The 2024 Q3 earnings season has kicked right into a a lot increased gear, with a pleasant number of firms already delivering quarterly outcomes. The interval seems to be constructive, with earnings progress anticipated to be optimistic once more regardless of current downward revisions which have contrasted with current durations.

Keep up-to-date with all quarterly releases: See Zacks Earnings Calendar.

Let’s take a better have a look at a couple of key firms – Tesla TSLA and Coca-Cola KO – which might be on the reporting docket for this week.

Tesla Faces Profitability Crunch

As normal, the important metric for Tesla that generally dictates value swings is its EV manufacturing/supply numbers. To the likes of buyers, the corporate unveiled its Q3 manufacturing and supply numbers lately; Tesla delivered roughly 463k EVs and produced practically 470k all through the interval.

As proven beneath, current EV supply outcomes have are available in properly beneath our consensus expectations, with Tesla falling brief in 4 consecutive durations.

Picture Supply: Zacks Funding Analysis

Nonetheless, margin pressures have been the true driver behind any adverse sentiment in current quarterly releases, which have declined fairly considerably over current durations amid increased prices. Beneath is a chart illustrating the corporate’s gross margin on a trailing twelve-month foundation.

Picture Supply: Zacks Funding Analysis

Revisions for the upcoming print have mirrored slight bearishness, with the $0.58 Zacks Consensus EPS estimate down modestly because the finish of July and suggesting a 12% decline year-over-year. Income revisions have adopted the same path, with the EV titan forecasted to see a ten% pop in gross sales year-over-year.

The income progress paired with the earnings decline displays a profitability crunch, additional seen within the margins chart above.

Picture Supply: Zacks Funding Analysis

Coca-Cola Shares See Momentum

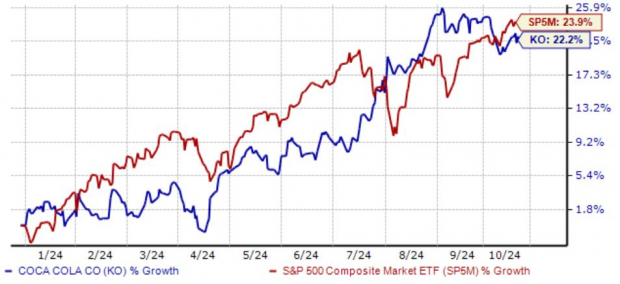

Maybe to the shock of some, shopper staples titan Coca-Cola has seen its shares largely observe the S&P 500 in 2024, up 22%. The share efficiency is actually notable, particularly given the risk-on atmosphere that’s been dominated by know-how.

Picture Supply: Zacks Funding Analysis

A driver behind the robust share efficiency might be attributed to margins recovering, as proven within the chart beneath. The beverage titan struggled with excessive prices all through 2022 given the financial atmosphere, with the pattern now reversing properly over current durations.

Please observe that the margin chart beneath is on a trailing twelve-month foundation.

Picture Supply: Zacks Funding Analysis

Earnings and income revisions for the quarter to be reported have been primarily flat, with Coca-Cola forecasted to put up flat earnings progress paired with a 3% gross sales decline. Favorable commentary surrounding its profitability and reaffirming its beforehand raised 2024 steerage might simply present tailwinds for the inventory post-earnings.

The valuation image for the inventory isn’t stretched, primarily in step with historic averages. Shares presently commerce at a 23.4X ahead 12-month earnings a number of, practically in step with the 23.8X five-year median and barely beneath five-year highs of 26.6X.

The present PEG of three.8X is actually steep however nonetheless stays in step with historic averages. The inventory sports activities a Fashion Rating of ‘D’ for Worth.

Backside Line

Earnings season is at all times an thrilling time for buyers, with firms lastly pulling the curtain again and unveiling what’s transpired behind the scenes.

And regarding notable releases coming this week, each firms above – Tesla TSLA and Coca-Cola KO – are on the reporting docket.

7 Greatest Shares for the Subsequent 30 Days

Simply launched: Specialists distill 7 elite shares from the present checklist of 220 Zacks Rank #1 Robust Buys. They deem these tickers “Most Probably for Early Value Pops.”

Since 1988, the total checklist has overwhelmed the market greater than 2X over with a mean acquire of +23.7% per yr. So make sure to give these hand picked 7 your instant consideration.

CocaCola Company (The) (KO) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.