Jensen Huang’s NVIDIA Company NVDA not too long ago achieved a brand new milestone and is now a part of an elite membership. And with the NVIDIA inventory hitting document highs, buyers should lament not proudly owning the inventory. Nevertheless it’s not too late to purchase the inventory both! Let’s see why –

NVIDIA Reaches $3.5 Trillion Market Cap

Among the many chip shares, NVIDIA stood out on Monday after its shares gained 4.1% and closed above $3.5 trillion market capitalization for the primary time. In June, NVIDIA surpassed the $3 trillion market worth and was price greater than Apple Inc. AAPL.

Nonetheless, Apple grew to become the primary firm to hit the $3.5 trillion milestone and is now valued at $3.6 trillion. Nonetheless, NVIDIA’s stellar efficiency in current instances might quickly propel it previous Apple. NVIDIA’s shares have surged 243% over the previous 12 months and a staggering 543% within the final three years primarily as a result of introduction of synthetic intelligence (AI).

4 Causes Why NVIDIA’s Shares Will Proceed to Rise

Insane demand for NVIDIA’s most sought-after cutting-edge Blackwell B200 chips, which have extra AI throughput than the present Hopper H100 chips, would enhance its share worth. NVIDIA has ramped up the manufacturing of Blackwell chips as demand has skyrocketed among the many likes of Microsoft Company MSFT and Alphabet Inc. GOOGL.

NVIDIA’s rising knowledge heart enterprise will possible enhance the inventory. The H100 chips are anticipated to be extensively utilized in powering generative AI purposes together with ChatGPT. Huge tech gamers proceed to point out eager curiosity in AI knowledge facilities, which is encouraging for NVIDIA. For example, Microsoft in its newest 10-Okay annual report has indicated spending $108.4 billion on knowledge facilities over the following 5 years.

NVIDIA’s dominance within the graphic processing items (GPU) market area additionally provides the corporate a aggressive edge over its friends. Most builders desire NVIDIA’s CUDA software program platform over the arch-rival Superior Micro Gadgets, Inc.’s AMD ROCm software program platform. NVIDIA accounts for 80% of the GPU market, which is projected to develop to $1,414.39 billion by 2034 from the current $75.77 billion, in line with Priority Analysis.

Lastly, the Federal Reserve’s current aggressive rate of interest cuts, with extra to return amid ebbing worth strain, are appearing as a tailwind for NVIDIA’s shares. It’s because rate of interest cuts would curtail borrowing prices, jack up income, and received’t disrupt money flows a lot wanted for development initiatives (learn extra: NVIDIA & 2 Other AI Stocks to Gain From Lower Interest Rates).

NVIDIA Inventory to Purchase Hand Over Fist

From the Fed’s dovish stance to being the pioneer within the GPU market to blossoming knowledge heart enterprise and sheer demand for AI chips, NVIDIA’s shares are all set to climb additional northward, making it a compelling purchase.

Brokers have collectively elevated the typical short-term worth goal of the NVDA inventory by virtually 9% to $150.36 from the final closing worth of $138. The inventory’s highest short-term worth goal is at $200, an upside of 44.9%.

Picture Supply: Zacks Funding Analysis

NVIDIA’s power within the AI area additionally compelled Financial institution of America Company’s BAC analyst Vivek Arya to not too long ago improve the chip big’s short-term worth goal from $165 to $190. Final week, CFRA analysis too raised NVIDIA’s short-term worth goal from $139 to $160.

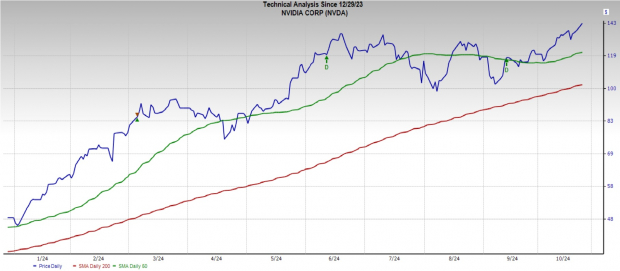

The NVDA inventory additional is buying and selling above each the short-term 50-day transferring common (DMA) and long-term 200-DMA in the mean time, indicating a bullish development, and a superb time to contemplate investing within the inventory.

Picture Supply: Zacks Funding Analysis

Furthermore, per worth/earnings, the NVDA inventory presently trades at 51.0X ahead earnings, lower than the Semiconductor – General business’s ahead earnings a number of of 55.8X. So, shopping for the inventory will burn a smaller gap in your pocket than its friends.

Picture Supply: Zacks Funding Analysis

NVIDIA presently has a Zacks Rank #2 (Purchase). You’ll be able to see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Infrastructure Inventory Growth to Sweep America

A large push to rebuild the crumbling U.S. infrastructure will quickly be underway. It’s bipartisan, pressing, and inevitable. Trillions shall be spent. Fortunes shall be made.

The one query is “Will you get into the precise shares early when their development potential is biggest?”

Zacks has launched a Particular Report that can assist you do exactly that, and right this moment it’s free. Uncover 5 particular firms that look to achieve essentially the most from development and restore to roads, bridges, and buildings, plus cargo hauling and vitality transformation on an virtually unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Bank of America Corporation (BAC) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.