With the S&P 500 index up 17% in 2024 and now buying and selling at a historically lofty price-to-earnings (P/E) ratio of 27, it could appear affordable to assume there aren’t many attractively priced securities remaining available on the market.

Nevertheless, the “Magnificent Seven” accounts for almost one-third of the index’s allocation, and these shares have a median P/E of 39. This outsize allocation makes the “true” valuation of the remaining S&P 493 someplace nearer to 21 or 22 instances earnings — which is barely under historic averages.

Lengthy story brief, it stays pretty much as good a time as ever to purchase and maintain for the lengthy haul. Listed below are my three favourite client items shares for affected person buyers to contemplate.

Picture Supply: Dutch Bros.

1. Dutch Bros

Up-and-coming espresso and hand-crafted beverage chain Dutch Bros (NYSE: BROS) could also be my favorite growth stock on the market today. House to over 900 shops throughout the western and southwestern portion of the US, Dutch Bros has doubled its retailer rely and tripled its gross sales since 2020.

And the long run seems even brighter.

Regardless of this development since 2020, roughly three-quarters of its 918 shops reside in simply 5 states: Texas, Arizona, California, Oregon, and Washington. Moreover, Dutch Bros solely has a presence in 18 states throughout the U.S., which is why administration believes it might attain a retailer rely of greater than 4,000 over the long run.

As tantalizing as these development prospects are, Dutch Bros’ almost positive free cash flow (FCF) is what makes the corporate so attention-grabbing to me proper now.

BROS Cash from Operations (Quarterly) information by YCharts

FCF equals cash from operations (CFO) minus capital expenditures (spending on new shops and upkeep on present ones), which means that Dutch Bros could be very near with the ability to fund its enlargement out of its personal pocket. It is delivered constructive same-store gross sales development for six straight quarters, and I am optimistic that the corporate will quickly attain constructive FCF, leaving it much less reliant upon shareholder dilution to boost funds for brand spanking new shops.

Buying and selling at 13 instances CFO — in comparison with its mega-peer Starbucks‘ mark of 16 — Dutch Bros’ enlargement potential and blistering 30% gross sales development in its newest quarter look attractively priced.

2. Chewy

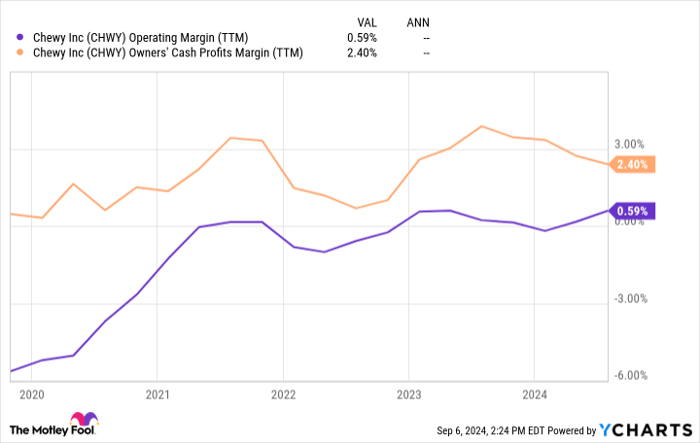

It’s no secret that Chewy (NYSE: CHWY) — the U.S.’s largest e-commerce pet retailer — is beloved by its clients, incomes a No. 1 rating on Forrester Analysis‘s buyer expertise index. Nevertheless, what isn’t as extensively identified is that Chewy lastly reached profitability.

Not solely is the specialty pet retailer producing internet earnings, however it’s also targeting five higher-profit revenue streams: Chewy Vet Care, Chewy Well being, pet insurance coverage, private-label merchandise, and sponsored advertisements. Mixed with the streamlining efficiencies Chewy sees from 78% of its gross sales being recurring autoship purchases, these high-margin ideas ought to proceed bumping the corporate’s profitability greater.

CHWY Operating Margin (TTM) information by YCharts

Chewy Vet Care seems significantly promising after the corporate opened six places within the final two quarters. In line with administration, early indications present that the clinics are a promising acquisition funnel for brand spanking new clients and have immense cross-sell potential. In comparison with the negatively viewed private equity firms which have began to dominate the veterinary trade over the previous few years, Chewy Vet Care is being welcomed by each vets and pet homeowners alike.

Buying and selling at 21 times forward earnings, Chewy’s budding profitability, religious buyer base, and veterinary development potential look moderately priced for potential buyers.

3. Vail Resorts

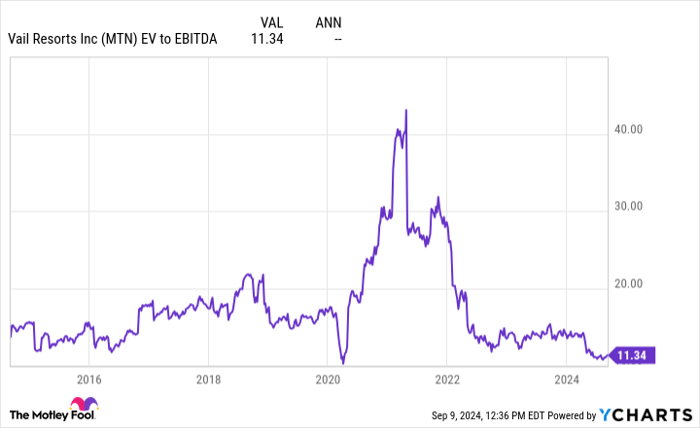

Consisting of 37 ski resorts throughout North America — together with three of the highest 5 and 5 of the highest 10 most visited yearly — Vail Resorts (NYSE: MTN) is the largest participant in its house continent’s ski resort trade. The principle purpose that Vail is one among my favourite shares for the long run is the straightforward incontrovertible fact that no new ski resorts of scale have been in-built over 40 years — giving the corporate a novel geographic benefit over any would-be opponents.

Nevertheless, following a post-lockdown increase, Vail’s share value has slid 50% from its 2021 highs on account of a weak client spending atmosphere, decrease snowfall totals at many North American resorts, and worries over its debt ranges.

Presently, Vail is house to a formidable internet debt stability of $2.1 billion versus $825 million in earnings earlier than curiosity, taxes, debt, and amortization (EBITDA). Nevertheless, after extending the maturity date on a $600 million word from 2026 to 2032 and likewise transferring the maturity date on its $969 million time period mortgage and $500 million revolver from 2026 to 2029, Vail gained some monetary wiggle room.

Regardless of these extensions, the corporate’s debt load signifies that Vail could also be extra targeted on making an attempt to keep up its valuable 4.7% dividend yield quite than elevating it, which is usually a nasty signal for buyers.

Nevertheless, with Vail buying and selling at simply 11 instances EBITDA — which looks like it might be a once-in-a-decade valuation — I am completely satisfied to tackle the chance of a possible dividend lower.

MTN EV to EBITDA information by YCharts

After briefly pausing its dividend through the pandemic as a precaution, administration returned the corporate’s dividend yield close to all-time highs. With 83% of its FCF getting used to fund these funds right now, although, Vail’s consideration will most likely flip to easily sustaining this dividend so it might concentrate on managing its debt stability.

Nevertheless, Vail has been FCF-positive yearly since 2010, so the corporate’s money era has confirmed as strong because the mountains upon which its resorts are constructed. Now producing 65% of its gross sales from a season move subscription mannequin (up from 26% in 2008), Vail ought to produce much less cyclical money flows going ahead, including further stability to the FCF wanted to fund its hefty dividend and debt stability.

Whereas it’s anybody’s guess as to when the broader client spending atmosphere will enhance, I am completely satisfied to gather Vail’s well-funded 4.7% dividend yield whereas I watch for a turnaround and hopefully see the corporate deleverage within the meantime.

Must you make investments $1,000 in Dutch Bros proper now?

Before you purchase inventory in Dutch Bros, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and Dutch Bros wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $630,099!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 9, 2024

Josh Kohn-Lindquist has positions in Chewy, Dutch Bros, Starbucks, and Vail Resorts. The Motley Idiot has positions in and recommends Chewy, Starbucks, and Vail Resorts. The Motley Idiot recommends Dutch Bros. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.