An old Wall surface Road claiming alerts capitalists not to ” Capture a dropping blade.” The claiming has value because typically, one of the most simple profession a financier can make is to acquire a currently existing fad due to the fact that ” The fad is your close friend.”

Nevertheless, some capitalists can make countertrend trading job. Countertrend professions use some distinctive benefits, consisting of:

Much more significant “reversion to the mean” possibility: Necessarily, a financier that effectively times a buy in a beaten-down supply has even more revenue possibility. When a supply or financial investment automobile is extended much in one instructions, it typically breaks back like an elastic band, as well as the reversion to the mean profession can be awesome.

Belief: When a financier purchases a greatly depressed possession, they go versus the grain as well as sell a contrarian frame of mind. If timed properly, the benefits for this sort of profession can be worthwhile.

Capitalist Choice: Like all points in life, there are ” Various strokes for various people.” Some capitalists might like to or jive much better by getting greatly affordable financial investment lorries.

Is Gas Establishing for a Reversion to the Mean?

Taking a look at today’s market, among one of the most ruthless sags remains in Gas. Over the previous year, the USA Gas Fund ETF ( UNG) has actually been down 77%. On the other hand, the ProShares Ultrashort Bloomberg Gas ETF ( KOLD) is up 236% over the exact same time.

In spite of the inadequate efficiency of gas, some technological indicators are starting to show up that recommend that the sag might be obtaining aging, consisting of:

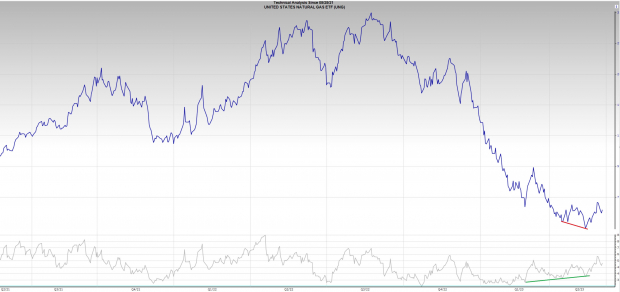

Close Over MA: The 50-day relocating standard is an overview utilized by intermediate-term capitalists to evaluate the fad. After being declined at the bottom of the relocating standard for months, recently, UNG shut over the 50-day relocating standard for the very first time considering that December 2022.

Photo Resource: Zacks Financial Investment Research Study

Favorable Aberration: The Family Member Toughness Index is a technological indication utilized to gauge energy. A favorable aberration takes place when underlying possession’s cost makes brand-new lows while the RSI makes greater lows. Presently, UNG is revealing a huge aberration in between the RSI as well as cost– recommending that bearish energy is slowing down considerably.

Photo Resource: Zacks Financial Investment Research Study

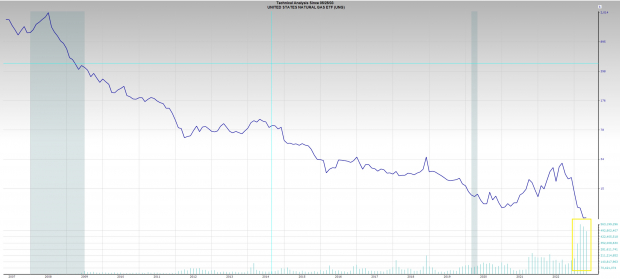

Blowout Quantity: When a greatly beaten-down possession takes lows, it usually includes a blowout or “capitulation” in quantity. In the previous couple of months, UNG has actually videotaped its greatest quantity degrees in background– an indication that beaten-down bulls might be lastly surrendering as well as giving way for a brand-new uptrend.

Photo Resource: Zacks Financial Investment Research Study

Verdict

Purchasing beaten-down properties has its share of positives, consisting of reversion to the mean possible as well as belief. The cost as well as quantity activity in the gas ETF is an instance of a possession that might be established for a substantial reversion to the mean action. If gas is to recuperate in the coming months, all-natural gas-related supplies such as Chesapeake Power ( CHK) as well as Vital Force ( VTLE) stand to profit.

7 Finest Supplies for the Following thirty days

Simply launched: Specialists boil down 7 elite supplies from the present listing of 220 Zacks Ranking # 1 Solid Buys. They regard these tickers “Probably for Very Early Cost Pops.”

Given that 1988, the complete listing has actually defeated the marketplace greater than 2X over with a typical gain of +24.3% each year. So make sure to offer these carefully picked 7 your prompt interest.

Chesapeake Energy Corporation (CHK) : Free Stock Analysis Report

United States Natural Gas ETF (UNG): ETF Research Reports

ProShares UltraShort Bloomberg Natural Gas (KOLD): ETF Research Reports

Vital Energy, Inc. (VTLE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints revealed here are the sights as well as viewpoints of the writer as well as do not always show those of Nasdaq, Inc.