Oil shares like ExxonMobil (NYSE: XOM) can have large ups and downs. The inventory was hammered throughout COVID-19, however has rebounded to outperform the S&P 500 on an annualized foundation over the previous 5 years.

It is an important improvement for a blue-chip firm that many traders gave up on after years of the inventory delivering middling outcomes. However that was then, and we’re speaking about now. Extra particularly, ought to traders nonetheless be placing their cash in ExxonMobil inventory?

Listed below are three observations about ExxonMobil inventory right now, and whether or not it is a purchase.

1. Oil costs stay robust

Simply since you should not overly depend upon the oil trade to purchase or promote shares doesn’t suggest you must ignore it fully. Oil costs have remained excessive sufficient for built-in oil firms like ExxonMobil, which discover fossil fuels and refines them to make wholesome income.

Oil costs have steadied primarily between $60 and $90 per barrel over the previous few years:

WTI Crude Oil Spot Price knowledge by YCharts

The Permian Basin is a big manufacturing location for ExxonMobil, producing oil at roughly $38 per barrel from present wells, based on a 2024 survey of oil producers. So, that is comfortably worthwhile for a corporation like ExxonMobil, which has a bigger dimension and scale than your typical oil exploration firm. Break-even factors are even decrease in Guyana, a world exploration area producing oil for between $25 and $35 per barrel.

How lengthy will oil costs keep robust? It is inconceivable to know, however present geopolitical tensions, as unlucky as they’re, might help increased costs the longer they drag on. That is one thing traders might want to watch over time.

2. Glowing financials

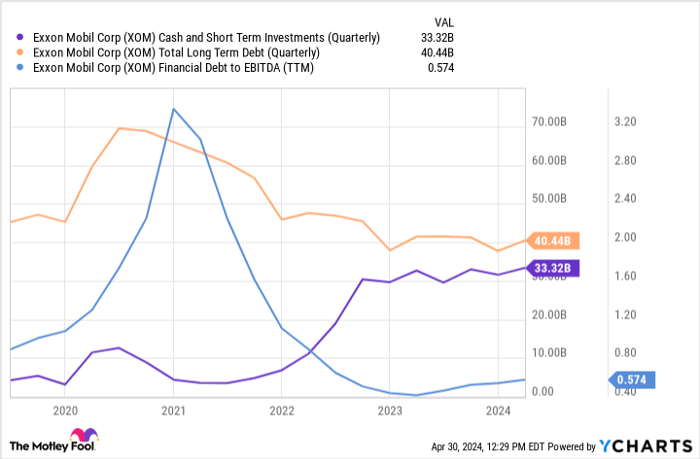

ExxonMobil is poised to shine when the oil trade inevitably experiences a downturn. The previous few years of strong income have enabled ExxonMobil to shore up its stability sheet. Immediately, leverage is sort of zero, based mostly on a $33 billion money hoard that leaves web debt at simply $7 billion.

XOM Cash and Short Term Investments (Quarterly) knowledge by YCharts

The corporate is a well-known dividend inventory. Administration has paid and raised the dividend for 42 consecutive years, enduring the ache of a number of recessions and oil trade downturns. Given ExxonMobil’s implausible stability sheet, it appears extremely doubtless the dividend will survive future turmoil, making the corporate an eventual Dividend King. Traders get a strong 3.2% dividend yield at right now’s share value.

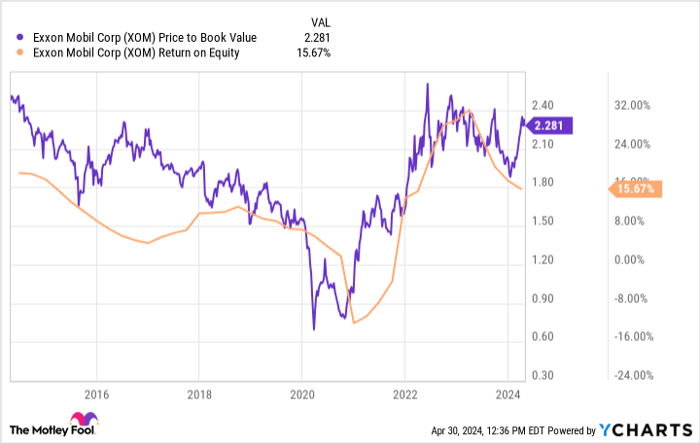

3. Shares are buying and selling close to decade highs

Traders in ExxonMobil have loads to be enthusiastic about right now. The dividend is as secure as ever, the stability sheet is in wonderful situation, and income are nonetheless rolling in due to increased oil costs. Naturally, optimism pushes shares increased, and ExxonMobil is about as excessive as ever.

When you value the asset-rich ExxonMobil by its ebook worth, its price-to-book value ratio is 2.3, roughly its highest charge in 10 years.

XOM Price to Book Value knowledge by YCharts

ExxonMobil can be driving a equally robust return on equity because the final time it was this costly.

Is ExxonMobil a purchase?

A number of statements could be true. On one hand, ExxonMobil is seemingly justifying its increased valuation with rock-solid fundamentals and wholesome oil costs which are bringing in income. On the opposite, these nice circumstances should doubtless maintain up for shares to keep up this momentum, and it is unclear simply how far more upside there may be for traders shopping for shares proper now.

This hemming and hawing over ExxonMobil’s price ticket is a clear maintain sign.

Traders who’ve loved the experience from a cheaper price level should not essentially look to promote, as a result of ExxonMobil is in implausible form as a enterprise and is poised to proceed creating worth for long-term traders. However the long run is important right here. Traders nonetheless on the surface trying in ought to think about ready for some eventual volatility to shake up the share value, or no less than depart some funds to purchase extra sooner or later.

Do you have to make investments $1,000 in ExxonMobil proper now?

Before you purchase inventory in ExxonMobil, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 best stocks for traders to purchase now… and ExxonMobil wasn’t one among them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $525,806!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Could 3, 2024

Justin Pope has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.