Today’s episode of Complete Court Money goes into the uncommonly silent market after the very first genuinely hectic week of revenues period that included arise from Tesla and also others. Wall surface Road may not stay tranquil with Microsoft, Meta, and also Amazon.com all reporting throughout the week of April 24. The inquiry currently is should capitalists get these resurgent mega-cap technology supplies heading right into revenues, or wait?

Tesla’s 10% autumn on Thursday looked like it can have stimulated a larger relocation, however the S&P 500 just handled to go down 0.6% after purchasers can be found in late in the session. Before the small decrease, the marketplace stayed virtually stationary throughout the very early component of the week as Wall surface Road just remains on its hands, which is what it did Friday.

The peace in the middle of the very first hectic week of revenues can imply that capitalists are much more concentrated on the following couple of rising cost of living records and also what the Fed does. It is likewise feasible that Wall surface Road is awaiting something extremely creepy or extremely favorable from a couple of essential records in order to make a relocation.

Luckily, Microsoft, Meta, Amazon.com, and also lots of various other heavyweights all report following week and also needs to aid capitalists recognize if the controlled trading will certainly stay till the following Fed conference on May 2 & & 3 and also the April CPI record on May 10.

It deserves regularly bearing in mind that the Nasdaq and also the S&P 500 have both relocated approximately laterally over the last couple of months, while continuing to be well over both their 50-day and also 200-day relocating standards.

Capitalists currently require to ask themselves if the most awful is currently valued right into large technology.

Microsoft ( MSFT) is readied to report its Q3 FY23 results on Tuesday, April 25. MSFT has actually installed a return off its lows, however it continues to be regarding 18% listed below its highs as capitalists evaluate the length of time its reducing development will certainly last. Microsoft is coming off five-straight years of thriving sales and also revenues development, driven by cloud computer.

Photo Resource: Zacks Financial Investment Study

MSFT’s near-term overview still asks for development, complied with by a huge rebound in FY24 as it verifies its varied profile, from cloud to company software application, is also mission-critical to the economic situation to be held back for also lengthy. Microsoft is diving hastily right into generative AI and also it is a golden goose with virtually $100 billion in money and also matchings. MSFT, which lands a Zacks Ranking # 3 (Hold) today, is up about 20% YTD and also trades not also away its five-year mean at 27.5 X onward 12-month revenues.

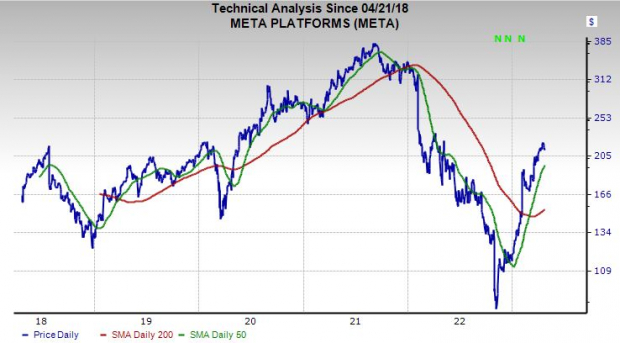

Meta Systems, Inc. ( META) associate orts its Q1 FY23 results on Wednesday, April 26. The moms and dad firm of Facebook, Instagram, and also WhatsApp gets to 2.96 billion individuals everyday and also 3.74 billion month-to-month, which is something marketers and also marketing experts just can not overlook despite the fact that Apple’s personal privacy modifications have actually harmed the whole market. Meta shares have actually soared over 130% because very early November as it dedicates to reducing prices, effectively, and also its core companies rather than the metaverse.

Photo Resource: Zacks Financial Investment Study

Zacks price quotes ask for Meta’s 2023 profits to climb up 5% and also pop 11% in FY24 to $135 billion. At the same time, Meta’s modified revenues are forecasted to leap 4% in FY23 and also 21% FY24. Meta’s surging revenues alterations aid it land a Zacks Ranking # 1 (Solid Buy). Regardless of its 135% climb off its lows it still trades nearly 45% below its tops. As well as Meta is trading at price cut to the Zacks Technology market’s 22.8 X at 19.4 X onward 12-month revenues.

Amazon.com ( AMZN) reports its very first quarter FY23 results on Thursday, April 27. Amazon.com’s autumn was nearly as harsh as Meta’s as the shopping and also cloud titan obtained hammered on problems regarding earnings and also reducing development. Chief Executive Officer Andy Jassy remains in the middle of attempting to tame widespread costs and also reducing prices, while still buying its very own generative AI designs and also various other essential initiatives. Amazon.com’s development is no question slowing down, however it’s still forecasted to upload 8% sales development in 2023 and also 13% in 2024 and also increase its profits by 90% and also 60%, specifically.

Photo Resource: Zacks Financial Investment Study

Amazon.com lands a Zacks Ranking # 3 (Hold) today and also it trades approximately 40% listed below its highs and also around where it was straight before the preliminary covid selloff. Its assessments degrees are still much from inexpensive, however they must remain to enhance as it concentrates on running its company like an extra secure company and also not a growth-at-all-costs startup. AMZN simply damaged back over its 200-day relocating standard for simply the 2nd time this year.

Zacks Names “Solitary Best Choose to Dual”

From hundreds of supplies, 5 Zacks specialists each have actually picked their favored to escalate +100% or even more in months to find. From those 5, Supervisor of Study Sheraz Mian hand-picks one to have one of the most eruptive benefit of all.

It’s an obscure chemical firm that’s up 65% over in 2014, yet still economical. With unrelenting need, rising 2022 revenues price quotes, and also $1.5 billion for redeeming shares, retail capitalists can enter at any moment.

This firm can measure up to or go beyond various other current Zacks’ Supplies Ready To Dual like Boston Beer Firm which skyrocketed +143.0% in bit greater than 9 months and also NVIDIA which grew +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints shared here are the sights and also viewpoints of the writer and also do not always mirror those of Nasdaq, Inc.