Alphabet GOOGL shares have been nearly flat since saying the $32 billion acquisition of New York Metropolis-based cybersecurity startup Wiz final Tuesday.

That mentioned, buying Wiz would improve Alphabet’s place in cloud safety and AI-driven options. To that time, Wiz makes a speciality of cloud detection and response safety (CDR), utilizing AI to establish vulnerabilities throughout cloud environments.

Anticipated to shut subsequent 12 months, the deal is topic to regulatory approval and can be Alphabet’s largest acquisition, topping the 2012 buy of Motorola Mobility for $12.5 billion which has bolstered Google’s {hardware} capabilities and secured patents to guard its Android working system.

Wiz Overview

Based in 2020, Wiz’s progressive cybersecurity options embody real-time agentless visibility, threat prioritization, entry permissions, and routine safety. As reported by Forbes, Wiz has scaled an unprecedented tempo, reaching $100 million in annual recurring income (ARR) in its first 18 months. Notably, Wiz achieved an ARR of $700 million in 2024 and had a personal market valuation of $12 billion.

Attributing to its lofty growth, Wiz’s clients embody the three largest cloud computing firms, Alphabet (Google Cloud), Amazon’s AMZN AWS, and Microsoft’s MSFT Azure. Along with this, Wiz’s platform is utilized by over half of the opposite Fortune 100 firms together with governments, which paints the image as to why Alphabet is keen to pay a premium to accumulate the cybersecurity agency.

Monitoring Alphabet’s Steadiness Sheet

Whereas Alphabet is paying a fairly penny to accumulate Wiz it’s noteworthy that the tech large at the moment has $95.65 billion in money & equivalents. Plus, Alphabet has $450.25 billion in complete belongings which is pleasantly above its complete liabilities of $125.17 billion.

Picture Supply: Zacks Funding Analysis

Google Cloud Progress

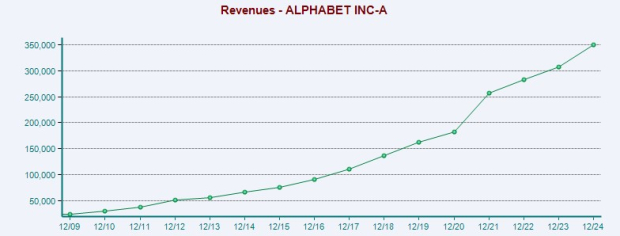

Additional explaining Alphabet’s willingness to accumulate Wiz at a stretched valuation to its market worth is that Google Cloud has been the tech large’s fastest-growing phase. Final quarter, Google Cloud income expanded 30% to $11.95 billion in comparison with $9.19 billion in This autumn 2023. Extra spectacular, is that the phase’s working revenue soared 142% to $2.09 billion versus $864 million within the comparative quarter.

Because the third largest cloud supplier behind Amazon and Microsoft, Google Cloud accounted for 12% of Alphabet’s income final 12 months at $43.2 billion, a 64% spike from $26.28 billion in 2023.

Picture Supply: Zacks Funding Analysis

Conclusion & Remaining Ideas

For now, Alphabet inventory lands a Zacks Rank #3 (Maintain). With its inventory down 13% 12 months so far, Alphabet hasn’t been proof against broader market volatility however expectations of double-digit prime and bottom-line progress in fiscal 2025 and FY26 are interesting to long-term buyers.

Contemplating Google Cloud has contributed to a good portion of Alphabet’s progress, buying Wiz may show to be a profitable enterprise down the road with regard to navigating the ever-evolving and really aggressive panorama of cloud computing, cyber safety, and AI configuration.

Solely $1 to See All Zacks’ Buys and Sells

We’re not kidding.

A number of years in the past, we shocked our members by providing them 30-day entry to all our picks for the overall sum of solely $1. No obligation to spend one other cent.

Hundreds have taken benefit of this chance. Hundreds didn’t – they thought there should be a catch. Sure, we do have a motive. We would like you to get acquainted with our portfolio providers like Shock Dealer, Shares Underneath $10, Expertise Innovators,and extra, that closed 256 positions with double- and triple-digit beneficial properties in 2024 alone.

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.