As we start 2025, Nike NKE shares have hovered close to 52-week lows whereas Adidas ADDYY inventory shouldn’t be removed from its highs. Absolutely, buyers might surprise if a pointy rebound is in retailer for Nike shares or if Adidas inventory can attain greater highs.

This makes it a worthy dialog of which iconic shoe and retail attire firm is the higher funding in the meanwhile.

Picture Supply: Zacks Funding Analysis

Why NKE is Down and ADDYY is Up

Attributed to what has been a continuing must revamp its product line, Nike is coping with elevated competitors exterior of Adidas from the likes of Below Armour UAA and New Steadiness. Correlating with such, slower gross sales progress and stock points have weighed on investor confidence.

In the meantime, Adidas has been in a position to capitalize on Nike’s downturn by strategically rising its product choices. This has led to improved monetary metrics for Adidas which has bolstered market sentiment.

Outlook Comparability & EPS Revisions

Primarily based on Zacks estimates, Nike’s complete gross sales are anticipated to say no 10% in fiscal 2025 to $46.34 billion in comparison with $51.36 billion final 12 months. Fiscal 2026 gross sales are projected to stabilize and rise 1% to $47.11 billion.

Nike’s annual earnings are presently slated to drop 47% this 12 months to $2.10 per share versus EPS of $3.95 in 2024. That stated, FY26 EPS is projected to rebound and rise 12% to $2.36. Nonetheless, it’s noteworthy that FY25 and FY26 EPS estimates have continued to say no during the last quarter and are noticeably decrease within the final 30 days.

Picture Supply: Zacks Funding Analysis

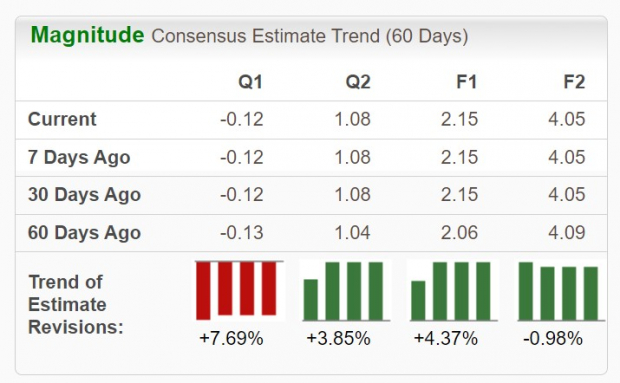

As for Adidas, its prime line is anticipated to extend 6% as the corporate rounds out FY24 with complete gross sales projected to develop one other 10% in FY25 to $27.3 billion. Even higher, annual earnings at the moment are anticipated to climb to $2.15 per share in FY24 from an adjusted EPS lack of -$0.36 in FY23. Extra intriguing, FY25 EPS is forecasted to soar one other 88% to $4.05.

Notably, during the last 60 days, Adidas FY24 EPS estimates are up 4% though FY25 EPS estimates are barely down.

Picture Supply: Zacks Funding Analysis

Valuation Comparability

Buying and selling at $71 a share, NKE is at a 34.3X ahead earnings a number of with ADDYY at $125 however at 30.9X. Nonetheless, each commerce at premiums to the benchmark S&P 500’s 22.1X and their Zacks Footwear and Retail Attire Trade common of 14.4X.

With regard to cost to gross sales, Adidas is extra engaging as effectively with ADDYY below the optimum degree of lower than 2X whereas NKE is at 2.3X.

Picture Supply: Zacks Funding Analysis

Dividend Comparability

Nike does have a transparent edge because it pertains to dividends with a 2.22% annual yield that towers over Adidas’s payout of 0.19% and tops their business common of 1.92%.

Picture Supply: Zacks Funding Analysis

Takeaway

Adidas inventory presently lands a Zacks Rank #3 (Maintain) whereas Nike shares are sadly tagged with a Zacks Rank #5 (Sturdy Promote) in the meanwhile. Nike might actually be extra engaging to revenue buyers, however the sharp decline in earnings estimate revisions does allude to extra draw back threat. In distinction, Adidas shareholders might nonetheless be rewarded when contemplating the corporate’s interesting progress trajectory.

7 Greatest Shares for the Subsequent 30 Days

Simply launched: Consultants distill 7 elite shares from the present checklist of 220 Zacks Rank #1 Sturdy Buys. They deem these tickers “Most Doubtless for Early Worth Pops.”

Since 1988, the complete checklist has overwhelmed the market greater than 2X over with a mean achieve of +24.1% per 12 months. So be sure you give these hand picked 7 your rapid consideration.

NIKE, Inc. (NKE) : Free Stock Analysis Report

Adidas AG (ADDYY) : Free Stock Analysis Report

Under Armour, Inc. (UAA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.