- Markets had a risky week, with US 100 (Nasdaq 100) reaching new highs and a robust probability of a Fed price reduce subsequent week.

- Main central financial institution conferences dominate the week forward.

- The BoJ faces a tricky determination on whether or not to lift rates of interest, with latest knowledge supporting a hike.

- The US Greenback Index (DXY) is at a vital resistance stage, and its efficiency could also be influenced by the Fed’s rate of interest determination and outlook.

Week in Overview: Uptick in US Inflation a Concern?

An fascinating week that noticed swings from threat off to threat on sentiment serving to to push US Equities to contemporary highs.

A robust batch of US Information retains the probability of a Fed Price reduce subsequent week robust and languishing above the 90% threshold heading into the weekend.

Supply: CME FedWatch Software

Latest will increase in each the US CPI and PPI knowledge have raised eyebrows concerning resurgent inflation in 2025. This comes towards the backdrop of proposed tariffs by incoming President Donald Trump. With that in thoughts nonetheless, many imagine the will strengthen resulting from this and it’s a believable state of affairs as Yields are additionally anticipated to rise.

The practice of thought round tariffs has been nicely mentioned with ING Thinks James Knightley placing it nicely “costs are going to rise, notably if Trump’s tariff plans are as daring as promised on the marketing campaign path. And development might rise within the quick time period. However timing is every thing. If tariffs kick in early, and aren’t compensated for by massive tax cuts, there’s going to be an actual squeeze on family spending energy.” I’ve to confess that i are likely to agree with the narrative.

These considerations make the upcoming PCE knowledge extra necessary to the Fed as we head into 2025, with my base case being a December reduce and January maintain.

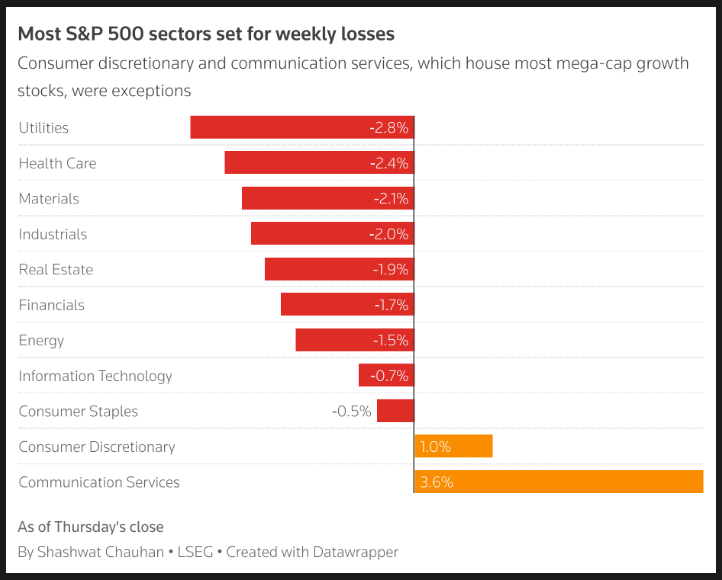

Wall Road Indexes had been blended this week with the on target for a constructive end thanks largely to chip shares. The Nasdaq 100 is doing higher than its Wall Road friends after Broadcom (NASDAQ:) gave a constructive outlook. This boosted pleasure about synthetic intelligence and helped increase the worth of chip shares dragging the index nearer to the 22000 deal with.

Wall Road indexes seem like taking a break after latest beneficial properties and a few robust financial knowledge earlier than the Fed’s assembly. This has put the and on observe for losses this week.

Supply: LSEG

costs recorded its first weekly acquire in three weeks regardless of each OPEC and IEA downgrading their forecasts for each 2024 and 2025. Stimulus measures introduced by China’s politburo for now although seem like supporting Oil costs and conserving above the essential $70 a barrel mark. Additional sanctions on Russia and the potential for elevated sanctions on Iran could also be partly the explanation for Oil value beneficial properties this week.

The loved a constructive week and consequently weighed on its G7 counterparts and lots of rising market currencies as nicely. The early week US Greenback energy could partly have been all the way down to haven enchantment following occasions in Syria over the previous two weeks. The DXY is languishing in a vital space heading into a large week and is prone to play a giant function because the month and 12 months attracts to an in depth.

costs loved a robust begin to the week thanks partly to renewed haven enchantment and the resumption of Gold purchases by the Peoples Financial institution of China following a close to six-month hiatus. Nevertheless, the robust PPI knowledge and potential profit-taking on Gold forward of a busy week have left the dear steel buying and selling up simply round 1% for the week at 2660 on the time of writing. A stark distinction from Thursday’s highs across the 2720 and ounce deal with. Any additional indicators of instability in Syria heading into subsequent week might be essential within the valuable metals subsequent transfer in addition to the outlook by the US Federal Reserve shifting ahead into 2025.

The Week Forward: Fed to Lower Charges, BoE Set to Maintain as BOJ Face a Powerful Alternative

Asia Pacific Markets

The week forward within the Asia Pacific area sees some key financial knowledge releases and occasions.

In China, the ultimate knowledge report of the 12 months will come out subsequent Monday. Key financial indicators are anticipated to point out modest enchancment. Industrial manufacturing could develop by 5.6% in comparison with final 12 months, retail gross sales are prone to pace as much as 5.1% development year-on-year, and glued asset funding might keep regular with a small enhance to three.5% year-to-date.

Stimulus bulletins by China final week provides one other layer of intrigue round China. Market contributors are hoping that the bulletins over the previous week will lastly result in a surge in demand.

In Japan, the Financial institution of Japan is assembly on Thursday. There are expectations for an rate of interest hike subsequent week, though it could be an in depth determination. Latest knowledge, like robust wage development, higher-than-expected inflation, and improved GDP figures, again the concept of a hike.

Nevertheless, one native wire in Japan reported that there’s a rising view {that a} untimely price hike needs to be averted except there’s a vital threat of inflation rising. This will likely give the BoJ some meals for thought.

Europe + UK + US

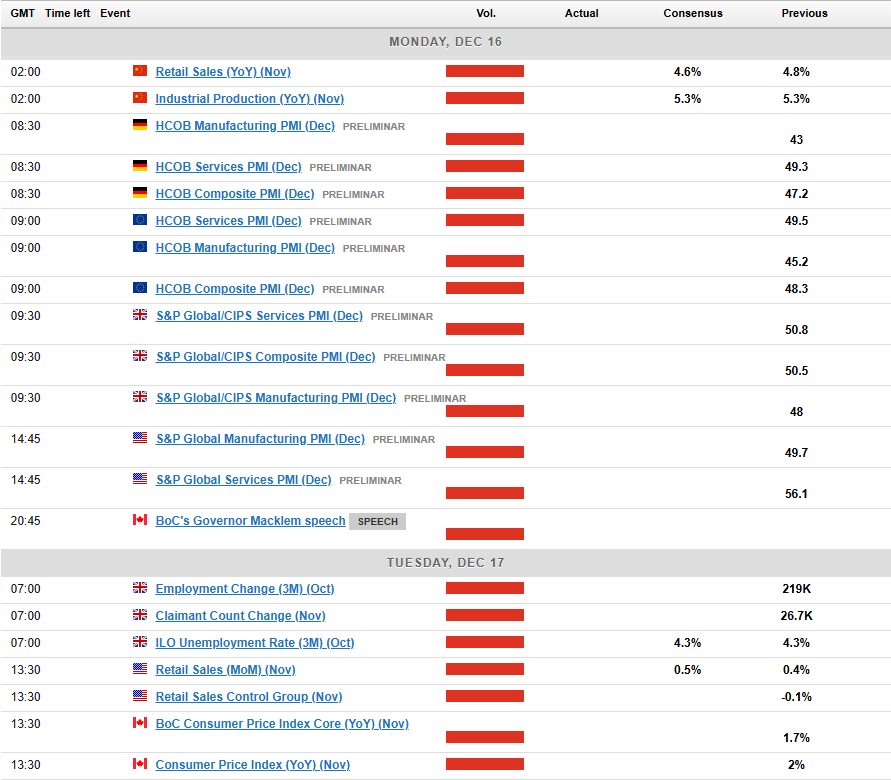

In developed markets, the main target strikes again to Central Banks with each the Federal Reserve and the Financial institution of England (BoE) rate of interest selections.

The Federal Reserve is predicted to scale back charges by one other 25 foundation factors on December 18. Inflation hasn’t moved a lot nearer to the Fed’s 2% goal not too long ago. Nevertheless, the Fed additionally displays the job market intently. Indicators like slower job development and rising unemployment assist the choice to regulate charges nearer to a impartial stage. That stated, the speed cuts are prone to decelerate in 2025 except inflation improves considerably or the job market weakens rather more.

The Fed’s most popular inflation measure, the core PCE deflator, is predicted to be round 0.2%, primarily based on latest knowledge from the CPI and PPI reviews.

In Europe the week is a bit quieter with the largest knowledge launch being PMI knowledge. Given the wrestle with development the Euro Space is experiencing, this can be a key launch and one that might stoke volatility and the likelihood of potential price cuts from the ECB. There may be additionally a speech by Christine Lagarde initially of the week which can shed extra gentle on this previous week’s price reduce.

Within the UK we now have a busy week with labor knowledge kicking issues off. The unemployment price has been fairly unpredictable resulting from well-known knowledge points. Nevertheless, there are clear indicators that the job market is slowing down. Regardless of this, wages haven’t been affected but and would possibly even rise barely subsequent week due to uncommon comparisons with final 12 months’s numbers.

Headline inflation is predicted to extend greater than the Financial institution of England predicted, partly resulting from a small rise in providers inflation. This measure, which is necessary to the BoE, is prone to keep round 5% throughout the winter. That is largely due to stubbornly excessive prices in areas like journey and rents, which the Financial institution doesn’t appear too involved about.

The Financial institution of England (BoE) seems snug with decreasing charges each different assembly. Since charges had been reduce in November, I don’t suppose there will probably be one other reduce earlier than the February assembly.

Chart of the Week

This week’s focus is again to the US Greenback Index which is as soon as once more in the important thing space across the 107.00 deal with.

I believed this can be a prudent time to have a look at the efficiency of the US Greenback publish the 2016 US election for a historic perspective.

After each the 2016 and 2024 elections, shares and the US greenback went up. Nevertheless, in 2017, the greenback misplaced energy, coming into a downward development that lasted a lot of the 12 months. This weak point within the greenback helped assist a gradual rise in U.S. and international inventory markets.

Taking a look at the place the US Greenback Index is at the moment resting in a key space of resistance. Will the latest uptick in inflation be a driving pressure for the US Greenback shifting ahead or will the Fed achieve conserving issues on an excellent keel?

The DXY has struggled to seek out acceptance above the 107.00 deal with, will this time show to be totally different?

A rejection right here could result in a retest of assist at 106.50 and the 106.00 deal with respectively.

A breach of 107.00 might want to show that it has discovered acceptance above this stage earlier than i will probably be satisfied of a sustainable transfer. The Fed rate of interest assembly might be the catalyst for this particularly in the event that they taper price reduce expectations for 2025.

US Greenback Index (DXY) Day by day Chart – December 13, 2024

Supply: TradingView.Com

Key Ranges to Contemplate:

Assist

Resistance

Learn Extra: