DeekSeek seems to have put a giant dent in what everybody believed was a supply of aggressive benefit within the AI race for Tech leaders like Microsoft MSFT, Alphabet GOOGL, Amazon AMZN, and others. And if we go by how Microsoft and Meta described the evolving AI aggressive panorama on their respective This autumn earnings calls final week, we are going to most certainly hear comparable commentary from Amazon and Alphabet as they arrive out with their December-quarter outcomes this week.

Market contributors have all alongside been skeptical of the funding case for the terribly heavy spending by Microsoft, Alphabet, Amazon, and others on AI-centric knowledge facilities and associated infrastructure. The difficulty all alongside has been these firms’ lack of ability to articulate a transparent case for a way these investments will get monetized.

Whereas quite a bit about DeepSeek’s precise value in constructing and coaching its mannequin is unknown, however the introduced determine of some million {dollars}, the lots of of billions of {dollars} that these firms are collectively pouring into the mission seems to be overkill. Microsoft and Meta reiterated their spending plans and see the ensuing knowledge middle capability as giving them a strategic benefit in the long term. We will safely assume that Amazon and Alphabet will comply with Microsoft and Meta on this important query.

Whereas the market’s collective focus was primarily on the AI query for Microsoft and Meta, the previous disillusioned in its core outcomes, with cloud steerage arising quick, whereas the latter confirmed loads of working momentum in working outcomes. Microsoft’s December-quarter earnings had been up +10.2% from the identical interval final yr on +12.3% greater revenues, whereas Meta’s earnings and revenues elevated +48.7% and +20.6% from the year-earlier ranges, respectively.

Apple and Tesla, the opposite Magazine 7 gamers that additionally reported outcomes final week, acquired favorable market reception. Nonetheless, the constructive market follow-through was possible much less of a response to the core outcomes and extra of a sigh of aid at better-than-feared numbers.

China has emerged as a serious threat within the Apple story, with tepid iPhone demand in that key market and the corporate’s persevering with AI struggles taking middle stage. Some anecdotal proof means that a few of Apple’s native Chinese language rivals are giving it quite a bit more durable competitors than in years previous. On prime of that’s the prospect of tariffs, a far larger subject for Apple than the remainder of its Magazine 7 friends.

Apple’s December-quarter earnings had been up +7.1% on +4% greater revenues, whereas Tesla’s earnings and revenues for the interval had been up +15.7% and +2.1% from the year-earlier stage, respectively. Internet margins had been up at Apple and Tesla, with Apple’s margins up 86 foundation factors from the identical interval final yr whereas Tesla’s expanded 105 bps.

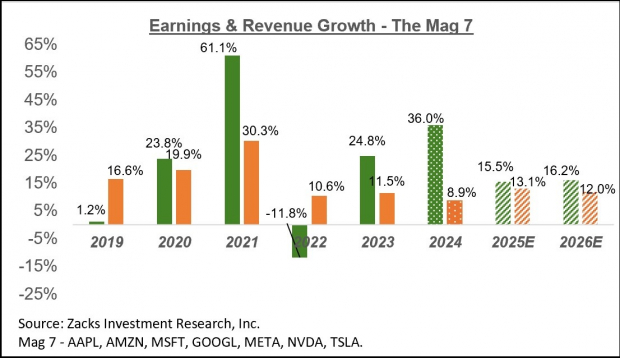

Check out the chart under that exhibits present consensus expectations for the ‘Magazine 7’ shares as an entire for the present and coming durations within the context of what they had been in a position to obtain within the previous interval. The +25.6% earnings progress includes precise outcomes from the 4 group members which have reported and estimates for Alphabet, Amazon, and Nvidia (that haven’t reported but).

Picture Supply: Zacks Funding Analysis

The chart under that exhibits the group’s earnings and income progress on an annual foundation.

Picture Supply: Zacks Funding Analysis

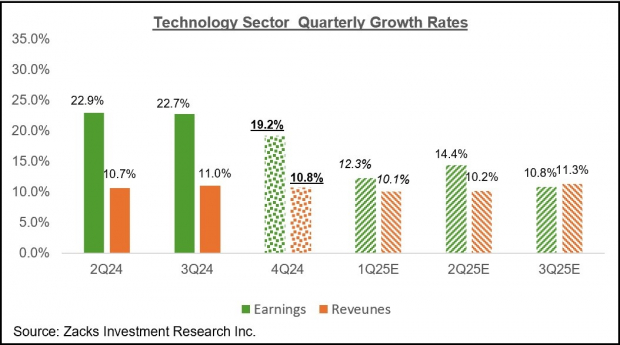

Past these Magazine 7 gamers, whole This autumn earnings for the Expertise sector as an entire are anticipated to be up +19.2% from the identical interval final yr on +10.8% greater revenues.

The chart under exhibits the sector’s This autumn earnings and income progress expectations within the context of the place progress has been in latest quarters and what’s anticipated within the coming three durations.

Picture Supply: Zacks Funding Analysis

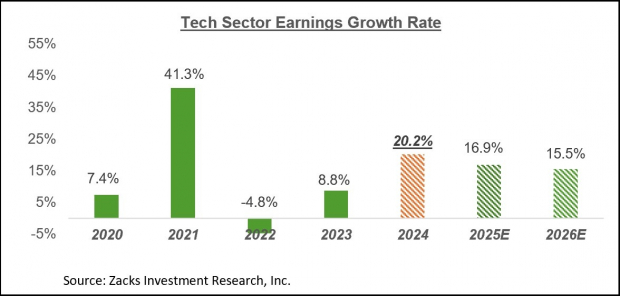

The chart under exhibits the sector’s progress image on an annual foundation.

Picture Supply: Zacks Funding Analysis

The Tech sector has loved a good revisions development for the previous few quarters, with the Magazine 7 shares within the fore entrance of the rising estimates development. The +16.9% earnings progress anticipated for the sector for 2025 at current is up from the +15.8% progress anticipated three months again.

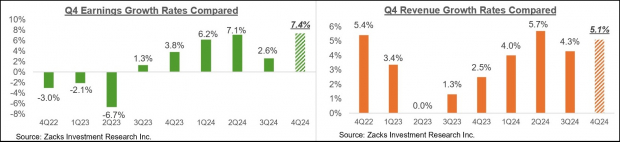

This autumn Earnings Season Scorecard

By Friday, January 31st, we’ve got seen This autumn outcomes from 179 S&P 500 members, or 35.8% of the index’s whole membership. Whole earnings for these firms are up +7.4% from the identical interval final yr on +5.1% greater revenues, with 80.4% beating EPS estimates and 67% beating income estimates.

The comparability charts under put the This autumn earnings and income progress charges relative to different latest durations for a similar group of index members.

Picture Supply: Zacks Funding Analysis

The comparability charts under put the This autumn EPS and income beats percentages relative to different latest durations for a similar group of firms.

Picture Supply: Zacks Funding Analysis

Key Earnings Reviews This Week

The 132 S&P 500 members on deck to report outcomes this week embrace a number of blue-chip operators like Pfizer, Pepsi, Ford, and others, along with the aforementioned Magazine 7 gamers (Amazon and Alphabet).

By the top of this week, we can have seen This autumn outcomes from greater than 63% of the index’s whole membership.

The Earnings Huge Image

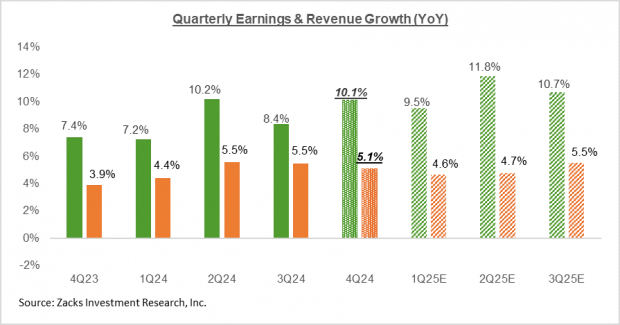

The chart under exhibits the This autumn earnings and income progress expectations within the context of the place progress has been within the previous 4 quarters and what’s anticipated within the coming 4 quarters.

Picture Supply: Zacks Funding Analysis

Excluding the contribution from the Magazine 7 firms, S&P 500 earnings would have been up +5.6% on +4.1% greater revenues.

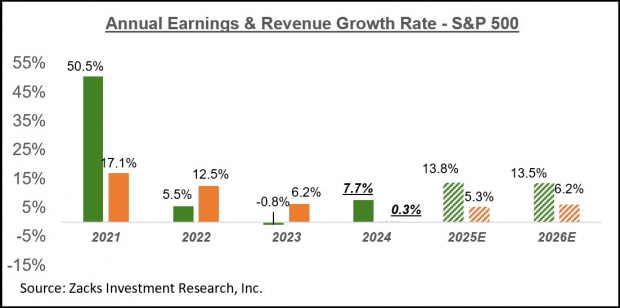

The chart under exhibits the general earnings image on a calendar-year foundation, with double-digit earnings progress anticipated in 2025 and 2026.

Picture Supply: Zacks Funding Analysis

Please observe that the very sturdy progress anticipated in 2025 isn’t pushed by one or two sectors however is relatively broad-based. All 16 Zacks sectors are anticipated to take pleasure in constructive earnings progress in 2025, with 8 of the 16 Zacks sectors anticipated to realize double-digit earnings progress.

For an in depth take a look at the general earnings image, together with expectations for the approaching durations, please try our weekly Earnings Tendencies report >>>> Broad Based Sector Growth Expected for 2025

Zacks’ Analysis Chief Names “Inventory Most Prone to Double”

Our group of specialists has simply launched the 5 shares with the best chance of gaining +100% or extra within the coming months. Of these 5, Director of Analysis Sheraz Mian highlights the one inventory set to climb highest.

This prime decide is among the many most revolutionary monetary corporations. With a fast-growing buyer base (already 50+ million) and a various set of leading edge options, this inventory is poised for giant features. After all, all our elite picks aren’t winners however this one might far surpass earlier Zacks’ Shares Set to Double like Nano-X Imaging which shot up +129.6% in little greater than 9 months.

Free: See Our Top Stock And 4 Runners Up

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.