Friday:

Monday:

Over the weekend break, our covered 3 vital proportions to assist decode the marketplace activity as well as the dominating macro style for the economic climate.

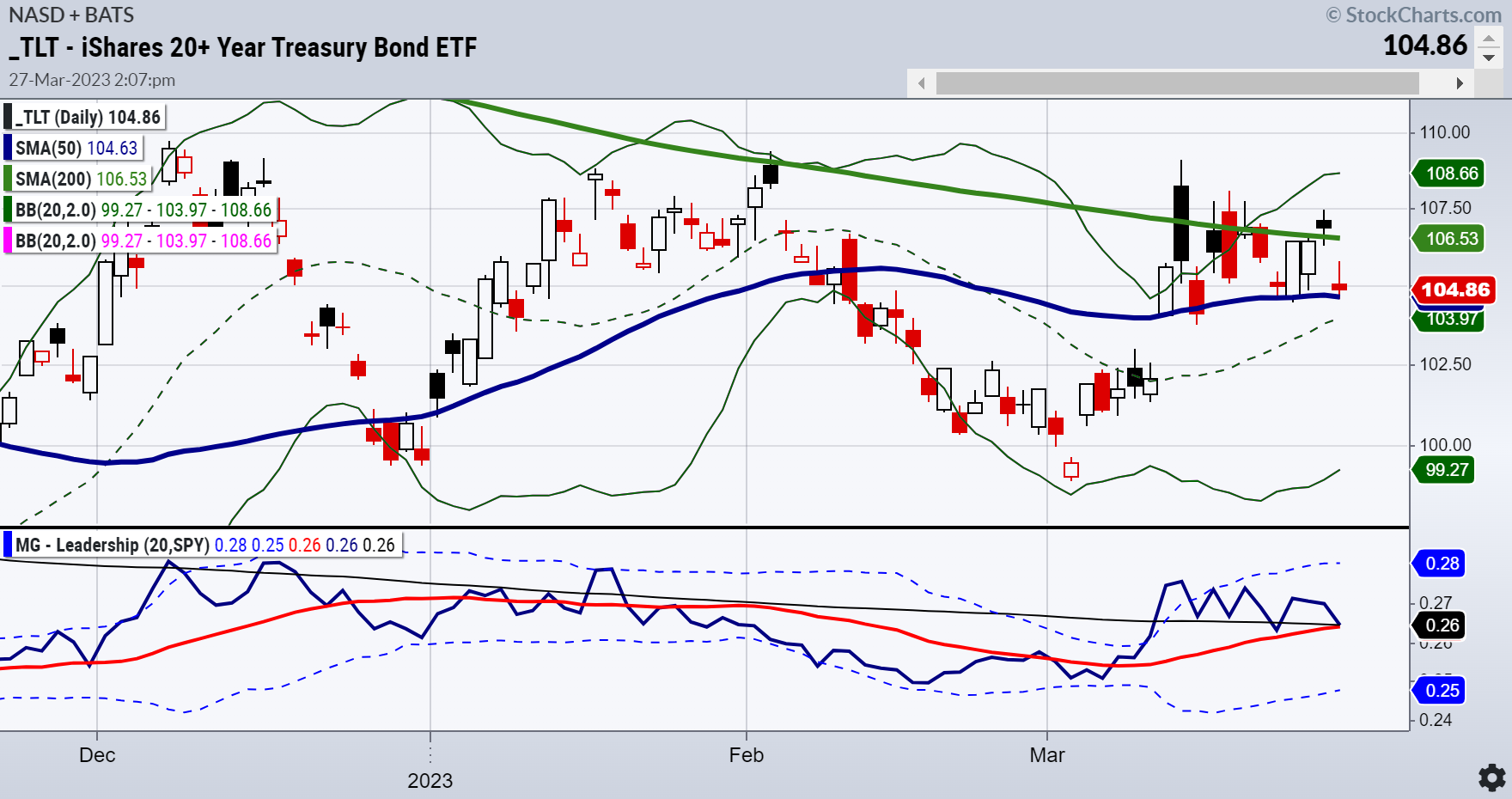

We began with the one in between lengthy bonds () as well as the() All recently, lengthy bonds outshined the SPY with require economic crisis.

Today thus far, bond returns have actually climbed to 3.5%. While decreased a little bit together with semiconductors, was up $70 a barrel, as well as grains as well as sugar rates climbed.

Considering the TLT: SPY Monday, TLTs are doing on the same level with SPY. Economic crisis worries over, hi stagflation?

After That, as if to sustain the stagflation concept with returns increasing as well as the indices in a trading variety, remains to exceed.

Although silver rates likewise dropped, the proportion in between silver as well as gold went into the “rising cost of living concern” area.

For the third proportion, we remain to take a look at the for hints. The buck normally rises when rates of interest do.

Yet the buck decreased versus the euro, currently at 1.07. So we have returns increasing, silver outmatching, as well as the buck decreasing.

Our Tiny Cap All-Stars Design had the most effective everyday returns Monday after the financial institution problems started with great information.

The() can see a more bounce from right here. Yet continues to be stuck in a trading variety.

At the very least we are not seeing IWM head right into economic crisis region. The great information is that the marketplace is hopeful regarding staying clear of economic crisis.

The problem is that the marketplace has actually not yet handled the opportunity of stagflation. And afterwards there is.

A note on Bitcoin from Holden:

One of the most likely circumstance from right here is that we’ll see Bitcoin go sidewards momentarily in this brand-new variety up until a brand-new item of significant information appears to require a break one means or the various other. In case of a failure from right here, we would certainly anticipate BTC to discover assistance around the $25,000 degree, while the clear target from right here is to get the emotional $30,000 degree on a day-to-day closing basis.

ETF Recap

- S&P 500 (SPY) Demands to clear 400 as well as hold 390

- Russell 2000 (IWM) 170 held-so perhaps the proportions are suggesting no economic crisis after all-180 resistance

- Dow (DIA) 325 removed currently requires to hold

- Nasdaq (QQQ) 305 assistance 320 resistance

- Regional financial institutions (KRE) Daily up turnaround. Weekly extra inside the variety of the last 2 weeks

- Semiconductors (SMH) Follow up on that particular vital turnaround w/ 250 assistance

- Transport (IYT) 219 is a degree that has actually resembled a yo-yo cost

- Biotechnology (IBB) Held vital assistance at 125 area-127.50 resistance

- Retail (XRT) Gran held 60-still in the game-especially because that is the January schedule variety reduced