Palantir Applied sciences (NYSE: PLTR) has been one of many hottest shares out there this 12 months, with the inventory buying and selling up greater than 246% 12 months thus far as of this writing.

CEO Alex Karp took a victory lap following his firm’s most up-to-date earnings, saying the outcomes had been so robust that “I nearly really feel like we must always simply go house.” Later he took a swipe at any critics who challenged his sanity in making such a remark.

However whereas Karp has been celebrating the success of his firm and its inventory, he has additionally been aggressively promoting shares of Palantir. This in fact begs the query, ought to buyers observe Karp’s lead and promote Palantir inventory?

Elevated promoting amongst Palantir insiders

Karp has been a reasonably constant vendor of Palantir inventory since late 2020, utilizing what known as a Rule 10b5-1 plan. Below these plans, firm executives and different insiders arrange promoting directions to brokers to promote shares based mostly on a wide range of parameters. It may be so simple as promoting a set quantity of shares on set dates no matter value, or it may use a set of way more sophisticated triggers.

Karp seems to be utilizing a extra sophisticated set of triggers, however no matter they’re have led to an enormous enhance in promoting by the CEO within the couple of months. All of those latest gross sales have been by the train after which sale of inventory choices.

Karp’s elevated promoting started in mid-September when he exercised choices and offered 9 million shares at a median value of $36.18, value $325.6 million.

Simply forward of earnings he exercised choices and offered an extra 5.66 million shares at a median value of $45.01, taking house $254.6 million. Then instantly after earnings, he exercised choices and offered greater than 12.3 million shares at a median value of $52.71, good for proceeds of $650.6 million.

Earlier than the acceleration in promoting, Karp’s gross sales had been extra within the $15 million to $22 million vary.

Karp wasn’t the one insider to promote shares after earnings. Chief Accounting Officer Heather Planishek and Director Lauren Friedman Stat additionally offered shares through 10b5-1 plans.

This is not the primary time Palantir has seen massive insider promoting, with Chairman Peter Thiel organising a Rule 10b5-1 plan and rapidly disposing of greater than 28.5 million shares in September and early October.

Picture supply: Getty Photos.

Ought to buyers observe Palantir’s Karp and promote shares?

Palantir is undoubtedly an excellent firm. It initially proved itself by offering knowledge gathering and analytic providers to the U.S. authorities and serving to it with such mission-critical duties as combating terrorism and monitoring COVID-19 circumstances. It has since grow to be a giant artificial intelligence (AI) winner, with the U.S. industrial sector now embracing its AI platform.

Palantir’s massive AI push into the industrial sector has helped it see accelerating income development, with income leaping 30% 12 months over 12 months final quarter. It was the corporate’s fifth straight quarter of income development acceleration, demonstrating the momentum its options have. The U.S. industrial sector led the way in which with a 54% enhance in income, or 59% when excluding strategic industrial contracts. U.S. authorities income, in the meantime, soared 40% 12 months over 12 months, as the federal government additionally has began to embrace its AI options.

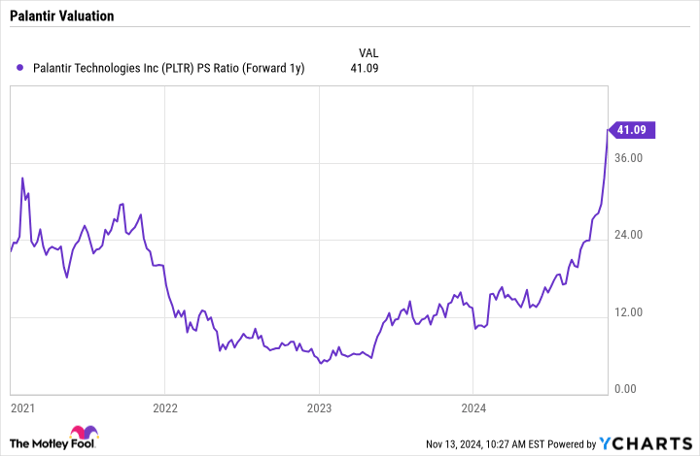

Proper now, the corporate is doing an excellent job of each bringing in new clients and increasing with current clients. Nevertheless, the most important subject on the subject of Palantir inventory just isn’t its operational efficiency, it is with Palantir’s valuation. Following the latest surge in inventory value, the inventory now trades at a ahead price-to-sales (P/S) ratio of 41 occasions 2025 analyst estimates.

PLTR PS Ratio (Forward 1y) knowledge by YCharts

For a inventory rising its income by round 30%, that valuation is fairly excessive. Whereas Palantir is a superb firm, sooner or later valuation does matter. CEO Alex Karp appears to acknowledge this as nicely, which is why he has accelerated his promoting of the inventory in latest months.

Again in August, I wrote that it was not too late to purchase Palantir inventory. With this newest surge in value, I am stepping again from that view. I believe the good factor to do at the moment is to observe the lead of Karp and different insiders and take some earnings within the inventory after an excellent run.

Don’t miss this second probability at a probably profitable alternative

Ever really feel such as you missed the boat in shopping for probably the most profitable shares? Then you definately’ll wish to hear this.

On uncommon events, our skilled crew of analysts points a “Double Down” stock suggestion for corporations that they suppose are about to pop. In case you’re anxious you’ve already missed your probability to take a position, now could be the very best time to purchase earlier than it’s too late. And the numbers converse for themselves:

- Amazon: when you invested $1,000 after we doubled down in 2010, you’d have $22,819!*

- Apple: when you invested $1,000 after we doubled down in 2008, you’d have $42,611!*

- Netflix: when you invested $1,000 after we doubled down in 2004, you’d have $444,355!*

Proper now, we’re issuing “Double Down” alerts for 3 unimaginable corporations, and there might not be one other probability like this anytime quickly.

*Inventory Advisor returns as of November 11, 2024

Geoffrey Seiler has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Palantir Applied sciences. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.