GE Vernova GEV has soared 140% since its April IPO as Wall Road buys shares that can energy the energy-hungry synthetic intelligence age.

Traders ought to contemplate GEV for its potential to develop alongside the power transition and the nuclear power resurgence. Extra Wall Road analysts have picked up protection of GE Vernova lately. GEV additionally provided bullish steering by means of 2028 earlier this month and introduced a dividend and inventory repurchase plan.

GEV’s cooldown over the past month affords an awesome shopping for alternative heading into 2025.

Why Wall Road Loves this Power Transition and Nuclear Power Inventory

GE Vernova went public in April 2024 after GE accomplished its separation into three firms: GE Aerospace (GE), GE HealthCare (GEHC), and GE Vernova. GE Vernova is a pure-play power transition firm rising alongside electrification, nuclear power growth, and past.

GE Vernova boasts that roughly 25% of the world’s electrical energy is generated by its clients utilizing GE Vernova’s applied sciences, together with fuel and wind generators, modern electrification expertise, and far more.

Picture Supply: Zacks Funding Analysis

Wall Road loves GE Vernova as a result of the U.S. authorities is all in on the power transition and nuclear power. The U.S. goals to triple nuclear power capability by 2050 because it makes an attempt to wean itself off of fossil fuels. On prime of that, nuclear will energy energy-hungry AI progress as Meta, Amazon, and others make nuclear power offers.

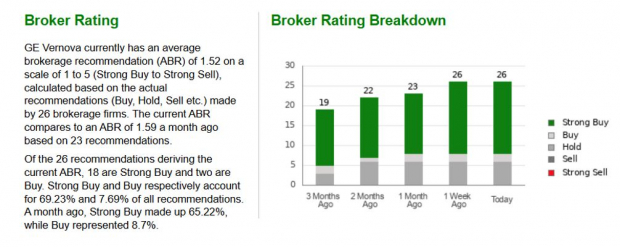

GEV has 26 brokerage suggestions at Zacks, up from 19 three months in the past, with 70% at “Sturdy Buys.”

GE Vernova experiences through three enterprise segments: Energy, Wind, and Electrification. GEV’s steam energy section has supplied nuclear turbine applied sciences and companies for all reactor varieties for many years.

GEV’s Hitachi Nuclear Power division is a number one supplier of superior nuclear reactors, gas, and nuclear companies.

GE Vernova is on the forefront of next-generation small modular nuclear reactor (SMR) applied sciences which can be considered as the way forward for the trade. The U.S. Division of Power chosen GE Vernova to assist construct out a key a part of the next-gen nuclear and uranium trade.

Exterior of nuclear, GE Vernova’s progress pipeline contains electrification software program, energy conversion, power storage, grid options, and extra. GE Vernova can also be streamlining its enterprise and reducing again on its struggling offshore wind unit as inflation and provide chain challenges plague the trade.

Picture Supply: Zacks Funding Analysis

GEV made a splash on December 10 when it declared its first dividend, payable within the first quarter of 2025, and authorized an preliminary $6 billion share repurchase plan.

GEV additionally supplied an up to date sturdy progress outlook by means of 2028. It expects its income to achieve ~$45 billion by 2028, marking a high-single-digit compound annual progress fee for natural gross sales vs. the 2025 base yr (an enchancment from its earlier mid-single-digit outlook).

Zacks estimates name for GE Vernova to develop its adjusted earnings by 194% YoY in 2025 from an estimated $2.26 a share in FY24 to $6.65 a share.

Purchase GEV Inventory for 2025 and Lengthy-Time period Upside?

GE Vernova is the fifth-best performing S&P 500 inventory this yr, placing it up there with Nivida NVDA and fellow nuclear power shares Vistra VST and Constellation Power CEG.

GEV has surged roughly 140% since its market debut on April 2, crushing Nvidia’s 45%, the S&P 500’s 17%, Constellation’s 23%, and Vistra’s 93%.

Picture Supply: Zacks Funding Analysis

GEV has cooled off over the last month, consolidating round its 21-day shifting common and close to impartial RSI ranges. GEV trades 9% beneath its November highs and 30% beneath the best present worth goal at Zacks.

Any pullback to GEV’s 50-day shifting common probably affords buyers a stable shopping for alternative.

On the valuation entrance, GE Vernova trades at a 60% low cost to its peaks by way of its worth/earnings-to-growth (PEG) ratio at 2.9, highlighting its strong earnings progress outlook.

Zacks Naming Prime 10 Shares for 2025

Wish to be tipped off early to our 10 prime picks for everything of 2025?

Historical past suggests their efficiency may very well be sensational.

From 2012 (when our Director of Analysis Sheraz Mian assumed accountability for the portfolio) by means of November, 2024, the Zacks Prime 10 Shares gained +2,112.6%, greater than QUADRUPLING the S&P 500’s +475.6%. Now Sheraz is combing by means of 4,400 firms to handpick the very best 10 tickers to purchase and maintain in 2025. Don’t miss your likelihood to get in on these shares after they’re launched on January 2.

Be First to New Top 10 Stocks >>

Constellation Energy Corporation (CEG) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Vistra Corp. (VST) : Free Stock Analysis Report

GE Vernova Inc. (GEV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.