Over the past six months, PrimeEnergy Sources Company PNRG inventory surged 81.8%, considerably outpacing the trade’s 14.1% progress. The corporate outperformed different upstream vitality gamers, together with Diamondback Power, Inc. FANG and APA Company APA, which posted declines of 9.3% and 22%, respectively, throughout the identical interval. With rising international vitality demand and favorable oil and fuel value traits, PNRG’s long-term prospects seem strong.

Picture Supply: Zacks Funding Analysis

Beneath, we discover the corporate’s key fundamentals and strategic initiatives.

Firm Snapshot: PrimeEnergy’s Strategic Method

Established in 1973 and headquartered in Houston, TX, PNRG is an unbiased oil and pure fuel producer. PrimeEnergy’s methods revolve round monetary flexibility, partnerships with main operators and a diversified portfolio of drilling initiatives. Along with its core actions, the corporate owns property resembling a 60-mile offshore pipeline in Texas via a wholly-owned offshore firm and an curiosity in a retail purchasing heart in Alabama, including diversification to its portfolio.

Capitalizing on the Permian Basin’s Wealthy Sources

PrimeEnergy holds substantial property in Texas and Oklahoma, focusing considerably on the Permian Basin. The corporate prioritizes horizontal drilling, enhancing manufacturing whereas minimizing floor disruption.

In 2023, PNRG participated in drilling 35 horizontal wells and accomplished 56 such wells by the tip of the third quarter of 2024. These efforts underscore its dedication to ramping up manufacturing. PrimeEnergy has a 12.5% overriding royalty curiosity in 30,000 acres in West Virginia, though this asset has but to generate revenues, pending future growth.

Amongst its key initiatives, PrimeEnergy contributed to 34 new horizontal wells in Reagan County, TX, within the first quarter of 2024. These wells, operated by Double Eagle and Civitas, goal key formations throughout the Permian Basin. The corporate allotted $140 million for these initiatives in 2024 and plans to speculate one other $95 million in comparable initiatives in 2025.

PNRG recognized 28 potential drilling websites in West Texas for 2026-2027, with an estimated funding of $67 million. The corporate plans to speculate greater than $300 million in horizontal growth in West Texas within the coming years. This forward-looking technique highlights its dedication to leveraging superior drilling strategies and concentrating on high-yield areas.

Portfolio Optimization & Strategic Transactions

PrimeEnergy continues to optimize its asset portfolio via acquisitions and divestitures. Not too long ago, the corporate acquired 100 internet acres in Reagan County for $1.11 million whereas promoting non-core property just like the Japanese Oil Effectively Service Firm for $2.8 million, realizing a acquire of $1.92 million. These transactions reveal PNRG’s concentrate on capital effectivity and its potential to align its portfolio with evolving market alternatives.

Development Catalysts for PrimeEnergy

Enhanced Drilling Focus: PNRG’s investments in horizontal drilling, notably in West Texas, allow greater manufacturing charges and sooner returns than conventional vertical drilling. This strategy aligns with broader trade traits to maximise useful resource restoration.

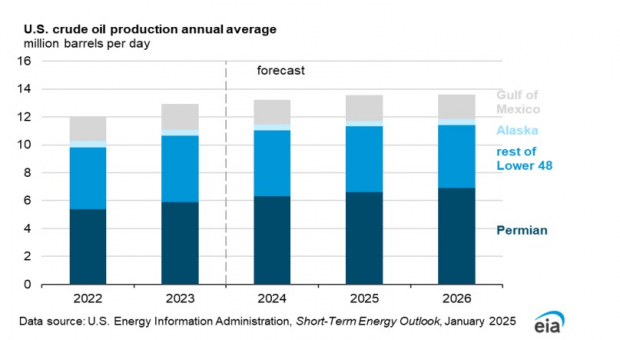

Rising U.S. Oil Output: The U.S. Power Data Administration initiatives document crude oil manufacturing ranges of 13.5 million barrels per day by 2025, pushed largely by the Permian Basin. PrimeEnergy, with vital operations within the area, is poised to profit from these favorable manufacturing dynamics.

Optimistic Value Setting: Pure fuel costs are forecast to rise, with the Henry Hub spot value anticipated to climb from $2.20/MMBtu in 2024 to $3.10/MMBtu in 2025. This upward development, coupled with elevated LNG exports, helps greater income potential for PrimeEnergy’s pure fuel operations.

Operational Efficiency

PrimeEnergy has achieved vital manufacturing progress. For the 9 months ending Sept. 30, 2024, oil manufacturing skyrocketed 131% yr over yr to 1.88 million barrels, whereas pure fuel manufacturing soared 82% to five.03 million Mcf. NGL manufacturing additionally surged 112% to 874,000 barrels. These outcomes spotlight the corporate’s potential to capitalize on favorable market circumstances and enhance properly productiveness.

Valuation

PNRG is at present buying and selling at a trailing 12-month enterprise worth to EBITDA (EV/EBITDA) ratio of two.86X in contrast with the trade common of seven.52X. This means relative undervaluation and the metric stays decrease than the corporate’s friends, together with Diamondback Power (10.52X) and APA Corp. (6.16X), suggesting a possibility for potential traders.

Picture Supply: Zacks Funding Analysis

Challenges to Watch

Regardless of its strengths, PrimeEnergy faces a number of dangers. Geopolitical tensions, potential adjustments in commerce insurance policies and OPEC+ manufacturing cuts may disrupt provide chains or influence value stability. Slower-than-anticipated oil consumption progress in key markets, resembling China, might dampen demand. Growing manufacturing from non-OPEC international locations in 2025, coupled with slower demand progress in Asia, may result in oversupply circumstances and downward strain on costs.

Picture Supply: U.S. Power Data Administration (EIA)

Closing Ideas: Is PrimeEnergy Price Shopping for?

PNRG has demonstrated a strong operational efficiency, sturdy manufacturing progress and strategic investments in high-yield areas just like the Permian Basin. The corporate’s concentrate on horizontal drilling, portfolio optimization and monetary effectivity positions it to capitalize on favorable trade dynamics, together with rising international vitality demand, and constructive oil and fuel value traits.

With a lovely valuation — buying and selling at a trailing 12-month EV/EBITDA ratio of two.86X, considerably beneath trade friends — PrimeEnergy presents a compelling funding alternative. Regardless of dangers resembling geopolitical and macroeconomic uncertainties, the corporate’s strategic initiatives and undervaluation make it a possible purchase for traders searching for publicity to the upstream vitality sector.

Analysis Chief Names “Single Finest Decide to Double”

From hundreds of shares, 5 Zacks specialists every have chosen their favourite to skyrocket +100% or extra in months to come back. From these 5, Director of Analysis Sheraz Mian hand-picks one to have probably the most explosive upside of all.

This firm targets millennial and Gen Z audiences, producing practically $1 billion in income final quarter alone. A current pullback makes now a super time to leap aboard. After all, all our elite picks aren’t winners however this one may far surpass earlier Zacks’ Shares Set to Double like Nano-X Imaging which shot up +129.6% in little greater than 9 months.

Free: See Our Top Stock And 4 Runners Up

APA Corporation (APA) : Free Stock Analysis Report

Diamondback Energy, Inc. (FANG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.