Mastercard (NYSE: MA) is without doubt one of the largest fee processors on the earth, sharing an efficient duopoly with Visa (NYSE: V). Mastercard has rewarded traders with big development over time, and the inventory has superior a large 500% over the previous decade alone. However is that this one of the best fee processor to purchase proper now? It’d pay to do a little bit of comparability buying before you purchase.

What does Mastercard do?

Though shoppers typically take into account the bank cards they’ve of their wallets Credit cards or Visas, the reality is that the playing cards are issued by different firms. The logos actually simply signify that Visa and Mastercard deal with the back-end work of approving and monitoring using these playing cards. Do not underestimate what this implies — the know-how and world community that Mastercard (and Visa) have created is spectacular. And, maybe much more vital, the methods are extremely safe.

Picture supply: Getty Pictures.

The way in which Mastercard makes cash is by charging a tiny payment for each transaction that strikes via its processing community. A couple of cents right here and some {dollars} there would not sound like a lot, however if you course of $2.5 trillion {dollars} value of transactions in a single quarter, the numbers begin to add up. Revenues and earnings have been on a reasonably regular upward climb for many years, exhibiting the power of Mastercard’s underlying enterprise.

Principally, Mastercard (and Visa) have been on the forefront of a shift from money to card/digital funds. That shift is more likely to preserve going, notably as on-line buying expands its attain. And since making certain the protection of transactions is simply as vital as merely facilitating these transactions, it appears doubtless that the 2 largest fee processors have a protected business place given their potential to spend on frequently upgrading their processes and methods. There are superb causes to imagine that purchasing Mastercard will work out nicely over the long run, in case you personal it lengthy sufficient.

Is Mastercard your best option at the moment?

The issue right here is that virtually all the pieces optimistic about Mastercard’s enterprise might be mentioned about Visa’s enterprise, too. In reality, the 2 have range related development charges over the long run (although Mastercard’s near-term efficiency has been stronger). Nevertheless, there is a refined distinction between the 2 shares at the moment and that exhibits up of their valuation.

For instance, Mastercard’s price-to-sales (P/S) ratio is roughly equal to its five-year common. However Visa’s P/S ratio is barely under its longer-term time period common. The identical story is true of the price-to-earnings (P/E) ratios for these two firms. Utilizing conventional valuation metrics will not lead you to imagine that Mastercard is overpriced per se, however in case you evaluate the corporate to its essential competitor you’ll come away considering that Visa is extra attractively priced.

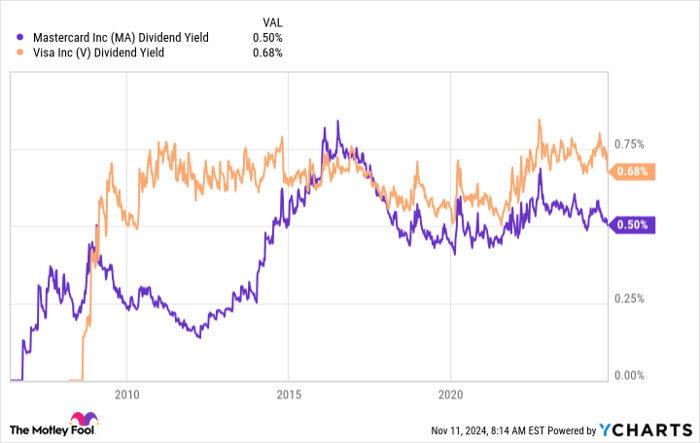

MA Dividend Yield knowledge by YCharts

That flows via to the dividend yield as nicely, a much less conventional valuation instrument. Mastercard’s yield is roughly 0.5% whereas Visa’s yield is 0.75%. Neither of these are giant, however Visa’s yield is 50% bigger. And, extra to the purpose, Visa’s dividend yield is towards the excessive finish of its historic yield vary whereas Mastercard’s yield is extra center of the highway.

All in, Visa seems extra attractively priced despite the fact that it shares most of the similar enterprise attributes that again the long-term funding attraction of Mastercard. Though you can argue that this distinction displays stronger near-term development from Mastercard, the similarity between the 2 companies means that the valuation distinction could also be putting too giant a reduction on the long-term potential Visa provides. Certainly, if Mastercard might assist you to obtain millionaire standing, it appears doubtless that cheaper Visa might do the identical, and with a extra enticing dividend alongside the best way.

Mastercard is ok, Visa simply seems higher at the moment

There’s nothing mistaken with Mastercard, and most long-term development traders would in all probability be advantageous shopping for it. However in case you care about valuation, equally positioned Visa seems like it could be a more sensible choice proper now for these seeking to construct a seven-figure nest egg with long-term investing.

Do you have to make investments $1,000 in Mastercard proper now?

Before you purchase inventory in Mastercard, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 best stocks for traders to purchase now… and Mastercard wasn’t one among them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $870,068!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of November 11, 2024

Reuben Gregg Brewer has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Mastercard and Visa. The Motley Idiot recommends the next choices: lengthy January 2025 $370 calls on Mastercard and brief January 2025 $380 calls on Mastercard. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.