With Q1 outcomes from Apple AAPL and Amazon AMZN now out, we solely have Nvidia’s NVDA outcomes nonetheless awaited at this stage of the ‘Magnificent 7’ group of corporations. The sub-par progress numbers from Tesla TSLA and Apple however, the Magazine 7 group as an entire confirmed spectacular top- and bottom-line progress numbers.

Actually, had it not been for the substantial earnings contribution from the Magazine 7, Q1 earnings progress for the remainder of the S&P 500 index could be in destructive territory.

It’s fascinating to notice right here that the market response to the Tesla and Apple releases has to date been the perfect of the group. This will look odd since Tesla’s Q1 earnings had been down -53.4% from the year-earlier stage on -8.7% decrease revenues, and Apple’s earnings and income progress charges had been -2.2% and -4.3%, respectively. However it isn’t stunning as each corporations’ outcomes proved higher than what market individuals had feared. We additionally want to remember the affect of Apple’s blockbuster buyback announcement, the biggest ever in historical past.

Utilizing estimates for Nvidia, which will probably be popping out with its March-quarter outcomes on Could 22nd, and precise outcomes for the opposite six members of the group, complete Q1 earnings for the group are anticipated to be up +49% from the identical interval final yr on +13.6% larger revenues.

The chart beneath reveals the group’s Q1 earnings and income progress efficiency within the context of what we noticed from the group within the previous quarter and what’s at the moment anticipated for the subsequent three quarters.

Picture Supply: Zacks Funding Analysis

The chart beneath reveals the group’s progress image on an annual foundation.

Picture Supply: Zacks Funding Analysis

The charts beneath present the mixture earnings and revenues for the group on an annual foundation.

Picture Supply: Zacks Funding Analysis

Please notice that the Magazine 7 corporations at the moment account for 29.9% of the S&P 500 index’s complete market capitalization and are anticipated to usher in 21.2% of the index’s complete earnings in 2024. For 2024 Q1, the Magazine 7 group is on observe to usher in 22.1% of all S&P 500 earnings.

The chart beneath reveals the group’s earnings contribution to the index over time and what’s at the moment anticipated for the subsequent two years.

Picture Supply: Zacks Funding Analysis

Given their huge earnings energy and progress profile, it’s onerous to argue with the group’s market management.

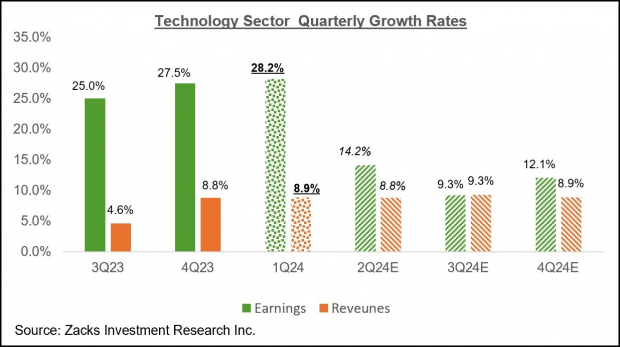

Past these mega-cap gamers, complete Q1 earnings for the Expertise sector as an entire are anticipated to be up +28.2% from the identical interval final yr on +8.9% larger revenues.

The chart beneath reveals the sector’s Q1 earnings and income progress expectations within the context of the place progress has been in latest quarters and what’s anticipated within the coming 4 intervals.

Picture Supply: Zacks Funding Analysis

Earnings Season Scorecard and This Week’s Earnings Experiences

We stay within the coronary heart of the Q1 earnings season this week, with greater than 1200 corporations reporting outcomes, together with 54 S&P 500 members. This week’s notable reviews embody Disney, Uber, Lyft, Shopify, and others.

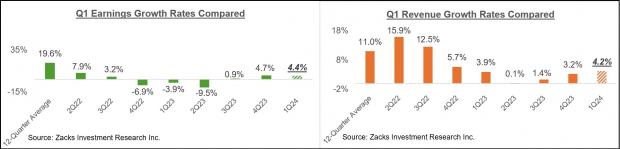

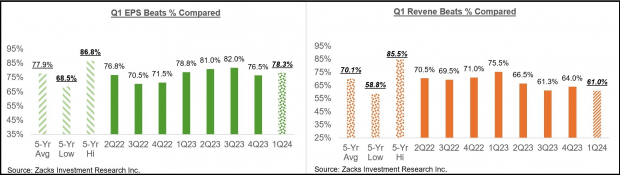

Via Friday, Could 3rd, now we have seen Q1 outcomes from 400 S&P 500 index members, or 80% of the index’s complete membership. Whole Q1 earnings for these 400 index members are up +4.4% from the identical interval final yr on +4.2% larger revenues, with 78.3% beating EPS estimates and 61% beating income estimates.

The comparability charts beneath put the Q1 earnings and income progress charges in a historic context.

Picture Supply: Zacks Funding Analysis

The comparability charts beneath put the Q1 EPS and income beats percentages in a historic context.

Picture Supply: Zacks Funding Analysis

The Earnings Large Image

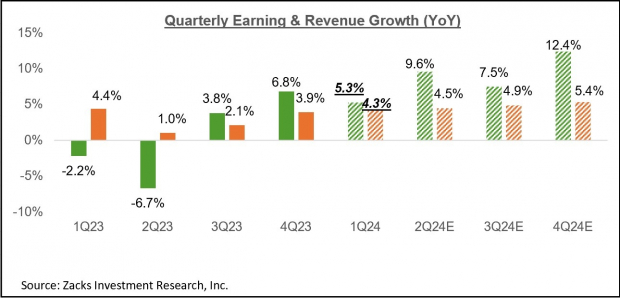

Taking a look at Q1 as an entire, complete S&P 500 earnings are anticipated to be up +5.3% from the identical interval final yr on +4.3% larger revenues, which might observe the +6.8% earnings progress on +3.9% income good points within the previous interval.

The chart beneath reveals present earnings and income progress expectations for 2024 Q1 within the context of the place progress has been over the previous 4 quarters and what’s at the moment anticipated for the next three quarters.

Picture Supply: Zacks Funding Analysis

As you probably know already, the Tech and Vitality sectors are having the alternative results on the mixture progress image. Excluding the Tech sector, Q1 earnings for the remainder of the index could be down -2.2%, whereas the expansion tempo improves to +8.3% on an ex-energy foundation.

Trying on the general earnings image on an annual foundation, complete 2024 S&P 500 earnings are anticipated to be up +8.9% on +1.7% income progress.

Picture Supply: Zacks Funding Analysis

For an in depth take a look at the general earnings image, together with expectations for the approaching intervals, please take a look at our weekly Earnings Traits report >>>> A Positive Earnings Picture Remains

Highest Returns for Any Asset Class

It’s not even shut. Regardless of ups and downs, Bitcoin has been extra worthwhile for traders than every other decentralized, borderless type of cash.

No ensures for the longer term, however prior to now three presidential election years, Bitcoin’s returns had been as follows: 2012 +272.4%, 2016 +161.1%, and 2020 +302.8%. Zacks predicts one other vital surge in months to come back.

Hurry, Download Special Report – It’s FREE >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.