This week Novartis NVS upgraded its mid-term gross sales development steering. The European Fee permitted Pfizer’s PFE hemophilia drug Hympavzi (marstacimab). AstraZeneca’s AZN Tagrisso was really useful for approval within the EU for expanded use in EGFR-mutated lung most cancers. J&J JNJ and Lilly LLY introduced constructive information from mid/late-stage research.

This is a recap of the week’s most essential tales.

Novartis Raises Mid-Time period Gross sales Outlook

Novartis raised its mid-term gross sales development steering by growing its CAGR goal for the 2023-2028 interval from 5% to six%. Utilizing 2024 as the bottom yr, Novartis expects its gross sales to witness a CAGR of 5% throughout 2024-2029. The corporate’s steering enhance was backed by larger gross sales expectations for key medicine like Pluvicto, Kesimpta, Kisqali, Cosentyx and Leqvio coupled with some upcoming launches. In response to Novartis, eight of its medicine have peak gross sales potential between $3 billion and $8 billion. Moreover, it mentioned that there are 30 candidates in its pipeline, which ought to assist proceed mid-single-digit gross sales development past 2029. NVS stays on observe to ship core working earnings margin of greater than 40% by 2027.

EU Approval for Pfizer’s Hemophilia Gene Remedy Hympavzi

The European Fee granted advertising authorization to Pfizer’s anti-TFPI inhibitor Hympavzi (marstacimab) for the treatment of hemophilia A and B. The drug will probably be marketed as a prophylactic therapy to stop or cut back the frequency of bleeding episodes in adults and adolescents with hemophilia A or B with out inhibitors. Hympavzi’s approval was primarily based on constructive information from the section III BASIS research. It was permitted in america by the FDA final month.

Hympavzi is Pfizer’s second hemophilia therapy to be permitted this yr. Beqvez/ Durveqtix (fidanacogene elaparvovec), a one-time gene remedy for hemophilia B, was permitted by the FDA in April 2024 whereas it’s nonetheless beneath evaluation within the EU.

J&J’s Icotrokinra Meets Objectives in Pivotal Plaque Psoriasis Examine

J&J pivotal section III research evaluating icotrokinra (JNJ-2113) for reasonable to extreme plaque psoriasis (PsO) met its co-primary endpoints at week 16. The ICONIC-LEAD research’s major endpoints had been Psoriasis Space and Severity Index (PASI) 90 and Investigator’s World Evaluation (IGA) of 0/1 response at week 16. Prime-line information from the research confirmed that at week 16, 64.7% of grownup and adolescent sufferers handled with icotrokinra achieved clear or nearly clear pores and skin (IGA 0/1) and 49.6% achieved PASI 90.

The constructive responses continued to enhance by means of week 24. At week 24, 74% achieved clear or nearly clear pores and skin (IGA 0/1), and 64.9% achieved PASI 90. J&J additionally mentioned that one other section III research, ICONIC-TOTAL, which evaluated once-daily icotrokinra, met the first endpoint of IGA of 0/1 at week 16 in comparison with placebo.

CHMP Nod to AZN’s Tagrisso for Expanded Use in NSCLC

AstraZeneca introduced that the Committee for Medicinal Merchandise for Human Use (“CHMP”) of the European Medicines Company (“EMA”) has really useful approval of Tagrisso (osimertinib) for treating unresectable EGFR-mutated non-small cell lung most cancers (NSCLC) following therapy with platinum-based chemoradiation remedy. The CHMP really useful Tagrisso for the therapy of EGFRm sufferers whose tumors have exon 19 deletions or exon 21 (L858R) substitution mutations. The CHMP’s advice was based on data from the phase III LAURA study. The FDA permitted Tagrisso for comparable use in September.

At the moment, Tagrisso is permitted in a number of international locations as a monotherapy for the first-line therapy of EFGR-mutated NSCLC, domestically superior or metastatic EGFR T790M mutation-positive NSCLC and adjuvant therapy of early-stage EGFRm NSCLC. Tagrisso can be permitted together with chemotherapy for frontline EGFR-mutated NSCLC primarily based on information from the FLAURA2 research in america and another international locations.

LLY Oral Ldl cholesterol Drug Lowers Lipoprotein Ranges in Part II

Lilly’s oral, once-daily cholesterol-lowering candidate muvalaplin reduced lipoprotein(a) or Lp(a) levels in adults with a high risk of cardiovascular events in a 12-week section II research.

Within the research, muvalaplin led to a big discount in elevated Lp(a) ranges in comparison with placebo, assembly the research’s major endpoint of % change in Lp(a) from baseline to week 12. Utilizing an intact Lp(a) assay, the very best dose (240 mg) of muvalaplin lowered Lp(a) ranges by 85.8%. Muvalaplin additionally met secondary endpoints for all three doses. Muvalaplin has a novel mechanism of motion. It disrupts the interplay between apolipoprotein(a) and apolipoprotein(b), which prevents the formation of Lp(a). Apolipoprotein(a) is a key part of Lp(a), which will increase the chance of cardiovascular occasions.

The NYSE ARCA Pharmaceutical Index declined 1.1% up to now 5 buying and selling classes.

Giant Cap Prescribed drugs Trade 5YR % Return

Large Cap Pharmaceuticals Industry 5YR % Return

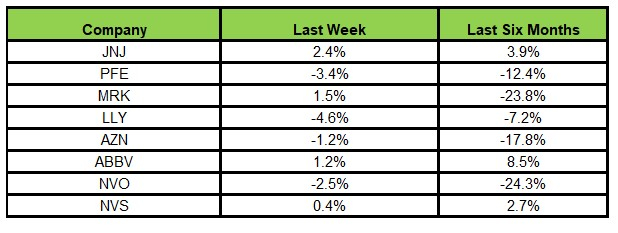

Right here’s how the eight main shares carried out within the earlier 5 buying and selling classes.

Picture Supply: Zacks Funding Analysis

Within the final 5 buying and selling classes, Lilly declined probably the most (4.6%), whereas J&J rose probably the most (2.4%).

Previously six months, whereas AbbVie rose probably the most (8.5%), Novo Nordisk declined probably the most (24.3%).

(See the final pharma inventory roundup right here: AZN, BAYRY’s Earnings, ABBV’s Pipeline Setback)

What’s Subsequent within the Pharma World?

Watch this house for normal pipeline and regulatory updates subsequent week.

AstraZeneca, Lilly, Merck and J&J have a Zacks Rank #3 (Maintain) every, whereas Pfizer has a Zacks Rank #2 (Purchase). You may see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Shares Set to Double

Every was handpicked by a Zacks professional because the #1 favourite inventory to realize +100% or extra in 2024. Whereas not all picks might be winners, earlier suggestions have soared +143.0%, +175.9%, +498.3% and +673.0%.

A lot of the shares on this report are flying beneath Wall Avenue radar, which supplies an awesome alternative to get in on the bottom ground.

Today, See These 5 Potential Home Runs >>

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Novartis AG (NVS) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.