Let’s examine what historic macroeconimic information tells us about that.

For the reason that U.S. is the lead financial system, representing about 25% of the worldwide financial system by way of absolute GDP in {dollars}, and being the greenback the reserve forex, we’ll deal with the U.S. information. Nothing signifies that the U.S. goes to lose this management quickly, and it has been within the lead for round a century already.

To start with, right here is at this time’s information. The SP500 is at 5.137,08, actually a brand new all time excessive. The U.S. rate of interest is 5.5%. This can be a excessive curiosity. The unemployment is low 3.7%, and it has been like that for a number of months. Lastly, inflation is at 3.1%, a suitable fee, after being as excessive as virtually 9% again in 2022. That’s the reason the curiosity bought so excessive just lately, to ensure inflation got here down because it did. Now that each unemployment fee and inflation are throughout the Fed targets, there isn’t a want to vary the rate of interest. Focusing solely on this information, we are able to solely say we’re in entrance of a robust financial system. So this shouldn’t be a foul second to speculate. Nevertheless, excessive rate of interest is a warning signal.

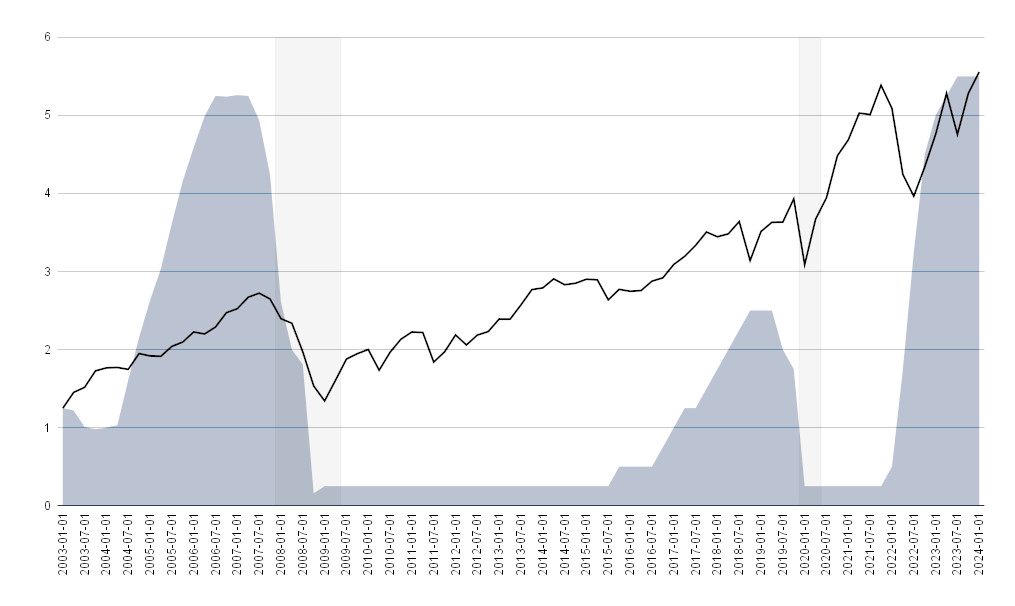

Let’s put that within the context of the next historic graph. It exhibits the SP500 worth [black], the U.S. rate of interest [blue], and with the recession intervals [gried out].

We are going to look additional again in time later. With this 10 12 months context what we are able to say is that, we solely lived the same state of affairs in 2019, have been the rate of interest was comparatively increased than earlier than and the SP500 value was additionally excessive. Later when COVID hit, unemployment grew quickly, SP500 plunged round 40%, and the Fed shortly helped decreasing the rates of interest. When the Fed helped, the financial system recovered.

This is only one instance, let’s look additional again in time. Right here we are able to additionally see the 2008 disaster. And as you may see the sample is analogous. Pursuits and costs go up in a robust financial system, then curiosity and value get caught, and if a recession hits, costs go down, the Fed helps decreasing the rates of interest to assist, and ultimately the financial system and SP500 value recovers.

March 2024, additionally resembles 2006. SP500 was at its all time excessive, curiosity was excessive 5.25%, and the robust financial system at the moment based however not solely on the actual state sector, as at this time we’d say it’s pushed by the Tech sector and the latest AI developments. In 2006, issues stayed good for a pair extra years. In 2008 the disaster got here, SP500 fell round 50%, and unemployment raised. Equally, the fed helped decreasing the rates of interest, and the financial system and the SP500 began to get well.

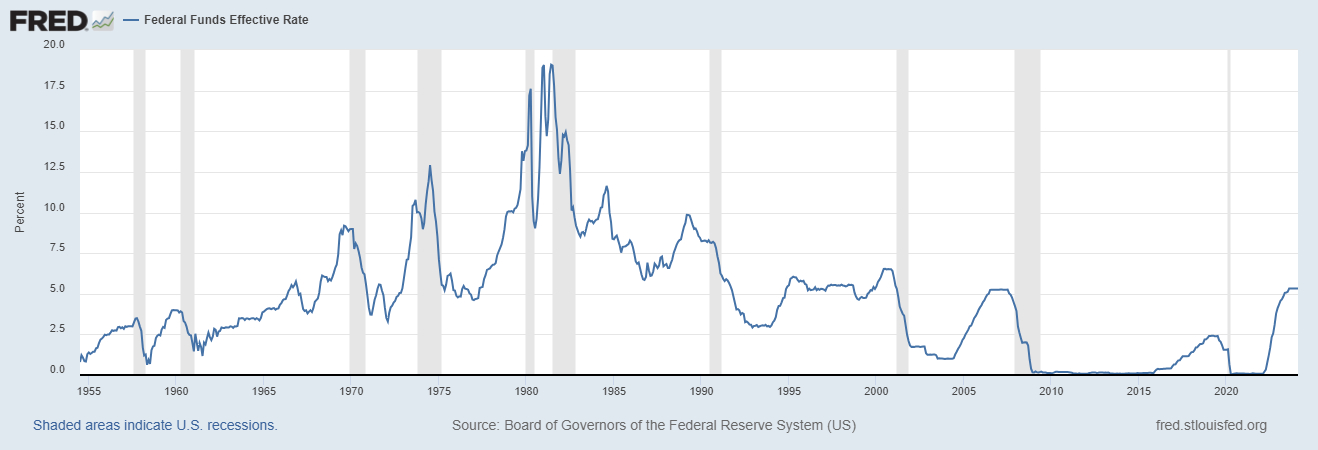

We may look again to 2001 and the dot-com bubble, or on the 10 recessions since 194. We are going to discover not equal however very comparable patterns. For instance, as it’s anticipated, each time a recession got here, the Fed lowered rates of interest and the recession ended.

Therefore, in macroeconomic phrases, an excellent second to speculate is one by which the rate of interest is low, after being excessive. And the SP500 index value low, far beneath its highs. For instance, between 20% to 50% beneath the earlier highs. We often discover such second in a recession interval.

Does that imply that we must always solely make investments when the curiosity is low and the worth is low?

No, it will probably take years to seek out a kind of. It will likely be definitely good if such an excellent second comes sooner or later, however ready could make us lose good years. E.g., in 2006 we nonetheless had 2 extra good years, and in 2014 we nonetheless had 5 good years. However nobody is aware of when the following disaster will come and the way deep it is going to be. We simply know that when it comes, when the Fed helps decreasing the rates of interest, likelihood is that could be a nice second to speculate, as historic information exhibits.

Is March 2024 an excellent second to speculate?

Given the present macroeconomic information, we are able to say it’s not a kind of clearly good moments. However the financial system is robust, so it nonetheless appears an okay second. One factor to observe is the rate of interest. A excessive rate of interest prior to now, has been many instances a warning sing. So we’ll keep vigilant.

In future articles, we’ll hold analyzing the macroeconomy because it modifications. We may even analyze in additional element the final 10 crises. We are going to present precise numbers of how totally different individuals may have invested throughout these crises and what would have occurred. For instance, evaluate an investor that invests month-to-month within the SP500 to 1 that invests extra when the curiosity and the worth are low.

We are going to hold checking till we discover the following good second to spend money on the inventory market. Keep tuned!