For those who’ve been following the electrical automobile (EV) business, it has been an attention-grabbing experience up to now. Some world markets are exploding a lot quicker than North America, particularly if you have a look at China, the place latest month-to-month EV gross sales accounted for greater than 50% of latest automobile gross sales. Lucid (NASDAQ: LCID) specifically has captured momentum, seemingly on the expense of rival Rivian, however is it a purchase for long-term buyers?

What have you ever achieved for me recently?

Lucid has an unlucky pattern in its brief historical past of disappointing buyers with its manufacturing hiccups, delays, and lower-than-expected deliveries. That mentioned, administration has quietly overcome these velocity bumps and turned in three straight quarters of report deliveries.

In actual fact, with Lucid hitting three consecutive quarterly information for deliveries, the corporate has now let customers take the wheel of over 7,100 Lucid EVs in 2024, already simply topping the corporate’s 2023 whole of 6,001 deliveries.

Regardless of the corporate’s supply momentum, which can solely enhance with the Gravity now formally on sale, its inventory worth has been caught in reverse — even when in comparison with rival Rivian, which posted a disappointing third-quarter supply outcome on account of a manufacturing snag of its personal.

Caught in reverse?

Lucid’s momentum with three quarters of report deliveries was basically offset by a combined third-quarter outcome and the announcement that the EV maker plans to promote greater than 262 million shares in a public providing. If accomplished, the providing can even promote practically 375 million shares to its majority shareholder, Saudi Arabia’s Public Funding Fund (PIF), which solely furthers the corporate’s ties to Saudi Arabia. https://ir.lucidmotors.com/news-releases/news-release-details/lucid-group-inc-announces-public-offering-common-stock-and-0/

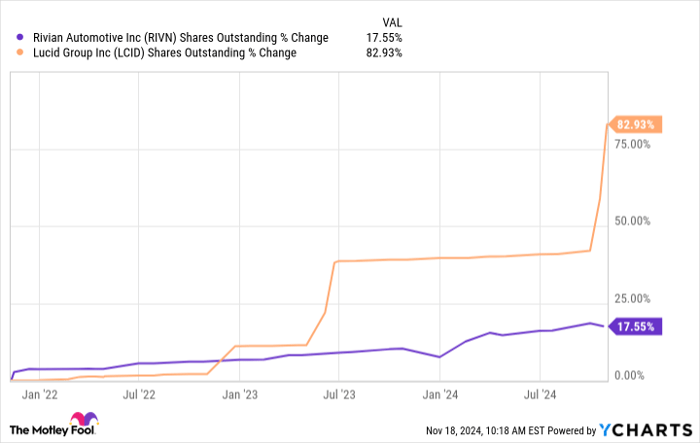

It is honest for buyers to say that is anticipated, as we largely acknowledge these younger EV makers will probably have to lift capital once more earlier than the businesses turn out to be self-sustaining. It is also honest to notice that Lucid’s shareholder dilution is noticeable in comparison with Rivian, as an identical instance.

RIVN Shares Outstanding information by YCharts.

Is Lucid a purchase now?

The silver lining is that the corporate’s supply momentum is poised to proceed shifting ahead. That is as a result of the corporate’s Gravity EV SUV not too long ago went on sale and can begin contributing to deliveries within the close to time period. The execution of the Gravity launch and following manufacturing ramp-up can be wanted for a robust end to the yr and to begin 2025 with gross sales momentum. There’s additionally a lesser-known step after the Gravity. Lucid plans to launch a midsize crossover priced decrease than $50,000, earlier than delivery, in about two years’ time.

The worldwide EV business appears to have an extremely brilliant future because the world transitions from gasoline-powered autos to EVs, however early buyers have to grasp how speculative and dangerous these shares are at present. Simply take a look at Fisker’s chapter mess.

Lucid’s present supply momentum is not sufficient to make it a purchase now, but it surely is sufficient to place Lucid in your watch checklist as the corporate drives by velocity bumps, expands its automobile lineup, cuts prices, and tries to place itself as one of many prime EV gamers in an increasing business. The corporate’s inventory worth is hovering simply above all-time lows and affords an intriguing entry point for investors willing to accept the risk of proudly owning Lucid. For these keen to take that danger, firms like Lucid ought to nonetheless spherical out a smaller place of your general portfolio.

Do you have to make investments $1,000 in Lucid Group proper now?

Before you purchase inventory in Lucid Group, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and Lucid Group wasn’t considered one of them. The ten shares that made the lower may produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $869,885!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of November 18, 2024

Daniel Miller has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.