Complying with a combined session the other day, financiers stay concentrated on Jerome Powell’s testament.

Obviously, all are looking for explanation as we attempt to learn a highly-unique financial background as well as a year-long tightening up project.

Powell thinks going back to larger price walkings can be required if information recommends the united state economic climate is warming up once more.

It deserves keeping in mind that the Fed went with a 25bps walk in its newest conference, an action down from the previous 50bps trek in December as well as the 75bps treks we saw in 2022.

As well as the marketplace responded to these remarks appropriately, with supplies observing damaging rate activity in action.

Throughout times of intense unpredictability, targeting low-beta supplies can give an important guard to the more comprehensive market’s activities.

3 low-beta supplies– Fiserv FISV, Visa V, as well as Stryker SYK– can all be factors to consider for financiers looking for enhanced profile protection.

The graph listed below highlights the efficiency of all 3 supplies year-to-date, with the S&P 500 combined in as a standard.

Picture Resource: Zacks Financial Investment Study

Allow’s take a more detailed consider every one.

Fiserv

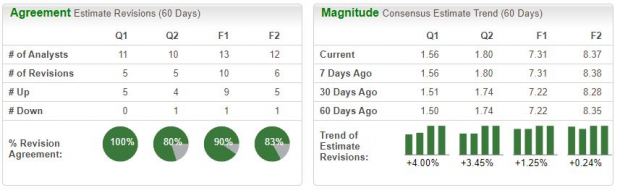

Fiserv is an international fintech as well as repayments business with remedies for financial, international business, seller obtaining, invoicing as well as repayments, as well as point-of-sale. The supply currently lugs a Zacks Ranking # 2 (Buy).

Picture Resource: Zacks Financial Investment Study

Fiserv’s appraisal multiples do not show up extended, with the present 16.1 X ahead profits several resting well below the 22.5 X five-year average as well as the Zacks Service Solutions field standard.

Picture Resource: Zacks Financial Investment Study

Furthermore, it’s tough to disregard the business’s development trajectory, with price quotes recommending 12.6% year-over-year profits development in its present (FY23) as well as an additional 14% in FY24.

The forecasted profits development begins top of anticipated year-over-year profits upticks of 6% in FY23 as well as 9% in FY24. Below is a graph showing the business’s profits on a yearly basis.

Picture Resource: Zacks Financial Investment Study

Visa

An international economic solutions business as well as a Zacks Ranking # 2 (Buy), Visa assists in digital funds transfers via Visa-branded debit, credit history, as well as pre paid cards.

Visa published a solid quarter in its newest launch, surpassing the Zacks Agreement EPS Price Quote by greater than 8% as well as coverage profits 3.4% over assumptions.

The marketplace was absolutely pleased with the outcomes, sending out shares on a higher trajectory. This is shown by the eco-friendly arrowhead in the graph below.

Picture Resource: Zacks Financial Investment Study

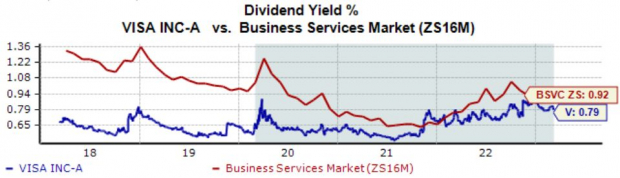

Furthermore, Visa shares give a revenue stream; V’s yearly returns presently generates 0.8%, a tick listed below the Zacks Service Solutions field standard.

Remarkably, the business’s payment has actually expanded by greater than 15% over the last 5 years.

Picture Resource: Zacks Financial Investment Study

As well as for the cherry ahead, Visa is a cash-generating equipment; V reported complimentary capital of $3.9 billion in its newest launch.

Picture Resource: Zacks Financial Investment Study

Stryker Corp.

Stryker is a clinical gadget business running in the international orthopedic market. Like the supplies over, SYK sporting activities a Zacks Ranking # 2 (Buy).

Shares obtained a huge increase adhering to Stryker’s newest quarterly launch. The business published profits of $3.00 per share, virtually 6% over assumptions.

Quarterly profits completed $5.2 billion, 5% in advance of price quotes as well as expanding 10.7% year-over-year.

Picture Resource: Zacks Financial Investment Study

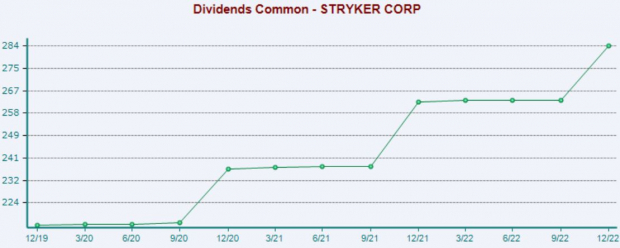

Comparable to V, Stryker shares pay a returns, presently producing 1.1% each year. While the return is listed below the Zacks Medical field standard, SYK’s 10% five-year annualized returns development price grabs the slack.

Picture Resource: Zacks Financial Investment Study

Profits

With a future tasks record as well as financiers absorbing Powell’s testament, it’s sensible to anticipate an increased degree of volatility throughout the week.

In unsure times, low-beta supplies, consisting of Fiserv FISV, Visa V, as well as Stryker SYK, can aid secure financiers from scary rate swings.

Along with being low-beta, all 3 sporting activity a beneficial Zacks Ranking, suggesting a confident near-term overview.

Free Record: Must-See Power Supplies for 2023

Tape earnings at oil business can imply large gains for you. With skyrocketing need as well as raised costs, oil supplies can be leading entertainers without a doubt in 2023. Zacks has actually launched an unique record disclosing the 4 oil supplies professionals think will certainly provide the largest gains. (You’ll never ever presume Supply # 2!)

Download Oil Market on Fire today, absolutely free.

Visa Inc. (V) : Free Stock Analysis Report

Stryker Corporation (SYK) : Free Stock Analysis Report

Fiserv, Inc. (FISV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views revealed here are the sights as well as point of views of the writer as well as do not always mirror those of Nasdaq, Inc.