Wall Road will watch Costco’s COST inventory intently this week with the meals and normal merchandise retailer set to report its fiscal fourth quarter outcomes on Thursday, September 26.

Let’s see if it’s time to purchase Costco’s inventory as earnings method and take a look at how the majority scale retailer stacks as much as a few of its opponents corresponding to Walmart WMT and Amazon AMZN.

Costco’s This fall Expectations

Like Walmart, Costco has strived to increase its digital development to compete in opposition to Amazon. Final quarter, Costco’s e-commerce gross sales rose 21% 12 months over 12 months with 12% development anticipated throughout This fall. General, Costco’s This fall gross sales are anticipated to be up 1% to $79.75 billion.

On the underside line, This fall EPS is predicted to extend 4% to $5.05. Notably, Costco has surpassed the Zacks EPS Consensus for six consecutive quarters posting a mean earnings shock of two.32% in its final 4 quarterly studies.

Picture Supply: Zacks Funding Analysis

Costco’s Development Trajectory

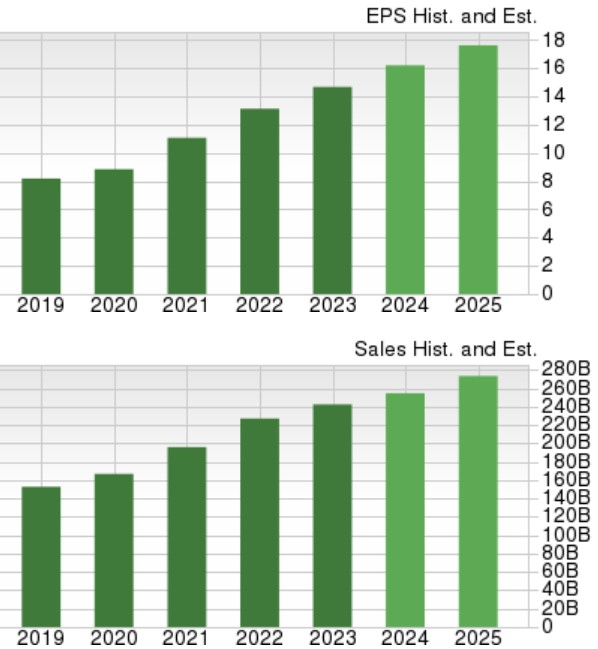

Primarily based on Zacks estimates, Costco’s whole gross sales at the moment are projected to be up 5% in fiscal 2024 and are forecasted to rise one other 7% in FY25 to $273.26 billion. Annual earnings are presently slated to increase 10% this 12 months and are projected to extend one other 9% in FY25 to $17.65 per share.

Picture Supply: Zacks Funding Analysis

Efficiency & Valuation Comparability

Costco shares have soared +36% 12 months up to now which has trailed Walmart’s +53% however topped Amazon’s +27% and the benchmark S&P 500’s +20%. Even higher, over the past three years, COST is up almost +100% to impressively outperform the broader indexes, Amazon’s +14%, and even Walmart’s +70%.

Picture Supply: Zacks Funding Analysis

Nevertheless, at present ranges of simply over $900, COST is at a 51.1X ahead earnings a number of in comparison with the benchmark’s 24.2X.

Regardless of being a retail chief, Costco’s inventory additionally trades at a noticeable premium to Walmart and Amazon which commerce at 33.1X and 40.8X ahead earnings respectively.

Picture Supply: Zacks Funding Analysis

Backside Line

After such a pointy YTD rally, Costco’s inventory lands a Zacks Rank #3 (Maintain). Though Costco’s enlargement stays compelling, there might actually be higher shopping for alternatives given the corporate’s valuation. That stated, COST ought to stay a viable long-term funding particularly if Costco can attain or exceed its This fall expectations.

7 Finest Shares for the Subsequent 30 Days

Simply launched: Consultants distill 7 elite shares from the present listing of 220 Zacks Rank #1 Robust Buys. They deem these tickers “Most Probably for Early Value Pops.”

Since 1988, the total listing has overwhelmed the market greater than 2X over with a mean achieve of +23.7% per 12 months. So be sure you give these hand picked 7 your speedy consideration.

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.