Today’s selloff was heightened by financial problems stemming in the economic market after the collapse of SVB Financial Team’s ( SIVB) Silicon Valley Financial Institution.

Nevertheless, the wider selloff in markets is developing possibilities as well as right here are 3 supplies that financiers ought to watch on.

Salesforce ( CRM)

We’ll begin the checklist with a Zacks Ranking # 1 (Solid Buy) as Salesforce’s supply is extremely appealing currently. After squashing its Q4 top as well as profits assumptions recently Salesforce supply had actually been seeing some good energy.

The wrench that was tossed at the rally from wider financial problems might provide financiers a much better purchasing possibility. In addition, a tiny adjustment can be healthy and balanced as well as deal longer-term assistance.

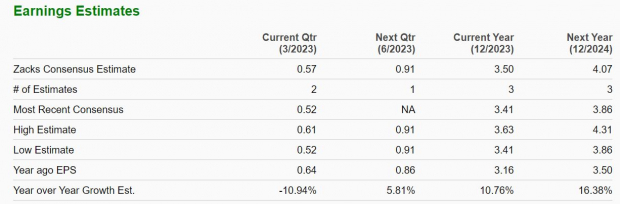

And also, profits price quote alterations have actually been trending greater complying with Salesforce’s outstanding fourth-quarter outcomes. This ought to remain to be a stimulant for Salesforce supply after the smoke removes from today’s market decrease.

Photo Resource: Zacks Financial Investment Study

Throughout the quarter, Salesforce’s monetary 2023 as well as FY24 profits quotes have actually currently risen 23% as well as 29% specifically. Monetary 2023 profits are currently anticipated to climb up 33% as well as dive one more 26% in FY24 at $8.75 per share.

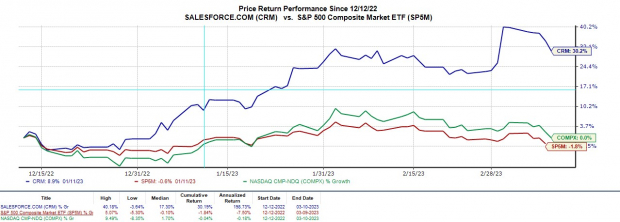

Also much better, Salesforce supply is still up +31% year to day to mainly outmatch the S&P 500’s +2% as well as the Nasdaq’s +6%.

Photo Resource: Zacks Financial Investment Study

Sterling Framework ( STRL)

Following is Sterling Framework which sporting activities a Zacks Ranking # 2 (Buy) as well as likewise got some good energy after the firm lately introduced it was granted a website advancement task for Hyundai’s EV battery center.

This gets on top of outstanding development in 2022 with profits price quote alterations remaining to trend greater for monetary 2023. Sterling’s profits are currently anticipated to leap 11% in FY23 as well as climb one more 16% in FY24 at $4.07 per share.

Photo Resource: Zacks Financial Investment Study

Sterling supply is still up +18% year to day to mainly outmatch the wider indexes as well as its eye-catching appraisal as well as outstanding efficiency over the last couple of years show there can be much more upside in advance.

Shares of STRL profession at $38 as well as simply 11.6 X onward profits which is well listed below the sector standard of 19.9 X as well as the S&P 500’s 17.9 X. And also, Sterling supply professions a lot more fairly than its years high of 298.8 X as well as at a small discount rate to the mean of 12.6 X.

Photo Resource: Zacks Financial Investment Study

EPR Qualities ( EPR)

Completing the checklist is EPR Qualities which likewise sporting activities a Zacks Ranking # 2 (Buy). Several REITs are ending up being eye-catching after the substantial selloff amongst the wider economic market as well as EPR’s supply might deserve taking into consideration for its eye-catching appraisal, varied profile, as well as financially rewarding regular monthly reward.

EPR’s residential or commercial properties consist of megaplex theaters, enjoyment retail facilities, lodging residential or commercial properties, as well as very early youth education and learning facilities to name a few.

Trading 33% from its 52-week highs EPR’s appraisal is beginning to stand apart. EPR professions at $37 per share as well as 8X onward profits which is well under the sector standard of 12.5 X as well as the standard.

Photo Resource: Zacks Financial Investment Study

EPR likewise trades 68% listed below its years high of 25.2 X as well as at a 40% discount rate to the mean of 13.2 X. Along with this, EPR’s 8.44% reward return surprise the REIT as well as Truth Trust Fund– Retail Markets 4.22% as well as the S&P 500’s 1.62%.

This ought to absolutely sustain patient financiers as well as revenue applicants as shares of EPR are down -9% YTD however are extremely attracting at their existing degrees.

Photo Resource: Zacks Financial Investment Study

Profits

Salesforce, Sterling Framework, as well as EPR Qualities supplies resemble solid buy-the-dip prospects following today’s selloff. There can be a lot of upside in advance for these supplies as volatility subsides as well as we return to what ideally remains to be a rebound year for numerous equities.

4 Oil Supplies with Huge Benefits

Worldwide need for oil is via the roofing … as well as oil manufacturers are battling to maintain. So despite the fact that oil costs are well off their current highs, you can anticipate large make money from the firms that provide the globe with “black gold.”

Zacks Financial investment Study has actually simply launched an immediate unique record to aid you rely on this fad.

In Oil Market ablaze, you’ll uncover 4 unanticipated oil as well as gas supplies placed for large gains in the coming weeks as well as months. You do not wish to miss out on these suggestions.

Download your free report now to see them.

Salesforce Inc. (CRM) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

EPR Properties (EPR) : Free Stock Analysis Report

SVB Financial Group (SIVB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views revealed here are the sights as well as point of views of the writer as well as do not always mirror those of Nasdaq, Inc.