracement in February (after an exceptional January) has actually removed the little positive outlook we had.

The graph over programs a huge spike in the Worldwide X Robotics & & Expert System ETF (NASDAQ:-RRB- this year. Nonetheless, it is necessary to keep in mind that the fad complies with the more comprehensive stock exchange, with a substantial decrease in rate in February.

Yet as constantly, the minute the more comprehensive market begins to increase once more (not an inquiry of if, however when), the story will certainly alter, so I choose to speak about it today with a clear and also kicked back mind, far from the hangover of the rallies.

5 Phases of a Financial Bubble

The adhering to describes the primary attributes of the development and also bursting of speculative bubbles to make sure that you can acknowledge them if and also when they take place in the future.

1. Secret Occasion

The essential occasion is generally innovation or an uniqueness in the marketplace. For instance, the Web in the dot-com bubble, subprime home mortgages that were packaged and also marketed with high returns and also marginal danger in CDOs in 2008, and also train shares or the carry-over device in the situation of ’29.

This uniqueness, which might additionally matter on a technical degree, nonetheless starts the following action, the self-reinforcing story.

2. Self-Reinforcing Story

When the media begins to follow suit, as they constantly do, overemphasizing (favorably in these circumstances) the brand-new innovation, the disastrous influence it will certainly carry culture, and also all the results and also advantages it will certainly give the globe. The very early supervisors start to framework and also develop items around the subject, influencers, and also celebs raise passion by getting to the masses. The marketplace gamers ensure that the message of brand-new innovation = brand-new chances = cash makes it through.

3. FOMO

This is where the 3rd stage starts, referred to as FOMO (anxiety of losing out), which merely indicates the anxiety of being neglected, of being the last to sign up with the event. Seeing your next-door neighbor, coworker, or buddy investing and also making a lot cash, you encourage on your own that you need to participate this brand-new company, lest you lose out on the following wave of earnings.

4. Loss of Rationality

The 4th phase is the most awful. All rational patterns damage down. Shedding supplies that remain to expand at double-digit prices, firms without any revenues that delight brand-new capitalists on a daily basis (see meme supplies), discussions that are currently only concentrated on a distinct team of supplies described as the following Microsoft, the following Meta, the following Google.

There is no taking a look at principles, no taking a look at the marketplace overall, no taking a look at development potential customers, and also no taking a look at the amount of years of revenues it will certainly require to cover evaluations. You do not fret about finance; worst of all, you do not believe that worths will at some point break down and also go back to regular.

5. Collapse

The 5th stage constantly comes, and also it is the cruelest. It is the go back to normality, which generally accompanies an excessive collapse in evaluations. The self-reinforcing device operates in opposite, and also every person ends up being persuaded that, offered the degrees got to, the entire circus did not make much feeling besides. However, this is additionally when capitalists involve terms with their losses; some discover their lessons, while others do not.

I do not understand if expert system will certainly be the following bubble, however stage 1 might be involving an end, and also stage 2 has actually simply started, so we’ll need to supervise the following couple of months to see if there are any kind of advancements because respect. We will see, however at the very least currently we understand just how the procedure unravels.

***

Please Note: This short article is created for informative objectives just; it does not comprise a solicitation, deal, recommendations, therapy, or referral to spend. Thus, it is not meant to incentivize the acquisition of properties at all. I want to advise you that any kind of kind of property is reviewed from numerous perspectives and also is very dangerous and also, as a result, any kind of financial investment choice and also the connected danger continue to be with the financier.