Hey Economic Downturn, Are We There Yet?

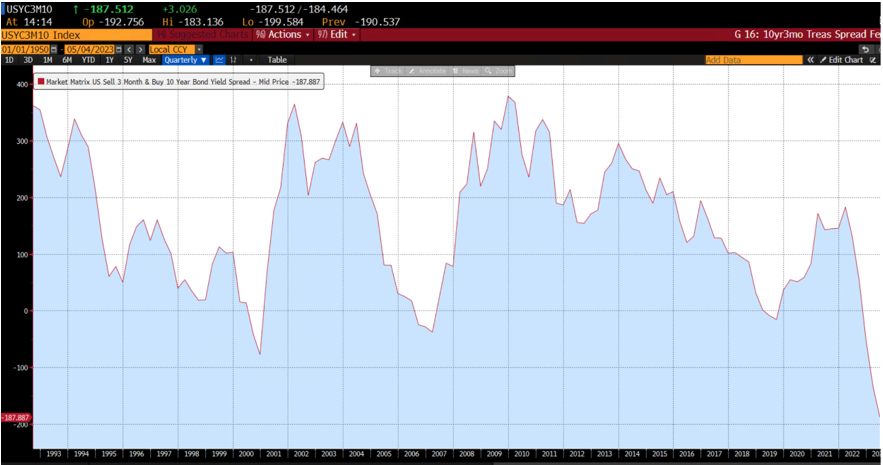

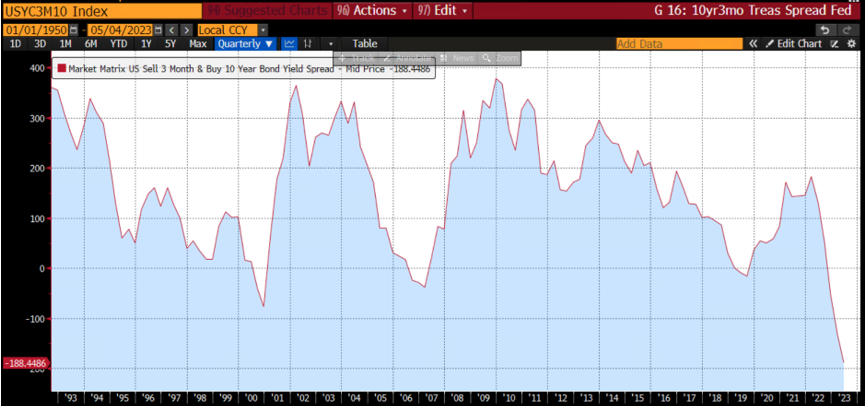

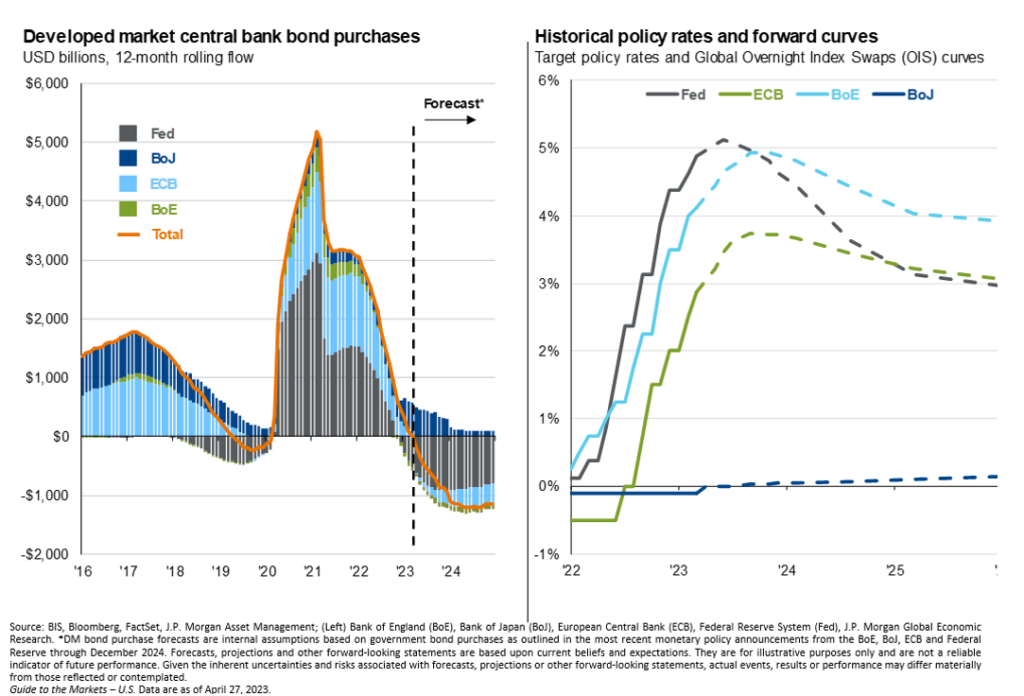

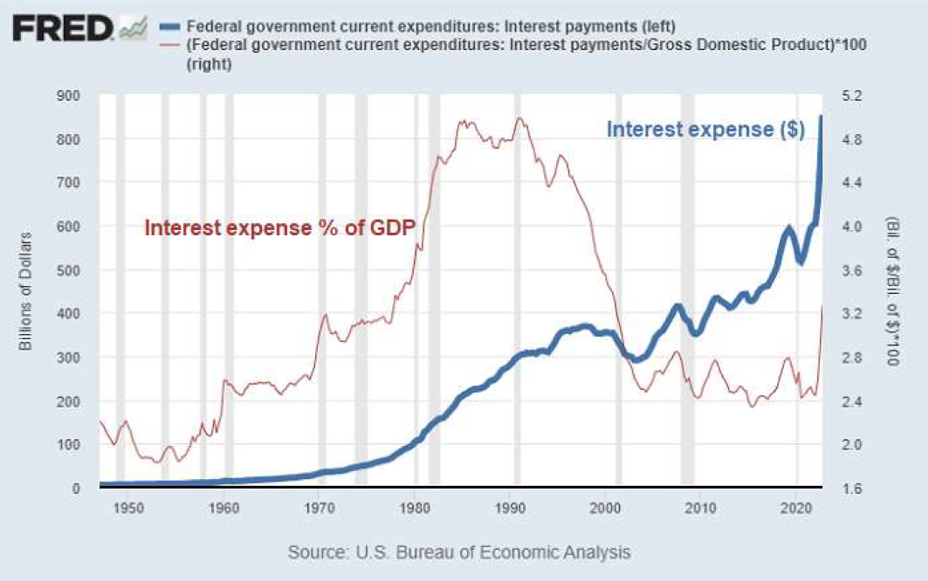

United States labor markets remain to be secularly limited, while innovations in the Fed funds price is doing whatever yet dealing with supply-driven inflationary stress. The Fed funds price struck 5-5.25%, the treasury return contour is as inverted as it’s remained in years, credit scores markets are running out, as well as financial institution down payments appear to go down additionally with every rise simply put term prices as financial institutions can not take on cash markets, specifically with an upside down return contour. If that appears complicated, it is! Measurable firm (QT) would likely have a higher impact on liquidity as well as need than short-term price relocations are having. QT is something frequently prepared as well as occasionally carried out. The Fed is trying to be positive rather than responsive when it pertains to temporary prices, as well as just time will certainly inform if they achieve success. The Fed is using procedures made use of to decrease a development market sustained by a flourishing credit scores market, other than credit scores markets are as rough as they have actually ever before been.

[wce_code id=192]

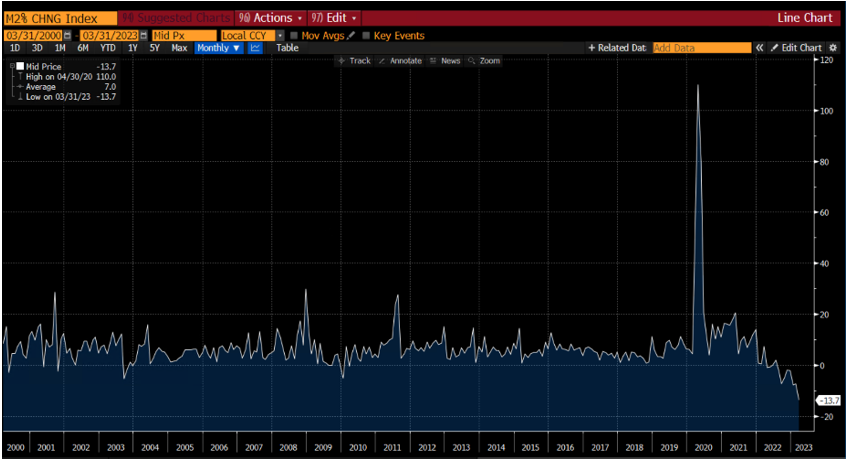

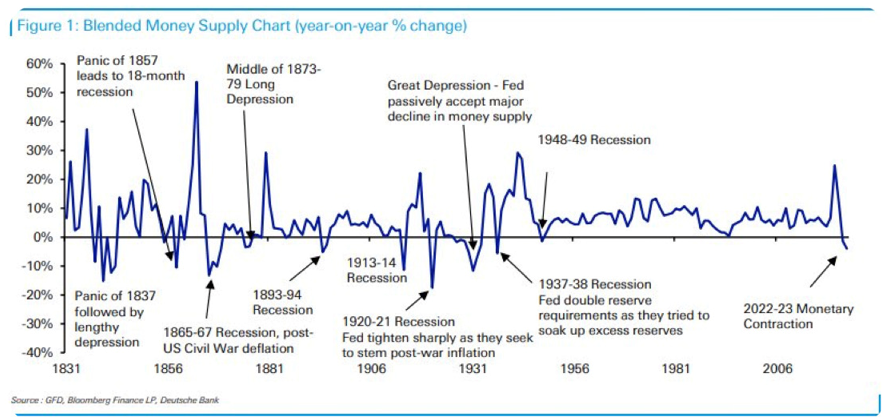

The fact is, our company believe, this moment is various. A lot of us have actually never ever seen a market setting where the Federal Get had intents of drawing Trillions of bucks out of the marketplace efficiently, without it triggering mass market interruptions. The last time we had intents of minimizing the annual report at simply a portion of the dimension of this measurable firm cycle was 2019. That measurable firm cycle was rather truthfully, going disastrously in our point of view, as well as lots of think covid QE concealed the worry most of us have currently. Do any one of us truly think they will have the ability to loosen up the annual report to the degree they state (95 billion a month– never ever accomplished in the background of financial plan)? If customers tighten their belt investing smart what will take place? And also exactly how fast might customers they reduced their investing? Will it be led by jobless technology employees? Self-confidence is rather reduced.

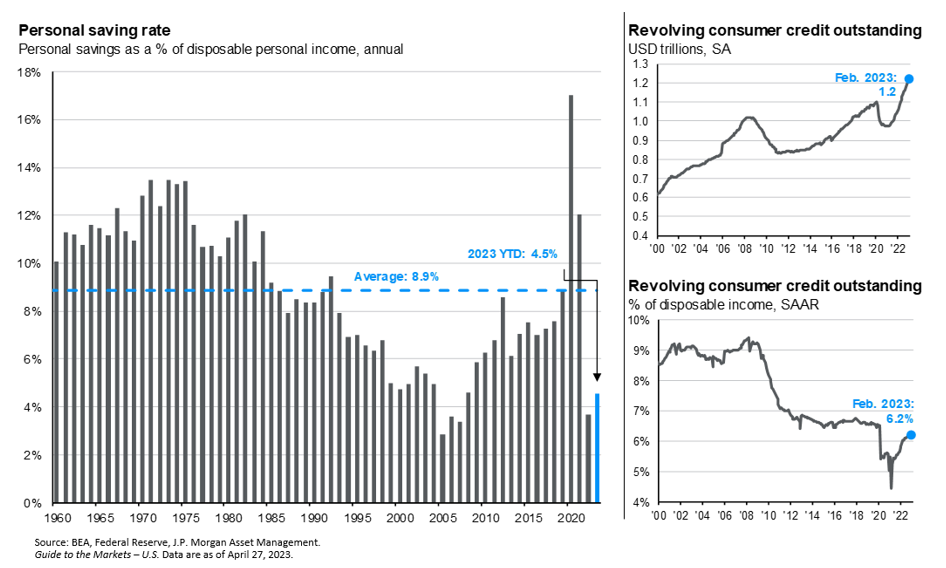

Wall Surface Road & & the FinTwit globe are flipping out, nearly excitedly waiting for a pending economic crisis, unusually sufficient doing so while investing within the cities they stay is growing. Attempt as well as reserve a dining establishment in New york city, LA, Austin, or Miami (sorry San Francisco), as well as you will certainly see exactly how well city economic situations are apparently standing up. The strange feature of human habits is that it’s simple to boost your degree of investing, yet extremely tough to lower. Financial experts around the globe are taking a look at rising cost of living led by real estate expenses, as either an occupant or brand-new proprietor, as well as attempting to identify where the non reusable earnings is originating from. Wage development is still reasonably high yet restrained as well as still listed below rising cost of living. While the cost savings price has actually reached 5.1% given that June in 2015, is still extremely reduced traditionally. Bank card financial debt has actually absolutely raised, as well as rates of interest on that particular credit scores are a lot greater. If we require to eliminate wage development as well as work to reduce this market down, we are basically pleading for Stagflation to eliminate rising cost of living in hopes of resulting in a 2% inflationary setting. This is challenging to manage.

Greater Than 85% of the S&P 500’s return year-to-date has actually been focused in 6 names. Several market experts think some type of financial debt spiral led by tightened up borrowing, an icy exclusive credit scores market, or industrial property is on the perspective. It’s similarly most likely that the typical “climbing up the wall surface of fear” leads markets greater for a lot longer than lots of have perseverance for (are we there yet, economic crisis??). Maybe a little bit of both, as well as an ongoing see-saw in between both situations, credit scores issues as well as traditional property rising cost of living lead by megacap supplies that might be extra solvent than federal governments around the world. The trouble in these huge cycle relocations is that maybe tomorrow, or 5 years from currently. In the coming months, we will certainly discover exactly how flexible exclusive credit scores markets are, as well as just how much damages has actually been done. It does show up that a wonderful section of the industrial property room inevitably wound up on the annual report of pension plans with bush fund allowances as well as might be the following “as well large to fall short” sector.

We have actually talked in detail regarding threats in the industrial property room. This has actually been highlighted of late by the leviathan in the room, Blackstone. Much more particularly, their substantial $70 billion Blackstone property earnings trust fund (BREIT). Given that October 2022, discharges have actually gone beyond redemption limitations. In April, capitalists tried to take out $4.5 billion. The Fund paid simply 29% of that $4.5 billion, a comparable proportion to what it paid in March. What would certainly need to take place in this globe for redemption demands to quit? We do not have a solution to that, which is scary.

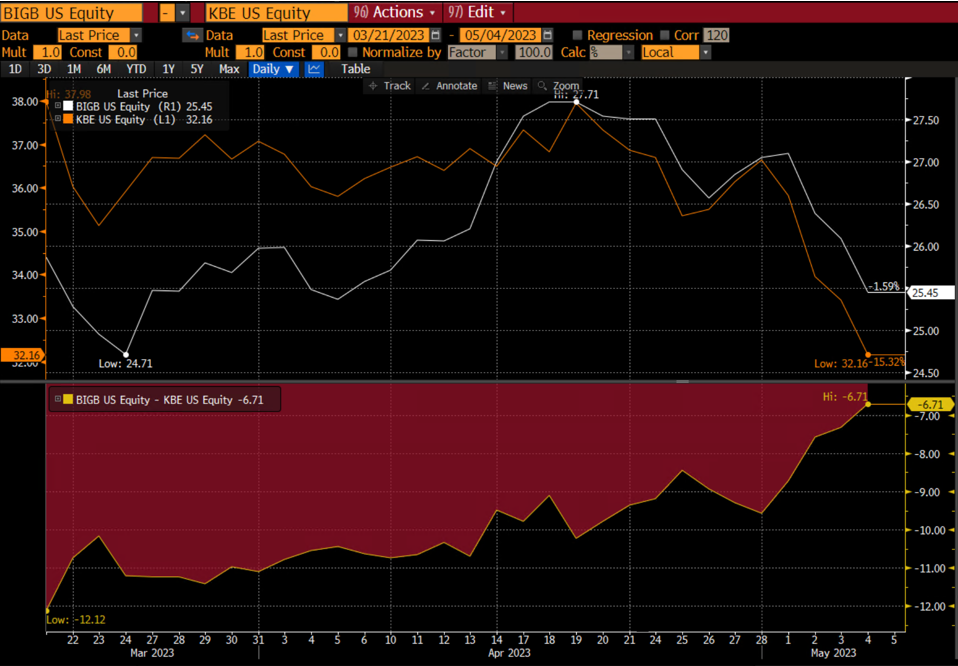

With several financial institutions in receivership, as well as all various other regionals down over -35% on the year, Powell mentioned “problems in [the banking] field have actually extensively enhanced given that very early March, as well as the united state financial system is audio as well as resistant,” adhered to by the following leg down in local financial, with Special-interest group West down -41% on Might fourth, the day after the FOMC conference. This is a cry versus an upside down return contour.

We have actually created continually that the moment invested in dislocated markets is in some cases more vital than the real midsts of an economic downturn in a globe where we require even more financial debt to sustain development to stay on top of old financial debt repayments. With First Republic Financial institution mosting likely to JP Morgan, JP Morgan as well as Financial institution of America currently make up around 31% of all financial institution down payments. Also large to fall short gets back at larger, backed by not just the FDIC (these financial institutions are as well large) yet the federal government, which is amidst an additional financial debt ceiling ordeal. Gold, Bitcoin, as well as Huge Cap United States Supplies rallied, as well as an instance might be created why each is an extra protected property course than United States Treasury bonds, besides temporary paper. Our team believe that there is no engaging factor to ever before hold even more money on a not-too large to fall short financial institution annual report than what is permitted under FDIC insurance policy. Regional Financial institutions are backed by FDIC insurance policy, large financial institutions are backed by the federal government. $250k is as well little for organizations to run pay-roll, as well as the Fed has actually compelled small companies that have actually prospered on local financial partnerships to ask the large gamers for focus. Regrettably, given that the economic dilemma, these bigger financial institutions have actually outmatched all various other financial institutions, gradually deteriorating market share from local financial institutions.

If industrial property paper remains to wear down, with redemptions from institutional gamers like Blackstone, a future Lehman minute occasion is still an opportunity, specifically late in 2023, as well as it’s not likely to be local. Credit report default swaps heading out a year are simply goofy. It’s additionally similarly most likely that development supplies rally additionally initially, as well as a debt occasion might conveniently be pressed out to 2024. There is no assurance right now. M2 has actually definitely diminished a high cliff.

United States EQUITIES

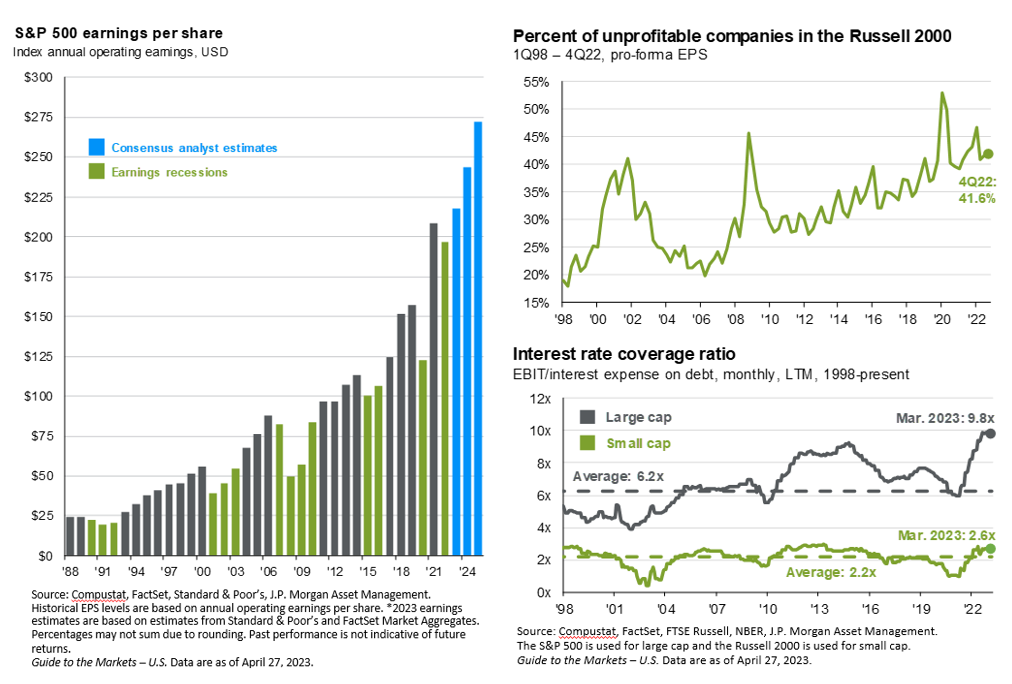

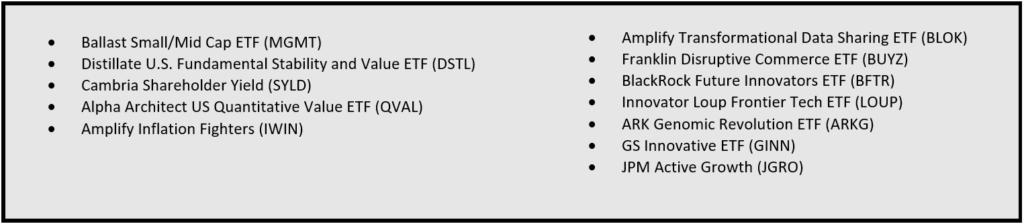

The innovation field blazed a trail in Q1 profits, with solid revenues driven by mass discharges. Nevertheless, future development leads doubt. Will the performance gains from expert system be understood in the short-term? Or will profits gains take longer to recognize? Many technology companies pointed out AI in between 40-200 times in this newest profits period. The iShares Core S&P 500 ETF (IVV) returned 9.16% with April. The iShares Russell 2000 ETF (IWM) returned just 0.91%. The aberration is also worse than it looks when you begin taking a look at the private names that generated nearly all the S&P 500 returns this year. The march in the direction of unprofitability in the Russell 2000 proceeds.

Global Established as well as Arising Market Equity

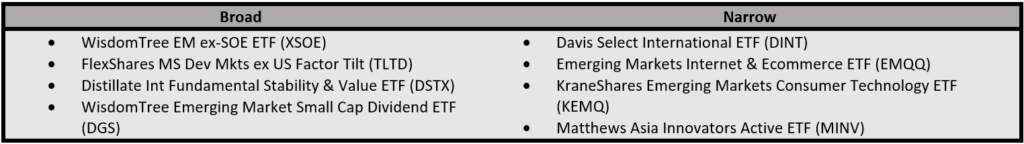

The iShares MSCI EAFE ETF (EFA) returned 11.59% with April, while the iShares MSCI Arising Markets ETF (EEM) returned 3.28%. China began the year solid yet has actually given that backtracked as well as is once again tracking United States markets. EMQQ Arising Markets Web & & Ecommerce ETF (EMQQ) was down over 7% for April, as well as its year-to-date total amount was -0.74%. This is all while the United States buck has actually quit ground, specifically to arising market money. The step far from the United States buck as the get money struck information circuits. There is a scarcity people bucks offered in arising markets, sustaining to the fire to locate a substitute. Any type of real adjustment to worldwide negotiation takes place gradually with time, as well as out a light button.

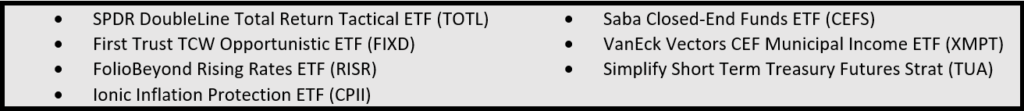

DEALT WITH EARNINGS

After a tragic 2022, iShares Barclays Accumulation Bond ETF (AGG) returned 3.74%. Long-term treasuries, gauged by PIMCO 25+ Year Absolutely No Promo Code United States Treasury ETF (ZROZ) recovered, returning 9.56% with April. The upside down return contour (3-month/ ten years) is extra upside down than it has actually ever before been.

We are once again anticipating a big drawdown in reserve bank annual report that is not likely to find to fulfillment.

Alternatives

The buck shed ground to a lot of established as well as arising money, while gold leapt 9.25% on the year. Bitcoin recovered highly, sustained by a gold-like rally message financial dilemma, as its bush versus the credit scores value of countries entered play.

A theoretical high-active-share restoration of a standard 60/40:

• 5% PIMCO 25+ Year Zero Coupon US Treasury Index ETF (ZROZ)

• 2% Angel Oak UltraShort Income ETF (UYLD)

• 2% Simplify Short Term Treasury Futures (TUA)

• 2% Simplify Managed Futures (CTA)

• 10% Saba Closed-End Funds ETF (CEFS)

• 2.5% AGFiQ US Market Neutral Anti-Beta Fund (BTAL)

• 1% Ionic Inflation Protection ETF (CPII)

• 1% FolioBeyond Rising Rates ETF (RISR)

• 2.5% WisdomTree Enhanced Commodity Strategy Fund (GCC)

• 1% Tecrium Agricultural Strategy No K-1 ETF (TILL)

• 4% SPDR Gold MiniShares Trust (GLDM)

• 4% Amplify Inflation Fighters ETF (IWIN)

• 5% Amplify Transformational Data Sharing ETF (BLOK)

• 5% Sofi Be Your Own Boss ETF (BYOB)

• 5% Franklin Disruptive Commerce ETF (BUYZ)

• 5% BlackRock Future Innovators ETF (BFTR)

• 4% Ark Genomic Revolution ETF (ARKG)

• 4% Emerging Markets Internet & Ecommerce ETF (EMQQ)

• 5% Ballast Small/Mid Cap ETF (MGMT)

• 5% ETF 6 Meridian Small Cap Equity ETF (SIXS)

• 5% Alpha Architect US Quantitative Value ETF (QVAL)

• 5% Cambria Shareholder Yield ETF (SYLD)

• 5% Distillate International Fundamental Stability Value ETF (DSTX)

• 2.5% Distillate US Fundamental Stability & Value ETF (DSTL)

• 2.5% GS Innovative Equity (GINN)

• 5% Mathews Asia Innovators Active (MINV)

For even more information, info, as well as evaluation, see the ETF Strategist Channel.

Disclosure

All financial investments lug threats, as well as capitalists might shed their principal.

The product given right here is for informative objectives just as well as need to not be taken into consideration personalizedinvestment guidance The financial investment methods pointed out right here might not appropriate for every person, as well as each capitalist ought to evaluate their very own scenario prior to making a financial investment choice.

Viewpoints revealed right here go through alter without notification because of market problems. Third-party information offered right here is gotten from resources thought to be trusted, yet precision, efficiency, or integrity can not be ensured.

The instances given are for illustratory objectives just as well as need to not be taken into consideration reflective of real outcomes.

Investments’ worth as well as earnings can vary, as well as capitalists might not recoup their preliminary financial investment. Elements that can influence financial investments consist of rates of interest adjustments, currency exchange rate variations, basic market problems, political, social, as well as financial growths, as well as various other variable elements. Financial investment lugs threats, such as repayment hold-ups, as well as loss of earnings or resources. Neither Toroso neither any one of its associates assure any kind of price of return or the return of resources spent.

This discourse product is for informative objectives just as well as does not comprise a deal to offer or a solicitation of a deal to purchase any kind of protection.

All financial investments as well as financial investment methods lug threats of loss, consisting of the feasible loss of all quantities spent, as well as absolutely nothing here ought to be understood as a warranty of any kind of certain end result or earnings. While we have actually collected info from resources our company believe to be trusted, we can not assure the precision or efficiency of the info offered.

The info in this product is personal as well as exclusive as well as might just be made use of by the desired individual. Toroso, its associates, or any one of their police officers or workers are not accountable for any kind of losses occurring from using this product or its materials. This product might not be replicated, dispersed, or released without prior created approval from Toroso. Circulation of this product might be limited in particular territories. Anybody getting this product ought to inquire to figure out whether there are any kind of limitations in their territory.

The sights as well as viewpoints revealed here are the sights as well as viewpoints of the writer as well as do not always show those of Nasdaq, Inc.