As cloud computing transforms the digital panorama, business giants Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOGL) dominate the race with their respective cloud platforms—Azure, AWS, and Google Cloud. Every firm has invested closely in AI, knowledge storage, and modern applied sciences to draw enterprise purchasers and seize larger market share. As we speak, Amazon leads the group in cloud market share with 31% of the market, then Microsoft with 20% adopted by Alphabet with 12%.

In line with Synergy Analysis Group, within the third quarter of 2024, spending on world cloud infrastructure companies surged by $15.7 billion, or 23%, over the identical interval in 2023, reaching over $84 billion for the quarter ending September 30. During the last 12 months, income from cloud infrastructure companies hit $313 billion, underscoring the extraordinary competitors on this sector. Regardless of its huge scale, the cloud market continues to develop quickly, with year-over-year (YoY) progress accelerating for the fourth straight quarter.

All three of those shares reported earnings this week, with the outcomes of their cloud companies segments underneath the microscope. Amazon and Alphabet had optimistic reactions to their earnings outcomes, whereas Microsoft noticed some promoting following its assembly. All firms had very optimistic outcomes although, beating gross sales and earnings estimates. Additionally notable, Amazon inventory has outperformed the market year-to-date (YTD), whereas Alphabet is about according to market efficiency and Microsoft beneath.

Picture Supply: Zacks Funding Analysis

AMZN, GOOGL and MSFT Earnings Revisions

Amazon, Alphabet, and Microsoft have every made vital strides in cloud computing, however their earnings revision tendencies and progress forecasts inform barely totally different tales. Each Amazon and Microsoft presently maintain a Zacks Rank #3 (Maintain), indicating a comparatively flat earnings revision pattern. However, Alphabet has a Zacks Rank #2 (Purchase), suggesting a extra favorable outlook pushed by latest upward revisions to its earnings estimates.

long-term earnings progress projections, Amazon stands out with an anticipated annual progress price of 27.2% over the subsequent three to 5 years led by AWS. Alphabet’s anticipated progress price of 17.6% per 12 months displays its continued progress in cloud companies, YouTube and now self-driving with Waymo, whereas Microsoft, anticipated to develop at 14.7% yearly, showcases regular positive aspects in each its cloud and software program choices, together with Azure and Workplace 365.

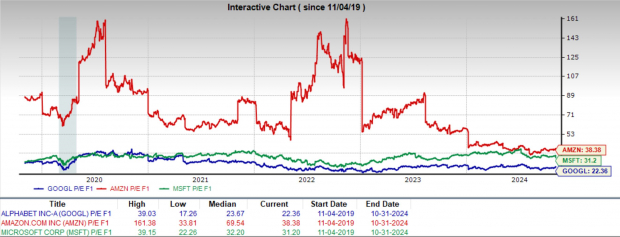

Their valuation additionally affords helpful perception into what buyers can anticipate going ahead. As we speak, Alphabet is buying and selling at a one 12 months ahead earnings a number of of twenty-two.4x which is beneath its 10-year median of 25.8x, Amazon at 38.4x can be beneath its 10-year median of 92.4x and Microsoft at 31.2x is above its 10-year median of 26.5x.

Picture Supply: Zacks Funding Analysis

AMZN, GOOGL or MSFT: Which Shares Ought to Buyers Purchase?

For buyers searching for one of the best mixture of progress potential and worth, GOOGL and AMZN stand out as probably the most enticing decisions among the many cloud giants. Each firms not solely boast robust earnings progress projections—with Amazon main the group—but in addition supply comparatively interesting valuations in comparison with Microsoft discounting for progress forecasts and historic valuations.

Alphabet’s latest efficiency within the cloud section and ongoing investments in AI and self-driving vehicles present big promise, and its ahead price-to-earnings ratio stays interesting given its progress trajectory. In the meantime, Amazon’s progress prospects are bolstered by its dominant place in e-commerce and the ever-expanding AWS, which stays a pacesetter within the cloud infrastructure market. Moreover, Amazon’s valuation is extra favorable relative to its progress price and historic common, making it a gorgeous possibility for these targeted on long-term potential.

In distinction, Microsoft’s substantial capital expenditures on AI and different tech developments—although anticipated to drive future progress—have been flagged as a degree of concern for now. Whereas Microsoft stays a cloud and AI powerhouse, these elevated prices may mood near-term returns, making it comparatively much less compelling at present valuations.

General, Alphabet and Amazon’s combine of strong progress forecasts and favorable valuations make them high picks within the cloud panorama for buyers searching for progress at an affordable value.

Zacks’ Analysis Chief Names “Inventory Most More likely to Double”

Our staff of consultants has simply launched the 5 shares with the best chance of gaining +100% or extra within the coming months. Of these 5, Director of Analysis Sheraz Mian highlights the one inventory set to climb highest.

This high decide is among the many most modern monetary corporations. With a fast-growing buyer base (already 50+ million) and a various set of innovative options, this inventory is poised for large positive aspects. In fact, all our elite picks aren’t winners however this one may far surpass earlier Zacks’ Shares Set to Double like Nano-X Imaging which shot up +129.6% in little greater than 9 months.

Free: See Our Top Stock And 4 Runners Up

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.