Oklo Inc.’s OKLO shares have surged a formidable 90.1% within the year-to-date interval, outperforming the Zacks Alternative-Energy industry’s return of 60.8% in addition to the broader Zacks Oils-Energy sector’s development of 6.8%. It additionally outpaced the S&P 500’s surge of 27.7% in the identical interval.

With quickly growing demand for clear vitality sources as the popular option to generate electrical energy, Oklo rides on its not too long ago signed partnerships and different initiatives that replicate its robust dedication towards providing dependable, commercial-scale clear vitality to its clients.

The same stellar efficiency has been delivered by different trade gamers, similar to GEV Vernova GEV, Constellation Vitality Company CEG and Bloom Vitality BE, whose shares have surged 148.6%, 119.1% and 75.4%, respectively, yr up to now.

Picture Supply: Zacks Funding Analysis

With Oklo driving excessive, people could rush so as to add the inventory to their portfolio. Nevertheless, earlier than making any hasty determination, it will be prudent to check out the explanations behind the surge, the inventory’s development prospects in addition to dangers (if any) to investing in the identical. The concept is to assist traders make a extra insightful determination.

What Led to OKLO Inventory’s Worth Surge?

Growing information heart development throughout the globe, together with rising electrical energy consumption, notably in rising nations and creating economies, backed by strengthening financial actions and prosperity in these nations, has been boosting world electrical energy demand. To this finish, it’s crucial to say that Oklo is creating next-generation fast-fission energy vegetation known as “powerhouses.” Specifically, its Aurora powerhouse product line is designed to provide 15-50 megawatts electrical (MWe) from recycled nuclear gas and recent gas, with the potential to extend the determine to 100 MWe.

The corporate has achieved a number of important deployment and regulatory milestones in latest occasions for deploying its Aurora powerhouses, which should have boosted traders’ confidence on this inventory. This, in flip, bought mirrored in OKLO’s share value hike.

Evidently, in September 2024, the corporate signed a Memorandum of Settlement (“MOA”) with the DOE Idaho Operations Workplace, which provided the previous entry to conduct investigations at its most well-liked website in Idaho to assemble energy vegetation. Oklo has additionally signed extra non-binding letters of intent with Equinix, Diamondback Vitality and Prometheus Hyperscale (previously Wyoming Hyperscale) and obtained two different letters of intent to supply an extra 750 MWe for information heart clients. That is anticipated to deliver OKLO’s present complete deployment of Aurora powerhouses to greater than 2,100 MWe in capability, which displays almost a 200% enhance since July 2023.

Will OKLO Inventory Proceed to Develop?

Oklo’s strategic partnership agreements with a number of firms, like one with Equinix earlier this yr for 500 MW of energy, replicate the eye and potential demand surrounding its Aurora powerhouse product line within the electrical energy market.

America is the world’s largest producer of nuclear energy, accounting for about 30% of the worldwide era of nuclear electrical energy (as per the newest report by the World Nuclear Affiliation). Thus, Oklo’s long-term development prospects stay important.

Nevertheless, the corporate has not but began producing revenues. With its first Aurora powerhouse focused for deployment in 2027, we could not count on it to ship any stable top-line efficiency within the close to time period. In the meantime, it’s persevering with to incur important working bills to efficiently develop its powerhouses, which in flip has been placing downward stress on its backside line. So, the efficiency of the corporate when it comes to producing formidable income and revenue stays slick within the close to time period, which could be a reason behind concern for its traders.

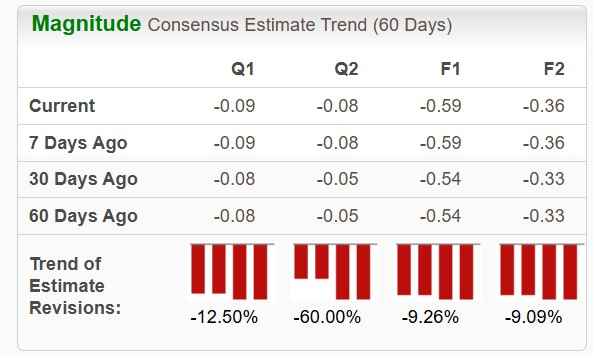

The downward revision noticed in its near-term earnings estimate mirrors the same image. Such downward revisions are indicative of analysts’ dwindling confidence within the inventory of late.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

OKLO’s Poor ROE Poses One other Threat

A fast sneak peek on the firm’s return on fairness (ROE) over the previous yr in comparison with that of its peer group exhibits a dismal situation. OKLO’s ROE is decrease than that of its peer group. A detrimental ROE signifies that an organization is making a loss, as is clear from its latest quarterly outcomes.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Ultimate Ideas

To conclude, traders considering OKLO inventory ought to watch for a greater entry level, contemplating the downward revision in its earnings estimate and a detrimental ROE.

Nevertheless, those that have already got this Zacks Rank #3 (Maintain) inventory of their portfolio could proceed to take action, contemplating its long-term development prospect and spectacular share value efficiency to this point this yr.

You’ll be able to see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Finest Shares for the Subsequent 30 Days

Simply launched: Specialists distill 7 elite shares from the present record of 220 Zacks Rank #1 Sturdy Buys. They deem these tickers “Most Doubtless for Early Worth Pops.”

Since 1988, the complete record has overwhelmed the market greater than 2X over with a median achieve of +24.1% per yr. So be sure you give these hand picked 7 your fast consideration.

Constellation Energy Corporation (CEG) : Free Stock Analysis Report

Bloom Energy Corporation (BE) : Free Stock Analysis Report

GE Vernova Inc. (GEV) : Free Stock Analysis Report

Oklo Inc. (OKLO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.