Motion over the past three months within the inventory market has been marked by a notable shift in leaders from Tech and AI to extra defensive sectors like Utilities, Healthcare, Actual Property and Bonds. Within the chart under we will see that since June, the Actual Property ETF XLRE, Treasury ETF TLT, Utilities ETF XLU and Healthcare XLV have outperformed each SPY and QQQ by a reasonably important margin.

Because the Federal Reserve alerts the beginning of a rate-cutting regime and broad financial indicators (employment, progress, inflation) level to a slowdown (not a recession), it isn’t stunning that some traders have shifted to extra conservative holdings.

Nevertheless, now that tech shares have been out of favor for almost three months, lots of the main names, such because the Magnificent Seven shares have traded to fairly enticing ranges. On this article, I’ll spotlight my prime three picks shifting ahead—Apple (AAPL), Meta Platforms (META), and Nvidia (NVDA)—together with key tactical buying and selling ranges to look at.

Picture Supply: TradingView

Apple: New iPhone and AI Improvements

On Monday, Apple unveiled a brand new lineup of merchandise, together with the iPhone 16 and iPhone 16 Professional, Apple Watch Sequence 10, and AirPods 4. Key options of the iPhone 16 sequence embrace enhanced digital camera capabilities, improved battery life, a brand new Motion button for fast shortcuts and its new AI system referred to as Apple Intelligence.

The Apple Watch Sequence 10 boasts upgraded well being monitoring options and a redesigned case. AirPods 4 supply improved audio high quality, lively noise cancellation, and enhanced listening to well being options.

Apple has expanded its foray into well being monitoring, with the AirPods now administering listening to exams and functioning as a ‘clinical-grade’ listening to help. Moreover, the Apple Watch will now be capable of monitor for sleep apnea by monitoring respiratory disturbances.

Though critics typically be aware the seemingly incremental enhancements to those new Apple merchandise, I discover the health-monitoring functionalities particularly compelling, whereas the brand new AI options might considerably enhance usability.

Apple inventory has notably outperformed all the Magnificent Seven shares since Could of this 12 months, which is particularly spectacular contemplating the excessive volatility the market has skilled over the past three months.

Picture Supply: TradingView

Together with the relative energy of Apple inventory, a extra granular take a look at the value motion exhibits a possible bull flag forming. If the broad market can maintain up and AAPL breaks out above the $220 stage, it ought to make an try at new all-time highs.

Moreover, the fabric integration of AI into the iPhone, probably the most broadly used cellular gadget on this planet units up Apple to probably ascend to AI management. In any case, if the AI narrative picks up once more, Apple needs to be on the forefront.

Picture Supply: TradingView

Meta Platforms: A Properly Rounded and Promising Inventory Choose

Though Meta Platforms appears to semi-regularly get caught up in frenzied controversy similar to political scandals and misguided investments (Metaverse) the enterprise continues to develop like loopy and spew income. These manic cycles, though typically exhausting, have created quite a few alternatives for savvy traders to choose up shares at a reduction.

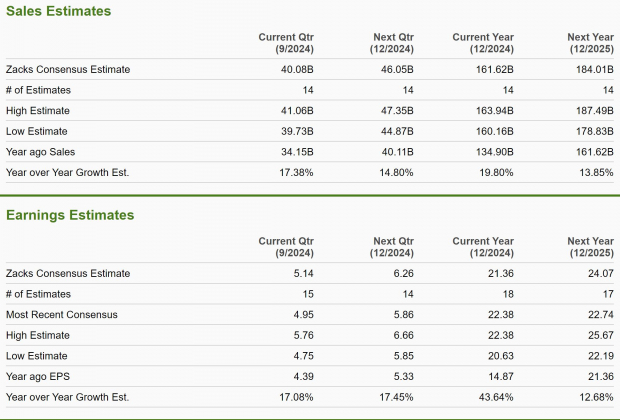

Gross sales are anticipated to develop 19.8% this 12 months and 13.9% subsequent 12 months, whereas earnings are projected to leap 43.6% this 12 months and 12.7% subsequent 12 months. Analysts forecast earnings per share (EPS) to develop 19% yearly over the subsequent three to 5 years. Moreover, the inventory is buying and selling at a one 12 months ahead earnings a number of of 23.6x, which is inline with the market common and under its 10-year median valuation of 25x.

Picture Supply: Zacks Funding Analysis

Meta Platforms isn’t presently blended up in any scandals and has relatively been the second-best performing inventory within the Magnificent Seven for the reason that begin of 2023, bested solely by Nvidia. However even with this unimaginable inventory value appreciation, META stays among the many most cost-effective of the group when evaluating relative valuations due to equally spectacular progress in EPS.

Picture Supply: TradingView

The worth motion in Meta Platforms’ inventory additionally paints a bullish image. Along with relative energy, META is constructing out a bull flag, nest inside a broader consolidation. If the inventory can escape above the $515 stage, it ought to transfer into the higher vary and past. Alternatively, if the inventory loses the decrease sure assist of ~$465, the broader market is probably going promoting off, and it might be prudent to attend for an additional alternative.

Picture Supply: TradingView

Nvidia: Most cost-effective Relative Valuation in Years

Nvidia, probably the most thrilling inventory out there over the past two years, has been struggling over the past three months. Between mid-June and early-August Nvidia staged a nasty correction, falling 35%. After rallying aggressively from the lows and testing the higher sure of the vary, the shares have once more offered off.

Hovering now simply above $100, I feel traders have a possibility to purchase the inventory close to the underside of the vary. And never solely has the inventory come all the way down to extra affordable ranges, so has the Semiconductor producer’s valuation.

Picture Supply: TradingView

At the moment, Nvidia is buying and selling at a one 12 months ahead earnings a number of of 38x, which is under its 10-year media of 42.8x and near the bottom it has been within the final 5 years. With EPS forecast to develop 41.7% yearly over the subsequent three to 5 years, Nvidia has a PEG ratio of 0.9, which is a reduction primarily based on the metric.

If we glance a bit of additional into the longer term, Nvidia is buying and selling at simply 28x FY26 earnings. If progress stays as excessive as projected, Nvidia inventory ought to proceed to understand strongly.

Ought to Traders Purchase Nvidia, Meta Platforms and Apple Inventory?

Given the present market circumstances, a shift in the direction of defensive sectors has created enticing shopping for alternatives among the many tech leaders, notably the Magnificent Seven. Shares like Apple (AAPL), Meta Platforms (META), and Nvidia (NVDA) have all skilled pullbacks in current months, presenting traders with entry factors at extra affordable valuations.

Apple, with its newest product releases and AI improvements, continues to indicate resilience and management, whereas Meta Platforms, regardless of previous controversies, is experiencing super progress and stays undervalued in comparison with its friends. Nvidia, regardless of its current correction, gives excessive progress potential and is buying and selling at its most tasty valuation in years.

For long-term traders, these shares supply a mix of stability, innovation, and progress. Apple’s regular outperformance, Meta’s explosive earnings progress, and Nvidia’s dominance in AI and semiconductor know-how make these three corporations well-positioned for the subsequent market uptrend. With their current pullbacks, now often is the time to capitalize on their future potential earlier than the market shifts again in favor of tech.

5 Shares Set to Double

Every was handpicked by a Zacks knowledgeable because the #1 favourite inventory to realize +100% or extra in 2024. Whereas not all picks may be winners, earlier suggestions have soared +143.0%, +175.9%, +498.3% and +673.0%.

Many of the shares on this report are flying below Wall Road radar, which gives an important alternative to get in on the bottom flooring.

Today, See These 5 Potential Home Runs >>

Apple Inc. (AAPL) : Free Stock Analysis Report

iShares 20+ Year Treasury Bond ETF (TLT): ETF Research Reports

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Invesco QQQ (QQQ): ETF Research Reports

SPDR S&P 500 ETF (SPY): ETF Research Reports

Health Care Select Sector SPDR ETF (XLV): ETF Research Reports

Utilities Select Sector SPDR ETF (XLU): ETF Research Reports

Real Estate Select Sector SPDR ETF (XLRE): ETF Research Reports

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.