Nvidia‘s (NASDAQ: NVDA) inventory has been an enormous winner every of the previous two years. After surging over 238% in 2023, the inventory has soared roughly 164% this yr, as of this writing. These are two large back-to-back yr beneficial properties which have propelled the corporate to develop into one of many largest on this planet.

The query is, can the inventory hit the market with a three-peat of outsized beneficial properties in 2025? Curiously, the inventory has been in a position to generate returns of 30% or extra for 3 straight years on 4 earlier events and returns of fifty% or higher for 3 straight years twice. It has by no means had 4 years in a row of 30% or extra returns, but it surely did have one stretch the place its inventory rose by 25% or extra for 5 straight years from 2013 to 2017.

The place to speculate $1,000 proper now? Our analyst workforce simply revealed what they consider are the 10 finest shares to purchase proper now. See the 10 stocks »

Let us take a look at why I believe Nvidia can flip in one other yr of robust efficiency in 2025.

Insane demand for AI chips

Any funding in Nvidia facilities round spending on artificial intelligence (AI) infrastructure. The graphics processing units (GPUs) that it designs have develop into the spine of the AI infrastructure buildout, as GPUs can carry out many calculations on the identical time, making them splendid to be used in coaching large language models (LLMs) and working AI inference.

In the meantime, as AI fashions develop into extra refined, they want exponentially extra computing energy, and thus GPUs, to advance. For instance, each Amazon‘s Llama 4 LLM and xAI’s Grok 3 mannequin had been educated on 10 instances as many GPUs as their predecessors educated on.

Demand for GPUs is being pushed by giant hyperscale (firms with huge information facilities) tech firms (comparable to Microsoft, Alphabet, Amazon, and Meta Platforms) in addition to well-funded AI start-ups like OpenAI and Elon-Musk backed xAI. At present, these firms are all racing to create one of the best and strongest AI fashions, resulting in what Nvidia has known as “insane” demand for its newest-generation Blackwell GPUs.

Nevertheless, progress isn’t anticipated to cease, with Nvidia’s largest prospects, by and huge, indicating that they plan to spend extra on constructing out information facilities to assist energy their AI ambitions. Nvidia prospects comparable to Meta Platforms and Alphabet have mentioned the most important threat with AI infrastructure is underinvesting, as they appear to capitalize on what they see as a generational alternative. Oracle, in the meantime, has mentioned it expects robust AI infrastructure progress to proceed over the subsequent 5 to 10 years.

Picture supply: Getty Photos.

A large moat

Nvidia is not the one firm that makes GPUs, but it surely has been in a position to create a large moat largely due its CUDA software program platform. GPUs had been initially developed to hurry up graphics rendering (therefore the identify) in functions like video video games. Nevertheless, as Nvidia appeared to broaden the use case for these chips, it created a free software program program that allowed builders to program its chips for different duties.

Whereas it took time, this led to CUDA changing into the usual on which builders discovered to program GPUs for numerous duties, creating the vast moat it has immediately. In the meantime, it was arguably the usage of its GPUs in cryptocurrency mining that actually helped set the groundwork for Nvidia’s present AI success immediately, because it demonstrated the facility of its GPUs in high-performance computing.

Nvidia has not sat nonetheless following its preliminary CUDA growth and within the years because it has constructed domain-specific microservices and libraries on prime of Cuda, known as CUDA X, to higher optimize it for AI. In the meantime, the corporate has additionally sped up its growth cycle for its GPUs to every year with the intention to stay on the forefront of GPU know-how.

The corporate’s greatest problem for the time being seems to be coming from customized AI chips, comparable to these Broadcom helps develop for purchasers. These are customized chips designed for very particular duties, and thus they are often extra environment friendly. Nevertheless, it additionally takes time to design and manufacture customized chips, and like most customized issues, they’re costlier. In a world racing for AI, Nvidia’s chips are extra accessible and cheaper and have an array of AI-specific microservices and libraries by way of CUDA X.

As such, whereas customized AI chips will possible proceed to take some share, Nvidia nonetheless appears to be like like it’s going to stay the king of AI chips for the foreseeable future.

Cheap valuation

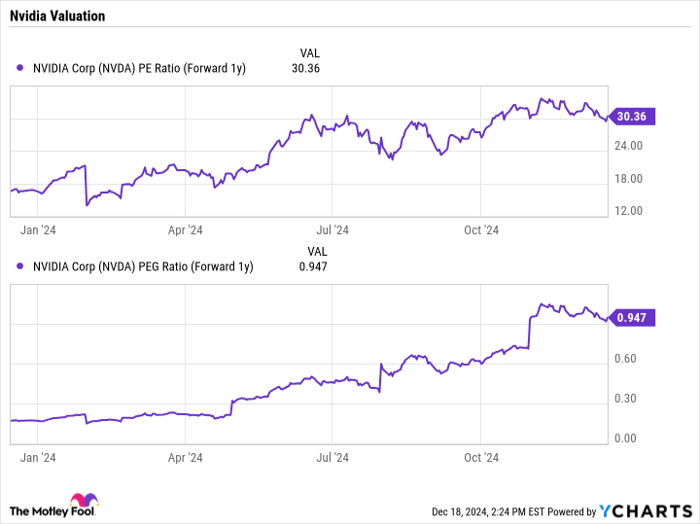

The ultimate cause why I believe Nvidia is poised for one more yr of outperformance in 2025 is its valuation. Regardless of its large beneficial properties over the previous two years, the inventory solely trades a forward price-to-earnings (P/E) ratio of about 30 primarily based on 2025 analyst estimates, and a worth/earnings-to-growth (PEG) ratio of roughly 0.95. A PEG ratio underneath 1 is usually seen as undervalued, however progress shares will usually have PEG ratios effectively above 1.

Information by YCharts.

For a corporation that simply noticed its income develop by 94% yr over yr final quarter and which is projected to see 50% income progress in 2025, that is a lovely valuation. With AI trying to be nonetheless in its early innings and the corporate having a large moat, the inventory appears to be like like a purchase heading into 2025.

Don’t miss this second probability at a probably profitable alternative

Ever really feel such as you missed the boat in shopping for probably the most profitable shares? Then you definately’ll need to hear this.

On uncommon events, our skilled workforce of analysts points a “Double Down” stock advice for firms that they suppose are about to pop. If you happen to’re nervous you’ve already missed your probability to speculate, now could be one of the best time to purchase earlier than it’s too late. And the numbers communicate for themselves:

- Nvidia: if you happen to invested $1,000 once we doubled down in 2009, you’d have $349,279!*

- Apple: if you happen to invested $1,000 once we doubled down in 2008, you’d have $48,196!*

- Netflix: if you happen to invested $1,000 once we doubled down in 2004, you’d have $490,243!*

Proper now, we’re issuing “Double Down” alerts for 3 unbelievable firms, and there is probably not one other probability like this anytime quickly.

*Inventory Advisor returns as of December 16, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Geoffrey Seiler has positions in Alphabet. The Motley Idiot has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Oracle. The Motley Idiot recommends Broadcom and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.