Being the 2 dominant gamers within the residence enchancment retail market, The House Depot Inc. HD and Lowe’s Firms Inc. LOW have constantly captured the eye of traders. HD and LOW are each extremely credible names within the residence enchancment sector, with a long time of expertise and powerful reputations.

House Depot’s credibility is bolstered by its expansive Professional buyer community and constant operational excellence. Its scale and effectivity have made it the go-to selection for contractors and large-scale tasks.

Lowe’s credibility is rooted in its deal with DIY prospects and customized service. Its efforts to cater to owners by way of tailor-made product choices and localized methods have resonated effectively with its goal demographic. Moreover, Lowe’s partnerships and initiatives to reinforce buyer expertise have strengthened its standing out there.

Moving into 2025, allow us to dive into the 2 firms’ key statistics, market share, valuation, dividend methods and inventory performances to find out which is healthier positioned for progress.

LOW vs. HD: Key Statistics & Market Share

House Depot and Lowe’s have been competing for the highest spot within the residence enchancment marketplace for greater than a decade. Whereas these firms goal the identical set of consumers with related product strains, there’s a stark distinction of their sizes, branding and supply-chain methods. Commanding a market cap of $381.7 billion, House Depot is far greater in contrast with Lowe’s, which has a market cap of $139.2 billion.

House Depot holds the lead with a market share of roughly 47%, whereas Lowe’s instructions round 28%. In fiscal 2023, HD reported revenues of $152.7 billion in contrast with Lowe’s $86.4 billion. Regardless of House Depot’s dominance, Lowe’s has been narrowing the hole in recent times by way of focused methods.

Picture Supply: Zacks Funding Analysis

LOW vs. HD: Earnings Estimate Revision Pattern

From the outlook perspective, House Depot continues to challenge modest progress in revenues and EPS, whereas Lowe’s expects to witness year-over-year declines in each.

House Depot’s fiscal 2024 revenues are projected to develop 3.9% 12 months over 12 months to $158.6 billion and EPS is predicted to extend 0.1% 12 months over 12 months to $15.12. HD’s EPS estimates for fiscal 2024 moved up 0.7% within the final 60 days. House Depot’s annual earnings are slated to extend 3.4% 12 months over 12 months to $163.9 billion in fiscal 2025, with EPS anticipated to broaden 3.5% to $15.65 per share.

HD Earnings Estimate Revision Pattern

Picture Supply: Zacks Funding Analysis

In the meantime, Lowe’s fiscal 2024 revenues are anticipated to say no 3.5% 12 months over 12 months to $83.3 billion and EPS is more likely to fall 10% to $11.88. LOW’s EPS estimates for fiscal 2024 have moved down 0.7% prior to now 60 days. Lowe’s annual earnings are slated to extend 1.1% to $84.3 billion in fiscal 2025, with EPS anticipated to broaden 5.7% to $12.56 per share.

LOW Earnings Estimate Revision Pattern

Picture Supply: Zacks Funding Analysis

Due to this fact, we are able to clearly see that House Depot has seen analysts elevating estimates, whereas LOW witnessed a downtrend in estimate revisions. Furthermore, HD’s estimates point out year-over-year will increase in revenues and earnings for this 12 months, whereas LOW’s estimates recommend declines.

LOW, HD Inventory Efficiency & Valuation Comparability

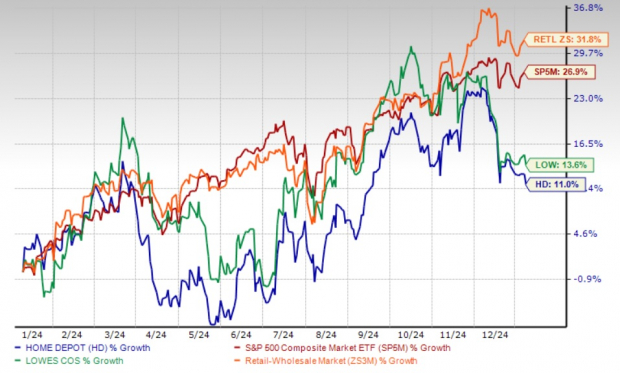

Over the past 12 months, Lowe’s inventory had the sting by way of efficiency, with LOW having a complete return of greater than 13%, together with dividends. This has noticeably lagged the benchmark S&P 500’s return of +26% however has topped House Depot’s 11% progress.

Prior to now 12 months, the performances of those residence enchancment giants have additionally vastly trailed the broader Retail-Wholesale sector’s whole return of +31%.

HD-LOW One-12 months Inventory Worth Efficiency

Picture Supply: Zacks Funding Analysis

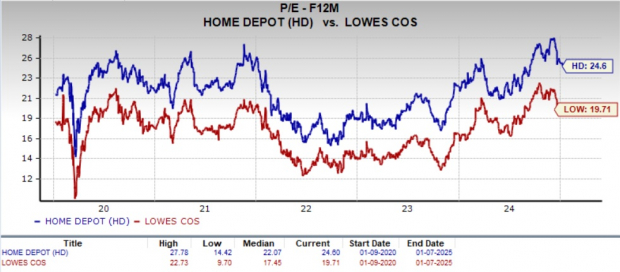

From a valuation perspective, HD and LOW have related ahead price-to-earnings (P/E) multiples. House Depot trades at 24.6X, which is above its 5-year median of twenty-two.07X, and Lowe’s is buying and selling at 19.71X, above its 5-year median of 17.45X.

Picture Supply: Zacks Funding Analysis

In the meantime, the Zacks Retail-Wholesale presently trades at a 24.8X ahead P/E a number of, which is actually above the multiples of House Depot and Lowe’s. Therefore, each firms look comparatively cheaper than the broader sector.

House Depot and Lowe’s presently carry a Zacks Rank #3 (Maintain). You may see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

LOW vs. HD: Dividend Evaluation

Aside from stability and progress potential, House Depot and Lowe’s have a tendency to draw traders with their robust file of paying common dividends. These firms have constantly raised dividend payouts, reflecting their confidence of their earnings progress potential.

House Depot gives a dividend yield of two.3%, supported by a payout ratio of 60%, signaling a steadiness between rewarding shareholders and reinvesting within the enterprise. HD has a five-year dividend progress charge of 11.2%. (Check HD’s dividend history here)

Lowe’s, with a dividend yield of 1.8% and a decrease payout ratio of 39%, gives extra room for dividend progress. LOW has a five-year dividend progress charge of 20.3%. (Check LOW’s dividend history here.)

Verdict: HD vs. LOW Inventory

Whereas House Depot boasts a bigger market share, increased revenues and a extra established Professional buyer base, Lowe’s is closing the hole with progress initiatives and value efficiencies. For conservative traders searching for stability, House Depot stays the safer wager. Nonetheless, these with a better danger tolerance would possibly discover Lowe’s a compelling selection for potential upside in 2025.

Each firms are well-positioned for progress, however the more sensible choice finally is determined by particular person funding targets and danger preferences.

7 Finest Shares for the Subsequent 30 Days

Simply launched: Consultants distill 7 elite shares from the present listing of 220 Zacks Rank #1 Robust Buys. They deem these tickers “Most Possible for Early Worth Pops.”

Since 1988, the total listing has crushed the market greater than 2X over with a median achieve of +24.1% per 12 months. So remember to give these hand picked 7 your rapid consideration.

Lowe’s Companies, Inc. (LOW) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.