Buyers typically look to Warren Buffett not just for funding concepts, but additionally for clues about what could also be subsequent for the inventory market. That is as a result of the billionaire has confirmed his information of the market over the long run, and it is produced large outcomes. On the helm of Berkshire Hathaway, he is led the portfolio to a compounded annual acquire of almost 20% over 58 years. That is in comparison with a compounded annual enhance of about 10% for the S&P 500.

Buffett understands when to make a specific investing transfer, whether or not it entails shopping for or promoting shares, and he typically goes towards the group. The Oracle of Omaha is understood for writing that he and his workforce “try to be fearful when others are grasping and to be grasping solely when others are fearful.”

So, at this time, because the S&P 500 soars to document excessive after document excessive, heading for a 22% enhance this 12 months, it is a good concept to have a look at Buffett’s newest strikes. In latest quarters, the highest investor has bought shares of his largest holding — Apple (NASDAQ: AAPL) — and put $2.9 billion into one other favourite. Is that this transfer a warning for Wall Avenue? Let’s dig deeper and discover out.

Picture supply: The Motley Idiot.

Shares could also be getting expensive

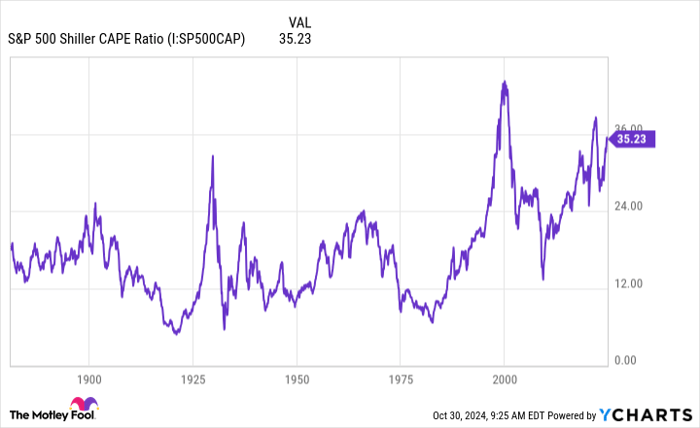

First, it is essential to notice that beneficial properties within the S&P 500 have been accompanied by a rise in valuations, suggesting that shares normally could also be getting costly. That is one thing that will set off an alarm for Buffett, a value investor. He goals to purchase a inventory when it is buying and selling beneath what the actual firm is actually price. Buffett’s objective is getting in on a inventory for a cut price — or a minimum of cheap — value and holding on for the long run. The thought is, as the remainder of the market discovers the corporate’s worth, the inventory value will rise, and Buffett will rating a win.

Right now, the S&P 500 Shiller CAPE ratio, an inflation-adjusted measure of earnings over a 10-year interval in relation to cost, is displaying shares at one in every of their most costly ranges ever. That is the third time the measure has surpassed 35 for the reason that S&P 500’s debut as a 500-stock index within the late Nineteen Fifties.

S&P 500 Shiller CAPE Ratio information by YCharts

Now, let’s focus on Buffett’s latest strikes. In opposition to this backdrop, Buffett hasn’t been a significant purchaser of shares these days. For instance, within the second quarter, he solely took on two new positions — Ulta Magnificence and Heico — and, as talked about, bought shares of Apple, one in every of his favourite long-term holdings. Buffett bought 49% of his Apple stake after already reducing his holding by 13% within the first quarter.

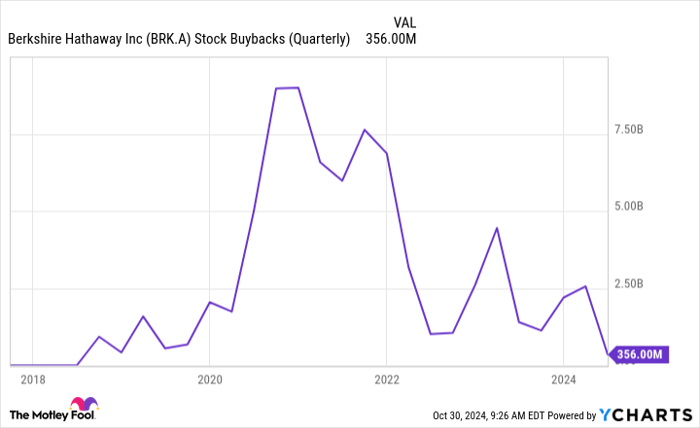

The billionaire additionally made a $2.9 billion wager within the first six months of the 12 months: repurchasing shares of Berkshire Hathaway. Whereas this may increasingly sound like a giant transfer, the repurchases even have slowed in latest occasions after a substantial spike in 2020 and 2021.

BRK.A Stock Buybacks (Quarterly) information by YCharts

Is Warren Buffett fearful?

Does Buffett’s promoting of one in every of his favourite shares, alongside along with his slowdown in Berkshire Hathaway repurchases, signify a warning for Wall Avenue? Might Buffett be fearful about declines available in the market within the coming months?

It is attainable Buffett might count on declines within the close to time period. In any case, in his newest shareholder letter, he stated markets are displaying increasingly more “casino-like habits.”

However this would not essentially push Buffett to promote or make investments much less in his favourite firms. Buffett earlier this 12 months stated he anticipated the capital beneficial properties tax to rise, suggesting his gross sales of a inventory like Apple was accomplished to lock in some earnings on the present fee. And Apple stays Berkshire Hathaway’s largest place.

As for the Berkshire Hathaway buyback degree, Buffett emphasised in his newest shareholder letter that repurchases are “100% discretionary” and, referring to the corporate normally, wrote, “Berkshire is constructed to final.” So, it is clear any dip in repurchases is not linked to a insecurity in the way forward for the market or the corporate.

As a substitute, we must always see Berkshire Hathaway’s quite common funding in itself at any degree as a optimistic transfer, displaying confidence within the portfolio and the final market over time. And this brings me to 1 different key level: Buffett’s funding technique is predicated on investing for the long run, which suggests he chooses high quality firms and sticks with them for years, it doesn’t matter what course the market as a complete is taking at a specific second.

All this implies Buffett’s latest moves aren’t a warning for Wall Avenue, however as a substitute, when examined intently, present this billionaire nonetheless believes within the potential of high quality firms — and the market normally — to ship over the long term.

Don’t miss this second likelihood at a doubtlessly profitable alternative

Ever really feel such as you missed the boat in shopping for probably the most profitable shares? You then’ll need to hear this.

On uncommon events, our skilled workforce of analysts points a “Double Down” stock suggestion for firms that they assume are about to pop. In the event you’re fearful you’ve already missed your likelihood to speculate, now could be the very best time to purchase earlier than it’s too late. And the numbers communicate for themselves:

- Amazon: should you invested $1,000 once we doubled down in 2010, you’d have $20,993!*

- Apple: should you invested $1,000 once we doubled down in 2008, you’d have $42,736!*

- Netflix: should you invested $1,000 once we doubled down in 2004, you’d have $407,720!*

Proper now, we’re issuing “Double Down” alerts for 3 unbelievable firms, and there is probably not one other likelihood like this anytime quickly.

*Inventory Advisor returns as of October 28, 2024

Adria Cimino has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Apple, Berkshire Hathaway, and Ulta Magnificence. The Motley Idiot recommends Heico. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.