There is a false impression that traders should make huge bets on particular person shares to achieve success within the inventory market. Nonetheless, quite a few kinds of investments, together with exchange-traded funds (ETFs), can create life-changing funding returns. The massive query is: How briskly are you making an attempt to get there?

Positive, those that wish to develop into millionaires seemingly in a single day should tackle enormous dangers which might be unlikely to repay. Making an attempt to get wealthy quick is nearly all the time a foul technique.

Nonetheless, you probably have some endurance, the Invesco QQQ ETF (NASDAQ: QQQ) may very well be the best choice for producing vital returns with out playing your hard-earned cash away.

Right here is why this exchange-traded fund is the millionaire maker you’ve got been on the lookout for.

Confirmed outcomes and the way the Invesco QQQ does it

Change-traded funds are teams of shares that commerce underneath one ticker image. Typically, ETFs observe a market index or investing fashion. The Invesco QQQ follows the Nasdaq-100, a gaggle of large-cap development shares, primarily within the know-how sector. Huge know-how firms have dominated the inventory marketplace for over a decade because of development traits corresponding to cloud computing and digital promoting. One of the best-known market leaders, often called the “Magnificent Seven” stocks, make up over 42% of the Invesco QQQ in the present day. It has produced extraordinary funding returns over the previous decade:

Knowledge by YCharts.

With a 700% whole return in only one decade, the millionaire-making query is whether or not this efficiency will proceed. There are causes to assume it may possibly. Right now, know-how leaders dominate the trendy financial system. Assume powerhouse firms like Amazon, Meta, Apple, Alphabet, Microsoft, Tesla, and Nvidia. They lead monumental and rising finish markets, together with synthetic intelligence (AI), cloud computing, digital promoting, self-driving autos, and renewable power.

The Nasdaq-100 and Invesco QQQ include dozens of different shares, however this small handful has develop into the muse. Analysts estimate that just about each Magnificent Seven inventory will proceed rising earnings at a double-digit price over the long run. These main contributors to the Invesco QQQ may proceed lifting the ETF to new heights if that occurs.

There’s a catch

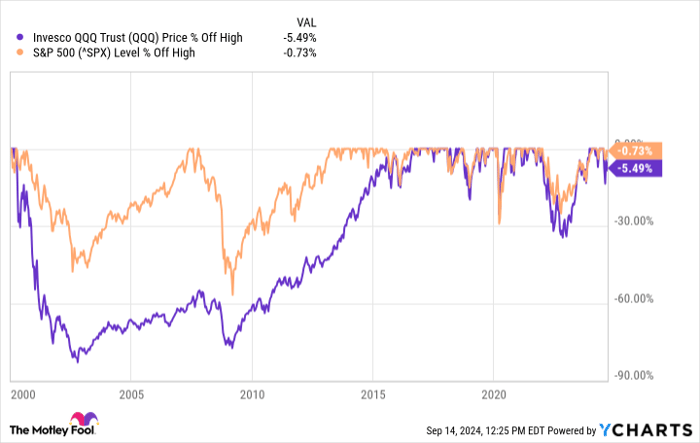

Threat and reward go hand in hand. Whereas the businesses within the Invesco QQQ are primarily large-cap shares with little chapter threat, high-growth know-how shares are susceptible to boom-and-bust market cycles that may create enormous drawdowns. Simply have a look at how far the Invesco QQQ has often fallen from its highs:

Knowledge by YCharts.

Many traders might wrestle to emotionally endure a 30%, 60%, or 75% decline of their funding. That is why portfolio diversification is so essential. Positive, the Invesco QQQ is diversified throughout over 100 shares, however traders must also take into account how a lot threat and volatility their total portfolio might need. Regardless of the Invesco QQQ’s long-term funding returns, investing all of your cash in it would not be clever.

Is the Invesco QQQ a millionaire-maker in the present day?

The massive know-how firms that comprise over 40% of the Invesco QQQ proceed to take pleasure in multi-decade development alternatives. The know-how cycle can generally be risky, however the long-term route appears to be up. So sure, Invesco QQQ is a possible millionaire-making funding.

That stated, the Magnificent Seven has already loved a exceptional two-year run that raises questions about whether know-how shares are as soon as once more in a bubble. Admittedly, no person is aware of when the following market crash will occur or how dangerous will probably be, so concentrate on the long run as an alternative.

Contemplate a accountable funding technique that features portfolio range and dollar-cost averaging. Purchase slowly and commonly, and add financial savings should you can. That approach, you possibly can take pleasure in long-term development whereas managing your threat and maybe even have some additional money helpful if a market downturn does happen.

Do you have to make investments $1,000 in Invesco QQQ Belief proper now?

Before you purchase inventory in Invesco QQQ Belief, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 best stocks for traders to purchase now… and Invesco QQQ Belief wasn’t one in every of them. The ten shares that made the minimize may produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $729,857!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Justin Pope has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.