As lots of have actually realised, expert system (AI) has actually been among the most popular market subjects of 2023.

Nevertheless, it’s understandable why, as the innovation enables us to accomplish electronic accomplishments that or else really felt difficult.

As well as, obviously, a number of big-tech gamers, consisting of Microsoft MSFT as well as Alphabet GOOGL, have actually been scampering to come to be the leader.

Microsoft has actually gotten extensive focus complying with news of its brand-new AI-powered Bing online search engine as well as Side web browser.

The brand-new online search engine as well as Side web browser are anticipated to provide boosted search engine result, total responses, a brand-new conversation experience, as well as a general a lot easier experience when checking out the internet.

On the other side, Alphabet has just recently introduced its brand-new conversational AI solution, Poet, powered by the firm’s next-generation LaMDA (language version for discussion applications).

Poet is anticipated to provide top notch feedbacks attracted from the internet, matching the world’s understanding with the power of Alphabet’s LaMDA.

It elevates a legitimate concern: with each firm going head-to-head, which one’s shares resemble a much more eye-catching alternative? Allow’s take a more detailed look.

Share Efficiency

We can have a look at each firm’s rate activity throughout a number of durations to much better recognize which supply purchasers have actually liked.

Over the last 6 months, MSFT’s 11% decrease smoothly defeats GOOGL’s 22% pullback.

Picture Resource: Zacks Financial Investment Research Study

When diminishing the duration to incorporate the year-to-date rate activity, MSFT’s 7.5% return once more slips by GOOGL’s 6.6% climb.

Picture Resource: Zacks Financial Investment Research Study

As we can see, purchasers have actually preferred MSFT shares over the last 6 months as well as in 2023.

Assessment

Certainly, an essential facet of any kind of financial investment choice focuses on appraisal, as lots of capitalists avoid firms trading at high multiples.

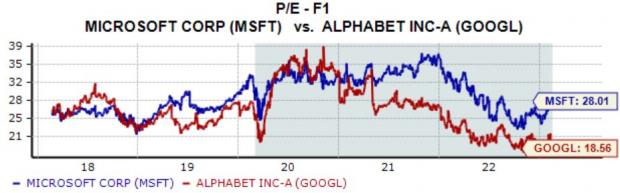

Presently, Alphabet shares profession at an 18.6 X ahead profits several, well underneath the 26.2 X five-year mean.

On the other side, Microsoft’s existing 28.1 X ahead profits several stays almost specifically in accordance with its five-year mean.

Picture Resource: Zacks Financial Investment Research Study

Additionally, Alphabet shares currently trade at a 4.9 X ahead price-to-sales proportion, once more underneath the 6.9 X five-year mean by a reasonable margin.

Rotating to Microsoft, the firm’s 9.4 X ahead P/S proportion rests over its 8.9 X five-year mean.

Picture Resource: Zacks Financial Investment Research Study

This round, GOOGL shares seem the far better alternative relating to worth, with the firm’s ahead P/S as well as ahead P/E proportions resting underneath their particular five-year typicals.

Quarterly Efficiency

Certainly, it’s constantly vital to see which firm has actually supplied a lot more durable quarterly outcomes, showing a capability to go beyond experts’ assumptions.

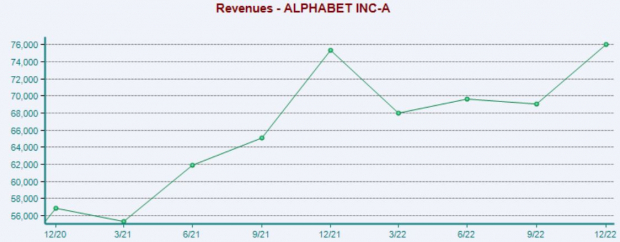

Alphabet has actually had a hard time to go beyond quarterly price quotes since late, disappointing leading as well as profits price quotes in each of its last 4 quarters. Below is a graph showing the firm’s profits on a quarterly basis.

Picture Resource: Zacks Financial Investment Research Study

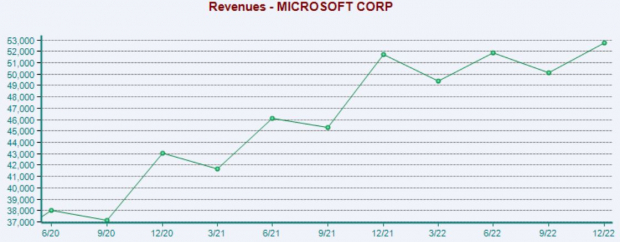

Microsoft has actually supplied a much more powerful profits efficiency, surpassing the Zacks Agreement EPS Quote in 3 of its last 4 quarters. Leading line outcomes have actually likewise been even more durable, with MSFT surpassing sales assumptions in 2 of its previous 4 launches.

Picture Resource: Zacks Financial Investment Research Study

This round, the success mosts likely to Microsoft.

Placing Whatever With Each Other

With these 2 technology heavyweights going head-to-head in an expert system race, capitalists might question which supply resembles a much better alternative.

Customers have actually preferred Microsoft shares throughout a number of durations, as well as the firm has actually supplied better quarterly outcomes.

On the other side, Alphabet shares are especially less expensive, with the firm’s ahead P/S as well as P/E proportions resting no place near their five-year typicals.

Nevertheless, a huge distinction in between both is Microsoft’s reward; MSFT’s yearly reward presently produces 1%, whereas Alphabet does not pay returns.

The choice can boil down to choice alone, with worth capitalists more than likely inclining Alphabet GOOGL as well as earnings capitalists locating Microsoft MSFT shares a lot more eye-catching.

4 Oil Supplies with Substantial Advantages

Worldwide need for oil is via the roof covering … as well as oil manufacturers are battling to maintain. So despite the fact that oil rates are well off their current highs, you can anticipate huge make money from the firms that provide the globe with “black gold.”

Zacks Financial investment Research study has actually simply launched an immediate unique record to aid you count on this fad.

In Oil Market ablaze, you’ll uncover 4 unforeseen oil as well as gas supplies placed for huge gains in the coming weeks as well as months. You do not wish to miss out on these suggestions.

Download your free report now to see them.

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints revealed here are the sights as well as viewpoints of the writer as well as do not always mirror those of Nasdaq, Inc.