McDonald’s Company MCD inventory has gained 7.8% within the year-to-date interval, outperforming the Zacks Retail-Restaurant business, the broader Retail-Wholesale sector and the S&P 500 index. The detailed value efficiency of the business gamers is proven within the chart beneath.

Picture Supply: Zacks Funding Analysis

After hitting a pause as a result of catastrophic E. coli outbreak announcement, this main fast-food chain has bounced again as a result of favorable buyer traits after it advocated meals security as its prime precedence. By instantly eradicating the provider from the availability chain, as a result of which it confronted extreme backlash, McDonald’s was in a position to reinstate the shoppers’ confidence. In addition to this, the efficient implementation of its in-house initiatives just like the Accelerating the Arches technique, menu innovation, worth choices and international growth methods has been supporting the corporate’s uptrend.

The business MCD operates in is very aggressive and sustaining a acknowledged place available in the market is a strenuous job. Backed by favorable tailwinds, the corporate has notably outperformed a number of of the acknowledged business gamers, together with Restaurant Manufacturers Worldwide Inc. QSR, The Wendy’s Firm WEN and Chipotle Mexican Grill CMG, 12 months so far. In the course of the stated timeframe, the inventory value of Restaurant Manufacturers gained 5.5% whereas Wendy’s and Chipotle shares have tumbled 7.9% and 15.5%, respectively.

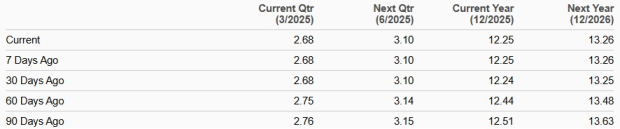

Estimate Pattern Favors MCD

As noticed within the chart beneath, the 2025 earnings estimate revision of McDonald’s has trended upward 0.1% prior to now 30 days. The 12 months’s earnings estimate pattern signifies 4.5% year-over-year progress, reflecting the optimistic views of the analysts, pushed by the traits in favor of the corporate.

EPS Pattern

Picture Supply: Zacks Funding Analysis

Components Fostering McDonald’s Momentum

McDonald’s is the world’s largest chain of fast-food eating places, with a presence in additional than 100 nations. Rising visitor counts stay the corporate’s high precedence and it intends to regain prospects by specializing in meals high quality, comfort and worth. The model recognition has helped the corporate achieve optimistic ends in its Arches marketing campaign methods, particularly Accelerating the Arches, initiated in its high markets throughout the globe, thereby driving progress.

Notably, MCD’s give attention to enhancing its core menu and guaranteeing worth choices has been driving its prospects. In January 2025, it launched its McValue platform in the US to offer consistency and compelling prospects with flexibility over selections. By the primary quarter of 2025 finish, the corporate goals to boost its worth packages throughout a number of worldwide markets to extend buyer engagement and foster site visitors progress. Much like the corporate, business gamers like Chipotle and Wendy’s are witnessing favorable buyer responses to menu innovation and pocket-friendly choices.

One other progress driver of MCD is its give attention to increasing its international footprint. It believes that there’s a large alternative to develop all its manufacturers globally by increasing its presence in current markets and coming into new ones. McDonald’s plans to open roughly 2,200 eating places globally in 2025, with 1 / 4 of those new openings in its US and IOM segments. It targets to open 50,000 eating places by 2027. World growth effort is without doubt one of the prime growth-driving methods on this aggressive business as Restaurant Manufacturers can be witnessing progress throughout its reportable manufacturers via robust retailer improvement.

Moreover, McDonald’s elevated give attention to supply, fostering digital penetration and providing a strong loyalty program additionally bode effectively. The corporate expects to extend the proportion of system-wide supply gross sales originating from its cell app to 30% by 2027. Because the launch of its loyalty program, the entire variety of 90-day energetic customers has reached greater than 170 million. In 2024, the system-wide gross sales to loyalty members had been about $30 billion. MCD anticipates reaching 90-day energetic customers of 250 million with $45 billion in annual loyalty system-wide gross sales by the tip of 2027.

MCD Buying and selling at a Low cost

The corporate’s present valuation is attractive for buyers to look into it. MCD inventory is at the moment buying and selling at a reduction in contrast with the business friends on a ahead 12-month price-to-earnings (P/E) ratio foundation. The discounted valuation signifies that, regardless of the latest inventory value enhance to date this 12 months, it stays a pretty choice for buyers on the lookout for an appropriate entry level.

Picture Supply: Zacks Funding Analysis

Headwinds to MCD’s Prospects

As the corporate paves via 2025, the lingering macroeconomic components and inflationary pressures stay considerations.

Softer demand patterns in France, the UK and China are anticipated to limit the corporate’s comps progress. In 2024, its international comps inched down 0.1% in opposition to 9% progress within the prior 12 months. Moreover, excessive wage inflation and elevated commodity prices are going to strain the margins for a while. In 2025, the corporate expects commodity prices and meals, paper and labor inflation to influence margins to some extent.

Analysts’ Expectations on McDonald’s Inventory

Analysts are optimistic about MCD. Out of 37 suggestions contributing to the corporate’s Common Brokerage Suggestion (ABR), 22 have rated the inventory as a Robust Purchase and two have rated it as a Purchase, resulting in a formidable ABR of 1.74 (representing 59.5% and 5.4% of all suggestions, respectively). A month in the past, Robust Purchase represented 58.3%. Wall Road’s common value goal for MCD inventory is $331.1 per share, implying a possible upside of 5.9% from latest ranges.

Easy methods to Play MCD Inventory?

Per the dialogue above, the corporate is witnessing a lift in its efficiency because of its in-house initiatives, together with menu innovation, worth choices, a strong loyalty program and a give attention to supply gross sales via its cell app. By rising the digital penetration amongst its prospects, MCD is predicted to bolster its gross sales traits globally.

Nevertheless, headwinds within the type of ongoing macroeconomic uncertainties and inflationary pressures are pressuring its margins to a sure extent. Additionally, softer comps traits in a number of of the key worldwide markets are off-putting as effectively.

Thus, by contemplating each side of the coin, it’s prudent for current buyers to carry on to this Zacks Rank #3 (Maintain) firm’s shares for now, whereas new buyers may wish to look ahead to a extra favorable entry level.

You’ll be able to see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks’ Analysis Chief Names “Inventory Most Prone to Double”

Our group of consultants has simply launched the 5 shares with the best chance of gaining +100% or extra within the coming months. Of these 5, Director of Analysis Sheraz Mian highlights the one inventory set to climb highest.

This high decide is among the many most progressive monetary companies. With a fast-growing buyer base (already 50+ million) and a various set of innovative options, this inventory is poised for giant features. In fact, all our elite picks aren’t winners however this one might far surpass earlier Zacks’ Shares Set to Double like Nano-X Imaging which shot up +129.6% in little greater than 9 months.

Free: See Our Top Stock And 4 Runners Up

McDonald’s Corporation (MCD) : Free Stock Analysis Report

Chipotle Mexican Grill, Inc. (CMG) : Free Stock Analysis Report

The Wendy’s Company (WEN) : Free Stock Analysis Report

Restaurant Brands International Inc. (QSR) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.