Taiwan Semiconductor Manufacturing (NYSE: TSM) is on a roll. On the heels of a three-year stoop in chipmaking providers, TSMC is dealing with unprecedented manufacturing demand. The synthetic intelligence (AI) surge that began two years in the past appears to have legs for years, and that is not even the entire story — fashionable vehicles want a ton of processors, and the smartphone market can be getting back from an extended downturn.

So, TSMC’s inventory has doubled in 2024. Its market cap has been hovering across the uncommon $1 trillion degree since October.

The place to take a position $1,000 proper now? Our analyst crew simply revealed what they consider are the 10 finest shares to purchase proper now. See the 10 stocks »

On the similar time, TSMC shares are buying and selling at lofty valuation ratios. Is the inventory overvalued at this time, or is TSMC nonetheless an ideal purchase at at this time’s excessive costs?

TSMC seems to be costly

The corporate works in a {hardware} manufacturing trade. It is a high-tech enterprise, far faraway from constructing houses, tractors, or industrial equipment, nevertheless it’s nonetheless a comparatively low-margin enterprise that requires very giant capital investments. Chipbuilding amenities do not develop on timber, you realize.

TSMC’s capital bills added as much as $24.6 billion over the past 4 quarters. That is greater than Apple, Tesla, and Nvidia spent on capital investments — collectively.

Corporations with pricey belongings are likely to develop pretty slowly, and their shares typically commerce as very modest valuation ratios. The ten largest industrial shares, for instance, at the moment commerce at a mean price-to-sales ratio (P/S) of two.5. TSMC’s inventory is price 12.8 occasions gross sales. It is the identical story with price-to-earnings or price-to-free money flows — TSMC’s inventory is hovering at traditionally excessive ratios, and it seems to be costly subsequent to corporations with related enterprise fashions.

TSM PS Ratio information by YCharts

Why you continue to would possibly wish to purchase this dear inventory

The corporate backs up its dear inventory valuation with strong enterprise outcomes.

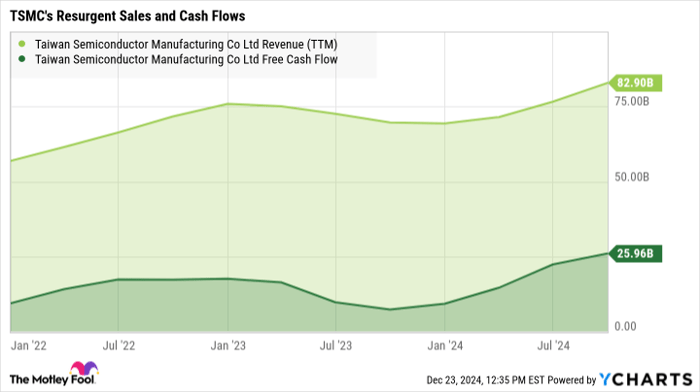

After a brief dip amid the latest scarcity of semiconductor supplies and engineers, TSMC’s gross sales and earnings are hovering once more. Revenues rose 39% yr over yr within the not too long ago reported third quarter. Internet revenue jumped 54% larger in the identical interval, and money earnings actually soared. TSMC’s free money flows practically tripled, rising 172% to $185 billion Taiwanese {dollars} (roughly $5.7 billion in U.S. {dollars}).

TSM Revenue (TTM) information by YCharts

So you might be paying a premium for TSMC shares, nevertheless it’s a world-class enterprise and arguably price each penny of its excessive inventory value. Progress-oriented valuation metrics look fairly affordable with a forward-looking P/E ratio of 23 occasions next-year estimates and a price-to-earnings-to-growth ratio (PEG) of 1.1. Each figures recommend that the present inventory value is nearly proper — neither terribly costly nor significantly low-cost.

TSMC is a stable purchase — however not for each investor

The Taiwanese chipmaking big is a tempting purchase in some ways. TSMC is an effective technique to spend money on the AI growth with out selecting a winner within the chip-design battles. Bear in mind, practically all of the main AI accelerator specialists depend on TSMC and others to truly make the bodily merchandise. Whoever dominates the {hardware} market in the long term, TSMC will most likely profit from all the AI sector’s success.

However you must be snug with the stock’s growth-based valuation first. In any other case, I would advocate a lower-priced chipmaker, or maybe an undervalued provider of AI software and services as a substitute. TSMC could also be a advantageous progress funding, nevertheless it’s not each Wall Road stroller’s cup of refined silicon.

Do you have to make investments $1,000 in Taiwan Semiconductor Manufacturing proper now?

Before you purchase inventory in Taiwan Semiconductor Manufacturing, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Taiwan Semiconductor Manufacturing wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $859,342!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of December 23, 2024

Anders Bylund has positions in Nvidia. The Motley Idiot has positions in and recommends Apple, Nvidia, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.