It has been a yr to recollect for shareholders of information analytics and synthetic intelligence (AI) software program firm Palantir Applied sciences (NYSE: PLTR). The inventory has surged by greater than 160% over the previous yr, and the committee that picks which corporations advantage membership within the S&P 500 added it to the benchmark large-cap index this month. Index inclusion is a badge of honor that acknowledges an organization’s sturdy efficiency and raises consciousness of it amongst buyers.

Palantir’s merchandise, especially its AIP platform, are driving accelerating income development and powerful profitability. Nonetheless, the share value has grown quicker than the underlying enterprise. Ought to shareholders think about promoting whereas they’re forward, or does Palantir have extra room to run?

The inventory has outrun the enterprise

I am not right here to select on Palantir’s enterprise. There’s a lot to be enthusiastic about.

The corporate has emerged as arguably the main AI software program play on Wall Road. It debuted the AIP platform final yr as a device for corporations to develop and deploy bespoke AI purposes, and its income development has steadily accelerated since then. Expertise advisory firm Forrester Analysis recently recognized AIP because the market’s high AI and machine studying platform.

And sure, its inclusion into the S&P 500 has possible generated some shopping for momentum for the inventory. Funds that observe the S&P 500 should add Palantir shares to replicate the index, and plenty of buyers gravitate to S&P 500 corporations as a result of they need to meet strict requirements to get into the index.

The issue is that the inventory value beneficial properties have dramatically outrun the expansion of the enterprise. Palantir’s trailing-12-month income has grown by a complete of round 16%. The inventory’s appreciation has outpaced that by an element of just about 10.

PLTR Revenue (TTM) knowledge by YCharts.

Simply how costly is Palantir?

In actuality, inventory costs at any given time are closely reflective of the market’s degree of enthusiasm for that inventory. A part of investing is recognizing when the market is just too excited or pessimistic.

Proper now, the market’s sentiment towards Palanir is borderline frenzied.

Bear in mind the “the whole lot bubble” of 2020-2021, when zero-percent rates of interest and loose-money fiscal insurance policies put in place to maintain the economic system steady through the pandemic disaster fed right into a speculative bubble throughout development shares, cryptocurrencies, and different property? Although the broad market indexes at the moment are setting new all-time highs once more, many development shares nonetheless commerce at fractions of the valuations they reached on the peak of that bubble.

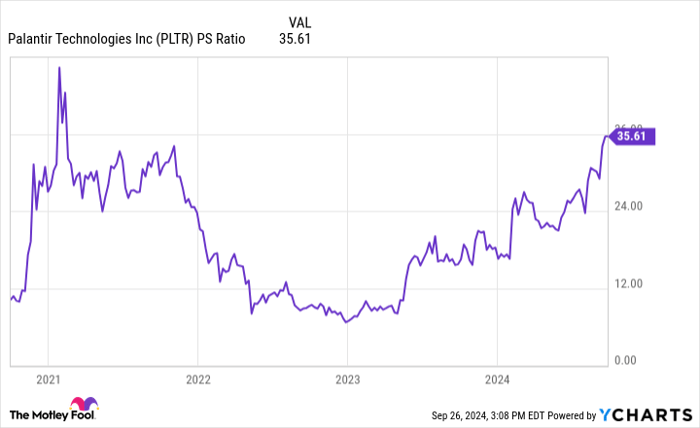

But on a price-to-sales (P/S) foundation, Palantir is approaching the best valuations it carried through the bubble.

PLTR PS Ratio knowledge by YCharts.

Analysts consider the corporate will generate $2.76 billion in income in 2024 and $3.32 billion in 2025. The inventory trades at a ahead P/S of 25 based mostly on subsequent yr’s income estimates. If the inventory ultimately settles all the way down to a long-term P/S ratio someplace in the midst of this wide selection — say, 15 instances income — its chart may go flat or decline for years whereas the enterprise grows sufficient to catch as much as the inventory value.

Ought to buyers promote Palantir?

Palantir’s valuation has arguably entered bubble territory, and quite a few elements may result in that bubble bursting. There’s political uncertainty because the U.S. election approaches. Geopolitical tensions are flaring in Europe and the Center East. Now that U.S. inflation has largely been put again in test, the Federal Reserve has begun slicing rates of interest, which ought to stimulate the economic system. However when such stimulus is required, it is typically as a result of the nation is heading towards a recession.

Inventory bubbles also can pop themselves. Bear in mind, excessive valuations create excessive expectations. Palantir inventory may maintain rising till the corporate inevitably falls wanting the impossibly excessive requirements the market has baked into the share value. As soon as this occurs, the ensuing correction may very well be fierce.

In different phrases, inventory bubbles are like a sport of musical chairs. They at all times finish ultimately.

For buyers, promoting winners whereas they’re nonetheless profitable is tough, and anybody who purchased Palantir as not too long ago as inside the previous few months is probably going sitting on unbelievable beneficial properties and feeling good. However promoting some shares to lock in your beneficial properties is likely to be clever. In any other case, it’s possible you’ll remorse it when the music stops.

Do you have to make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Palantir Applied sciences wasn’t one among them. The ten shares that made the lower may produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our advice, you’d have $743,952!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

Justin Pope has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Palantir Applied sciences. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.