Investor concern is brewing.

The market is pulling again, headlines are flashing warnings, and uncertainty is creeping in. Shares are sliding, Bitcoin simply dipped beneath $80,000, and Wall Avenue is scrambling to make sense of the newest financial indicators.

On Monday, the Dow tumbled practically 800 factors, the Nasdaq shed virtually 4%, and fear-driven promoting hit high-growth names the toughest.

President Trump’s newest feedback on a doable recession solely added gasoline to the fireplace, whereas issues over tariffs and inflation have buyers bracing for extra volatility.

That is the type of pullback that shakes out weak arms. It is also the type of second the place alternative exhibits itself for these paying consideration.

Market cycles are nothing new—investor feelings swing from euphoria to panic, creating moments the place high-quality property get caught within the crossfire.

We’re within the downturn cycle on the chart above — so it’s prime time to organize for the subsequent wave increased.

Proper now, Bitcoin is not the one asset flashing an accumulation window. A number of the most compelling development firms—names with plain tailwinds—are buying and selling at costs that will not final perpetually.

Approaching a Market Pullback

At LikeFolio, we focus on recognizing main client macro tendencies and understanding what makes folks tick – likes, dislikes, pain-points, and merchandise/providers they can not get sufficient of.

We do that by leveraging highly effective knowledge in real-time, together with digital site visitors patterns, app utilization, feedback on X, posts on Reddit, and even commentary from executives throughout earnings calls.

This strategy helps us to anticipate future demand, and thus, development prospects for publicly traded firms.

Our shopper base spans from main hedge funds and establishments to particular person merchants, such as you (and like us!).

We’ve recognized eight under-the-radar performs that would ship outsized returns because the cycle turns.

The complete report breaks down the names highest on our Watch Checklist for a rebound.

Let’s get began.

8. Bitcoin

Bitcoin has pulled again considerably from latest highs, even dropping beneath $90,000, as macro fears and short-term profit-taking weigh on sentiment.

The selloff comes after Bitcoin ETFs noticed their first main outflows, mixed with issues over potential tariffs and inflation.

In the meantime, President Trump’s pro-Bitcoin stance is fueling hypothesis that the U.S. could construct a strategic Bitcoin reserve, a transfer that might additional entrench Bitcoin’s position as a macroeconomic asset.

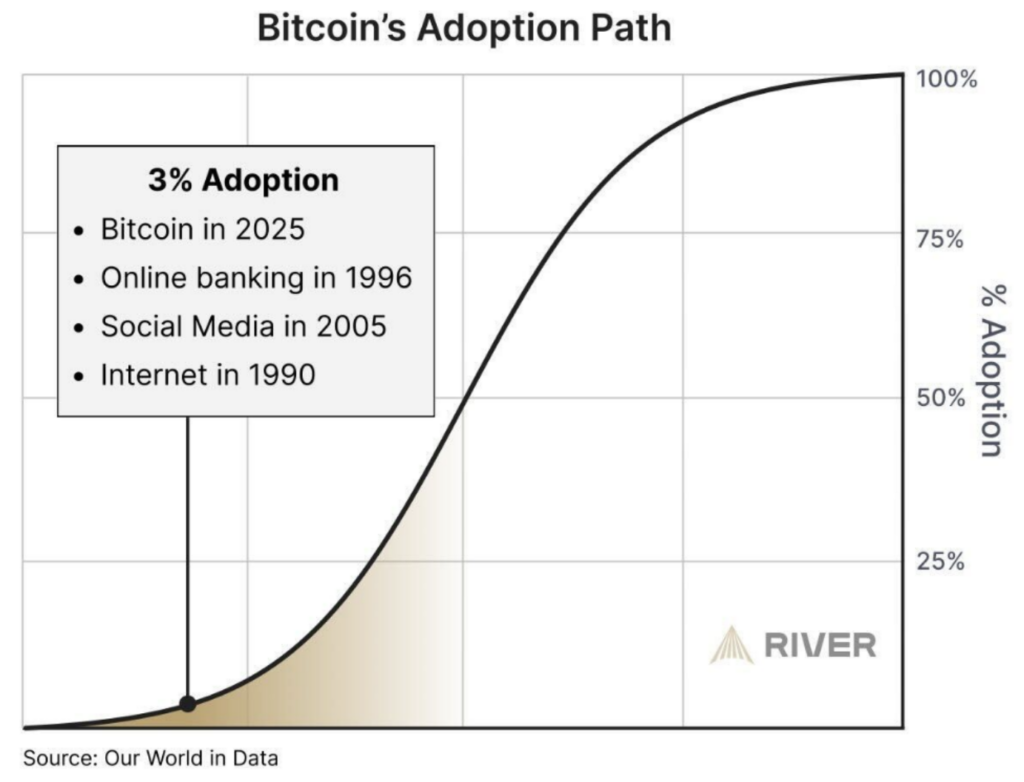

At LikeFolio, we consider we’re within the very early phases of Bitcoin adoption, and the wager is extra uneven than ever earlier than.

Bitcoin Tailwinds

- Professional-Bitcoin Administration within the U.S.: Trump’s public help for Bitcoin mining, ETFs, and a nationwide reserve is making a extra favorable coverage backdrop—a stark distinction to the earlier administration’s strategy. The thought of Bitcoin being added to U.S. nationwide reserves is gaining traction, positioning BTC as a geopolitical asset, not only a speculative one.

- Institutional Capital is Deeply Embedded: Whereas latest ETF outflows have contributed to Bitcoin’s pullback, main companies proceed to build up and broaden publicity.

- Cash Provide Enlargement: Milton Friedman as soon as famous that “inflation is at all times and in every single place a financial phenomenon.” In different phrases, when the availability of cash will increase sooner than financial output, inflation follows—and asset costs, notably these with fastened provide like Bitcoin, are inclined to react accordingly… and the cash provide has simply began to broaden once more…

Backside Line: It is a short-term pullback in the midst of the strongest structural setup Bitcoin has seen in years. With institutional demand constructing and coverage tailwinds forming, this selloff appears like an accumulation window forward of main catalysts.

7. Tesla (TSLA)

Tesla inventory TSLA is having a tricky yr, pushed by a mix of weakening European gross sales, political controversy surrounding Elon Musk, and rising competitors from Chinese language automakers.

Car registrations in key European markets dropped sharply, partly attributable to shifting client sentiment and aggressive pressures from manufacturers like Volkswagen and Renault. Moreover, regulatory hurdles in China could delay approval for Tesla’s Full Self-Driving (FSD) know-how, limiting enlargement on the earth’s largest EV market.

Whereas these challenges have pressured the inventory, Tesla’s aggressive push into autonomy, vitality storage, and reasonably priced EVs presents a compelling long-term alternative for buyers who see previous short-term headwinds.

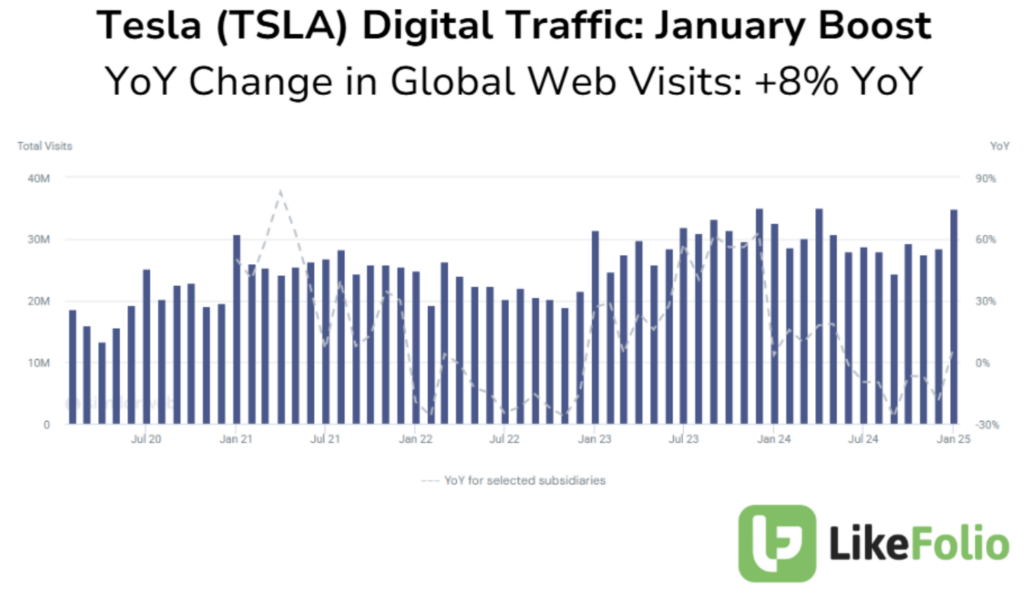

LikeFolio knowledge exhibits a soar in world internet visits in January, suggesting budding curiosity from customers – and contrasting with the media narrative at hand.

TSLA Tailwinds

- Robotaxi and Experience-Hailing Enlargement: Tesla is laying the inspiration for a serious shift in the way it monetizes its autos. The corporate plans to launch a robotaxi service in Austin, Texas, by June 2025, counting on a fleet of Tesla-owned automobiles operating unsupervised Full Self-Driving (FSD) software program. In California, Tesla is getting ready a separate ride-hailing service, beginning with human drivers however structured in a method that would transition to full autonomy. By proudly owning the fleet as a substitute of simply promoting automobiles, Tesla strikes right into a high-margin, recurring income enterprise, competing instantly with Uber and Lyft. If profitable, this shift might unlock a large new revenue stream and reshape Tesla’s long-term enterprise mannequin.

- Reasonably priced Subsequent-Era Car: Tesla plans to start manufacturing of a lower-cost EV within the first half of 2025. Relatively than ready for a brand-new manufacturing course of, Tesla is leveraging its current manufacturing traces to get these autos to market sooner and at decrease value. A less expensive mannequin means extra customers can afford a Tesla, serving to the corporate seize a bigger share of the EV market whereas making it more durable for rivals to compete on value.

- Power Storage Enlargement: Tesla deployed 31.4 GWh of vitality storage in 2024—greater than twice the earlier yr’s whole—and hit a report 11 GWh in This fall alone, a 244% improve yr over yr. To fulfill rising demand, Tesla has began manufacturing at its new Shanghai Megapack manufacturing facility, which may produce 10,000 Megapacks yearly (40 GWh). Power storage is changing into a serious income driver, with Tesla quickly scaling capability whereas rivals battle to maintain up. As grid operators and companies undertake large-scale battery storage, Tesla is positioning itself because the dominant provider.

- Optimus Humanoid Robotic Growth: Tesla plans to provide 10,000 Optimus humanoid robots in 2025, with preliminary items assigned to Tesla’s personal factories. By automating repetitive and unsafe duties, Tesla reduces labor prices and improves effectivity. If these robots show efficient in Tesla’s operations, the corporate might start promoting them to different industries, opening the door to a brand new income stream in industrial automation.

Backside Line: Wall Avenue is lacking the forest via the timber – at these ranges, TSLA shares look extraordinarily compelling.

6. Hims & Hers Well being Inc. (HIMS)

HIMS inventory HIMS plunged in February after the FDA dominated that compounded variations of semaglutide (Ozempic/Wegovy) have been now not obligatory because of the decision of provide shortages. These weight-loss prescriptions accounted for ~15% of gross sales, making the ruling a major short-term headwind.

Regardless of the drop, HIMS reported This fall 2024 income of $481 million, up 95% year-over-year, and guided 2025 income between $2.3B–$2.4B, exceeding expectations. The corporate additionally delivered its first full yr of GAAP profitability, producing $126 million in web revenue and practically $200 million in free money move.

Shares continued to unload after these outcomes, however this response could also be overdone, given the corporate’s robust subscriber development and ongoing class enlargement.

HIMS Tailwinds

- Subscriber Progress + Recurring Income: Hims & Hers reached 2.2 million subscribers by the top of 2024, a forty five% year-over-year improve. Greater than half of those subscribers are utilizing customized remedies, which include increased value factors and decrease churn charges. This fast improve in paying customers interprets instantly into stronger recurring income, giving the corporate more money move to reinvest in buyer acquisition and new providers.

- Testosterone and Menopause Remedies Broaden Addressable Market: In late 2024, Hims & Hers launched remedies for low testosterone (TRT) and menopause. These circumstances have an effect on tens of tens of millions of individuals, but conventional healthcare suppliers typically underserve them attributable to lengthy wait instances and lack of specialists. By providing direct-to-consumer entry, Hims & Hers captures demand that rivals are failing to fulfill. If these remedies scale as anticipated, they may grow to be as massive as the corporate’s current hair loss and erectile dysfunction companies.

- UK Enlargement Units Up Future Progress: The corporate entered the UK market, extending its prescription and wellness providers past the U.S. With regulatory approval in place and native partnerships forming, this transfer offers Hims & Hers entry to a healthcare system the place telemedicine is rising quickly. Success within the UK would offer a playbook for additional worldwide enlargement, doubtlessly into different European markets.

- Acquisition of Trybe Labs Provides At-Dwelling Testing, Growing Margins: In February 2025, Hims & Hers acquired Trybe Labs, an organization specializing in at-home lab testing. This acquisition permits Hims & Hers to offer diagnostic checks on to clients slightly than referring them to third-party labs, chopping prices and capturing extra income per affected person. Including testing additionally makes it simpler to prescribe customized remedies, rising the chance that clients will stay throughout the Hims & Hers ecosystem slightly than searching for care elsewhere.

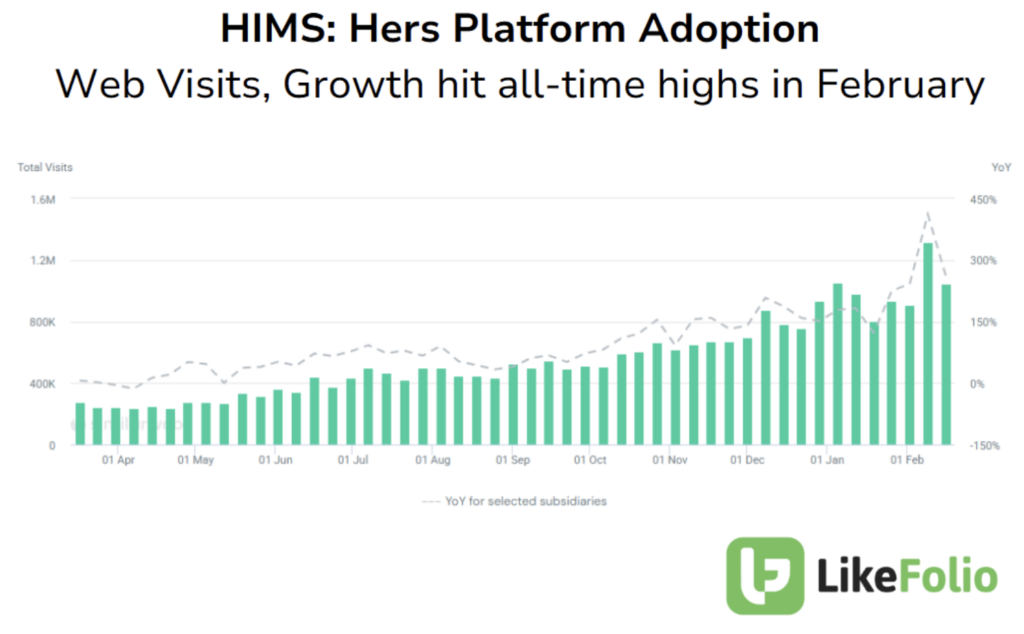

- Demographic Enlargement: Final quarter the Hers platform accounted for 30% of whole income. Internet knowledge suggests this can proceed to be a development driver shifting ahead – February development and general platform visits hit all-time highs.

Backside Line

The FDA ruling is a short-term overreaction—HIMS’ core enterprise is flourishing, with 45% subscriber development, class enlargement, and rising demand for customized remedies. The inventory’s pullback presents an accumulation alternative in an organization quickly scaling its platform whereas sustaining profitability.

Up Subsequent: The High 5 Alternatives Most Buyers Are Lacking

Whereas the names above are getting consideration, LikeFolio has recognized its TOP 5 firms that symbolize the most important alternatives in right this moment’s market:

- A fintech platform seeing report deposit development and engagement regardless of mortgage issues

- A retail buying and selling app with sustained person development that’s been unfairly punished

- An impartial advert tech agency taking up the giants

- A behind-the-scenes AI knowledge supplier powering the subsequent technology of fashions

- A transportation innovator on the verge of business deployment

Click here to see LikeFolio’s Top 5 Stock Opportunities

Every of those firms is experiencing robust tailwinds in line with LikeFolio’s client knowledge, but their shares have pulled again considerably throughout latest market volatility.

Observe: Full breakdown of those alternatives, together with detailed client pattern knowledge and actionable funding insights, obtainable solely on the LikeFolio platform.

Featured picture by Likefolio

This submit was authored by an exterior contributor and doesn’t symbolize Benzinga’s opinions and has not been edited for content material. This accommodates sponsored content material and is for informational functions solely and never supposed to be investing recommendation.

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.