The innovation market has actually been a preferred amongst capitalists, giving eruptive gains. Obviously, numerous understand the market’s boosted volatility.

Nonetheless, targeting low-beta innovation supplies can be a fantastic remedy if capitalists intend to secure themselves from creepy cost swings.

Beta is a step of a supply’s organized danger, or volatility, contrasted to the marketplace overall. Normally, the criteria is the S&P 500, which has a beta of 1.0.

Historically, supplies with a beta more than 1.0 are extra conscious the marketplace’s activities, while those with a beta much less than 1.0 are much less prone.

3 low-beta innovation supplies– International Organization Machines IBM, NetEase NTES, and also Juniper Networks JNPR– can all be thought about.

Allow’s take a better take a look at every one.

International Organization Machines

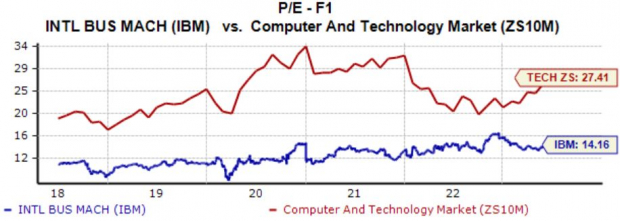

IBM, a present Zacks Ranking # 2 (Buy), is an infotech (IT) firm that’s been split right into 2 components: IBM and also Kyndryl. Shares presently produce a substantial 5% yearly, squashing the Zacks Computer system and also Innovation market standard.

Picture Resource: Zacks Financial Investment Study

IBM can tempt value-focused capitalists, even more shown by the supply’s Design Rating of “B” for Worth. Shares presently trade at a 14.2 X onward revenues several, underneath five-year highs of 16.5 X in 2022.

Picture Resource: Zacks Financial Investment Study

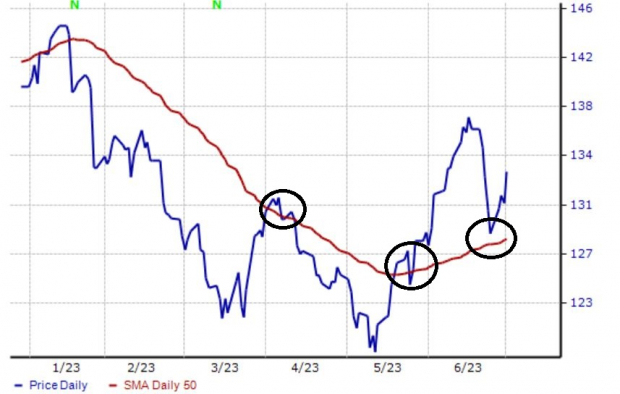

On top of that, shares have actually lately seen customers tip up boldy near the 50-day relocating standard in several circumstances, a degree that the supply formerly resisted. This beneficial cost activity has actually been shown in the graph below.

Picture Resource: Zacks Financial Investment Study

NetEase

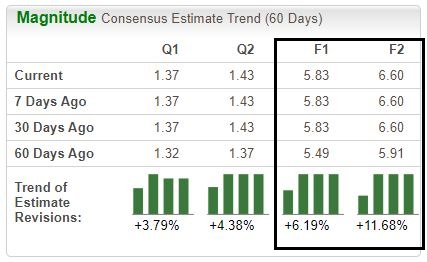

NetEase, a present Zacks Ranking # 1 (Solid Buy), is a Web innovation firm took part in the advancement of applications, solutions, and also various other modern technologies for the Web in China. The firm has actually delighted in favorable revenues quote modifications, with the fad especially notable for its present and also following .

Picture Resource: Zacks Financial Investment Study

The firm uploaded significantly solid cause its newest launch, surpassing the Zacks Agreement EPS quote by almost 30% and also providing a small profits shock. The marketplace responded well to the better-than-expected outcomes, stimulating an uptrend for shares.

Picture Resource: Zacks Financial Investment Study

NetEase shares supply direct exposure to innovation combined with an easy earnings stream; NTES shares presently generate 1.9%, with its payment expanding by a remarkable 30% over the last 5 years. And also to cover it off, the firm’s 22% payment proportion lives on the lasting side.

Juniper Networks

Juniper Networks, a present Zacks Ranking # 2 (Buy), is a leading carrier of networking services and also interaction gadgets. The firm has actually delighted in moderate favorable revenues quote modifications throughout a number of durations, with experts completely contract.

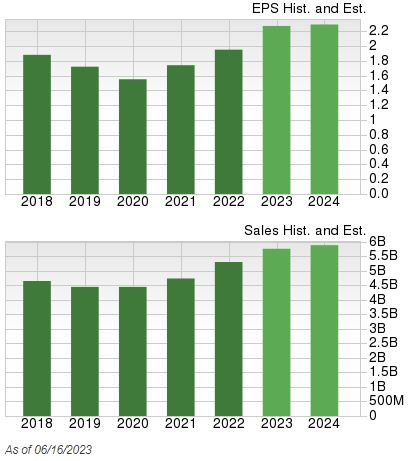

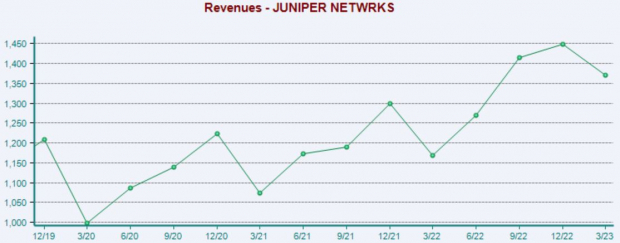

The firm is anticipated to expand progressively, with price quotes requiring 20% revenues development on 10% greater earnings in its present (FY23). Expecting FY24, forecasts mention an extra 7% of revenues development on 3% boosted earnings.

Picture Resource: Zacks Financial Investment Study

It might deserve watching out for JNPR’s following quarterly launch anticipated on July 27 th; the Zacks Agreement EPS Quote of $0.55 shows a 30% enter revenues year-over-year. Our agreement profits quote rests at $1.4 billion, 12% more than the year-ago quarter.

The firm’s profits has actually lately seen a velocity in development, as we can see listed below.

Picture Resource: Zacks Financial Investment Study

Profits

Targeting low-beta supplies can aid secure capitalists versus volatility, as these supplies are much less prone to the marketplace’s activities.

For those that look for direct exposure to technology, all 3 low-beta supplies above– International Organization Machines IBM, NetEase NTES, and also Juniper Networks JNPR– fit the requirements.

On top of that, all 3 have actually seen their revenues price quotes wander greater since late, showing beneficial positive outlook amongst experts.

Free Record: Top EV Battery Supplies to Acquire Currently

Just-released record discloses 5 supplies to benefit as countless EV batteries are made. Elon Musk tweeted that lithium costs have actually mosted likely to “outrageous degrees,” and also they’re most likely to maintain climbing up. Therefore, a handful of lithium battery supplies are readied to escalate. Accessibility this record to uncover which battery supplies to acquire and also which to prevent.

International Business Machines Corporation (IBM) : Free Stock Analysis Report

Juniper Networks, Inc. (JNPR) : Free Stock Analysis Report

NetEase, Inc. (NTES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints revealed here are the sights and also viewpoints of the writer and also do not always show those of Nasdaq, Inc.