We’re with the mass of the 2023 Q1 reporting cycle. Until now, outcomes have actually mainly sufficed to maintain view in check, with us staying clear of the incomes ‘armageddon’ several cautioned us of.

Certainly, we’re not completely out of the timbers yet, with innovation titan NVIDIA NVDA slated to disclose its Q1 results on Wednesday, Might 24 th, after the marketplace’s close.

We’re all very accustomed to NVDA, the globally leader in aesthetic computer modern technologies as well as the visuals handling device (GPU) innovator. The firm has actually gotten extensive focus in the middle of the expert system (AI) wave, assisting shares provide outsized returns year-to-date.

Yet just how does the firm tone up heading right into incomes? We can utilize arise from a peer, Advanced Micro Gadgets AMD, as a tiny scale. Allow’s take a better look.

Advanced Micro Tools

AMD uploaded outcomes over assumptions, going beyond the Zacks Agreement EPS Quote by approximately 7%. Quarterly earnings completed $5.3 billion, partially over price quotes as well as mirroring a 9% year-over-year pullback.

Photo Resource: Zacks Financial Investment Study

Shares really did not see a wonderful response at first post-earnings, as we can see shown by the environment-friendly arrowhead circled around in the graph below. Still, they have actually recouped perfectly over the last numerous weeks.

Photo Resource: Zacks Financial Investment Study

Pertaining to sections, earnings from Information Facility completed $1.5 billion, approximately 11% listed below the Zacks Agreement Price Quote. Even more, AMD’s Installed section uploaded sales of $1.3 billion, down substantially year-over-year however going beyond the Zacks Agreement Price Quote by greater than 15%. Both sections are important, making up over fifty percent of quarterly earnings.

AMD CHIEF EXECUTIVE OFFICER Dr. Lisa Su stated, “We carried out effectively in the very first quarter as we provided far better than anticipated earnings as well as incomes in a combined need atmosphere.”

NVIDIA

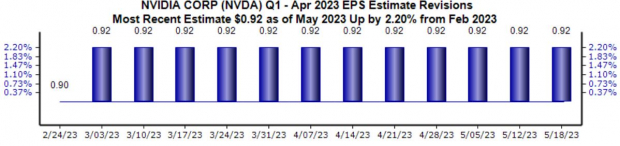

Experts have actually been a little favorable for the quarter to be reported, with the $0.92 per share quote being modified greater by a small 2.2% given that completion of February this year.

Photo Resource: Zacks Financial Investment Study

Furthermore, our agreement earnings quote currently rests at $6.5 billion, mirroring a 21% pullback from the year-ago quarter. It deserves keeping in mind that this quote has actually been modified downwards by a low 0.2%.

Below is a graph showing the firm’s earnings on a quarterly basis.

Photo Resource: Zacks Financial Investment Study

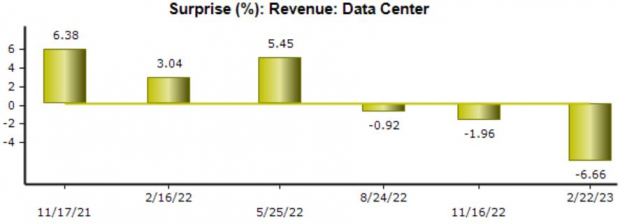

The firm’s Information Facility section includes its AI procedures; for the upcoming launch, we anticipate Information Facility earnings to get to $3.9 billion, mirroring a strong boost from the year-ago quarter. As revealed listed below, NVDA has actually fallen short to surpass the Zacks Agreement Quote for the section in 3 successive quarters.

Photo Resource: Zacks Financial Investment Study

Certainly, several will certainly additionally carefully keep an eye on the firm’s Video gaming results as the computer market has actually swiftly cooled down. We anticipate NVIDIA’s Video gaming section to upload earnings of $1.9 billion for the quarter, down a high 46% from the year-ago quarter.

Profits

With incomes period relaxing, market individuals pivot their emphasis to NVIDIA, among the last significant technology firms yet to report.

A peer, Advanced Micro Gadgets AMD, uploaded a double-beat however was adversely influenced by a slowing down computer market.

Experts have actually been a little favorable for NVDA’s launch, with the quarterly EPS quote being modified partially greater over the current term. Heading right into the launch, NVIDIA NVDA is a Zacks Ranking # 3 (Hold) with a Profits ESP Rating of 2.4%.

Free Record: Top EV Battery Supplies to Purchase Currently

Just-released record exposes 5 supplies to benefit as numerous EV batteries are made. Elon Musk tweeted that lithium costs have actually mosted likely to “ridiculous degrees,” as well as they’re most likely to maintain climbing up. Therefore, a handful of lithium battery supplies are readied to increase. Gain access to this record to uncover which battery supplies to acquire as well as which to stay clear of.

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views revealed here are the sights as well as point of views of the writer as well as do not always mirror those of Nasdaq, Inc.