It is no secret that during the last couple of years buyers have turn out to be more and more curious concerning the prospects synthetic intelligence (AI) presents. With that stated, I’ve discovered a whole lot of the dialogue round AI to be largely redundant.

Software program corporations are touting how AI-powered companies can yield larger productiveness ranges within the office, whereas {hardware} and infrastructure gamers primarily maintain the keys to the AI automobile by means of the ability of knowledge facilities and semiconductor chips.

Extra just lately, nevertheless, I’ve began studying about AI’s position within the navy. I already knew that Palantir Applied sciences (NYSE: PLTR) was a serious participant on the intersection of AI and the general public sector. Nonetheless, a latest announcement out of Meta Platforms (NASDAQ: META) has me interested by AI defense applications in a brand new means.

Under, I will element why Meta’s new partnership with Palantir is so essential. Moreover, I will assess which inventory I see as the higher purchase in the mean time because the navy AI motion heats up.

How is Meta serving to the navy?

One of many largest breakthroughs from the AI revolution to this point is the introduction of the large language model (LLM). Whereas there are a bunch of LLMs in the marketplace, OpenAI’s ChatGPT might be the one you are most conversant in.

Anecdotally, I’ve discovered working inside ChatGPT fairly entertaining. I take advantage of the LLM to assist me reply questions if I haven’t got the endurance to scroll by means of Google, and infrequently, I’ve even used it to assist me write some software program code for private tasks.

Unbeknownst to me, LLMs have much more energy than enhancing productiveness output or answering questions with the press of a button. In accordance with a latest press launch from Meta, the corporate’s Llama AI mannequin is making its means into the U.S. authorities and adjoining contractors within the personal sector.

In accordance with the announcement, LLMs “have helped to speed up protection analysis and high-end computing, establish safety vulnerabilities and enhance communication between disparate techniques.”

I assume I by no means actually gave the concept a lot thought, however the navy shares a whole lot of overlap with the personal sector with regards to operational ache factors. However with that stated, the navy is not simply targeted on effectivity — security is its prime concern. In accordance with Mordor Intelligence, the total addressable market size for AI analytics and robotic processing services within the protection sector will probably be value greater than $60 billion over the subsequent 5 years.

As a part of its deployment of Llama into the general public sector, Meta introduced that it is partnering with none apart from Palantir. Under, I will element some valuation developments and extra speaking factors about Meta and Palantir, and assess which inventory appears to be like like the very best alternative in the mean time.

Picture supply: Getty Photos.

Meta inventory: Purchase, promote, or maintain?

Meta’s AI thesis is fairly simple. The corporate owns a lot of social media platforms together with Fb, Instagram, and WhatsApp. Furthermore, Meta additionally has a budding operation targeted on digital actuality, gaming, and the metaverse.

On the social media aspect of the equation, Meta sits in a profitable place to leverage AI in such a means that helps it perceive its consumer base on an excellent deeper stage. In flip, Meta can enhance its focused promoting campaigns, which theoretically ought to yield larger engagement throughout its platforms. As well as, providing a singular suite of digital actuality and gaming merchandise opens the door to an entire new cohort of customers on the platform, all whereas diversifying the corporate’s advertising-heavy enterprise mannequin.

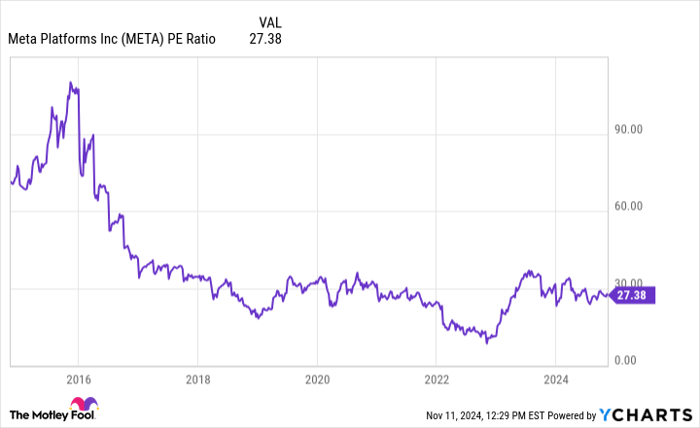

META PE Ratio knowledge by YCharts

I see Meta branching into the protection area and increasing its AI capabilities throughout the general public sector as a giant deal and a savvy option to diversify its long-term roadmap. But, regardless of these interesting tailwinds, Meta’s price-to-earnings (P/E) ratio of 27 is traditionally low. I believe buyers is likely to be overlooking a number of huge catalysts, making now a really perfect time to purchase Meta inventory hand over fist.

Palantir inventory: Purchase, promote, or maintain?

Palantir has turn out to be one of many largest profiles in AI during the last 12 months. Following the discharge of the Palantir Synthetic Intelligence Platform (AIP) in April 2023, the corporate has swiftly entered right into a renaissance hallmarked by accelerated buyer acquisition, income progress, and constant profitability.

Palantir’s transformation hasn’t gone unnoticed, both. Earlier this 12 months the corporate introduced a partnership with cloud computing specialist Oracle, in addition to a take care of Microsoft that marries AIP with Microsoft’s Azure cloud infrastructure throughout U.S. protection businesses.

All of those developments, whereas spectacular, have made a noticeable impression on Palantir’s share value. As I write this, shares of Palantir have gained over 240% this 12 months — making it the second-highest-performing inventory within the S&P 500.

With a market capitalization of roughly $140 billion and a price-to-sales (P/S) a number of of 53, I’ve to say that Palantir inventory has gotten out of hand.

In the event you’ve learn my prior items about Palantir then you definitely’ll know that I’m extremely optimistic concerning the firm’s future and I absolutely intend to stay a shareholder. However proper now, there may be simply an excessive amount of momentum fueling Palantir shares and its valuation has turn out to be disconnected from actuality. For these causes, I might move on Palantir for now however would encourage buyers to be looking out for any sell-offs that might happen and use these as alternatives to purchase the dip.

Don’t miss this second likelihood at a probably profitable alternative

Ever really feel such as you missed the boat in shopping for probably the most profitable shares? You then’ll need to hear this.

On uncommon events, our professional workforce of analysts points a “Double Down” stock suggestion for corporations that they suppose are about to pop. In the event you’re anxious you’ve already missed your likelihood to speculate, now’s the very best time to purchase earlier than it’s too late. And the numbers communicate for themselves:

- Amazon: in case you invested $1,000 once we doubled down in 2010, you’d have $23,818!*

- Apple: in case you invested $1,000 once we doubled down in 2008, you’d have $43,221!*

- Netflix: in case you invested $1,000 once we doubled down in 2004, you’d have $451,527!*

Proper now, we’re issuing “Double Down” alerts for 3 unbelievable corporations, and there might not be one other likelihood like this anytime quickly.

*Inventory Advisor returns as of November 11, 2024

Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Meta Platforms, Microsoft, and Palantir Applied sciences. The Motley Idiot has positions in and recommends Meta Platforms, Microsoft, Oracle, and Palantir Applied sciences. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.