Poland’s GDP is set to expand further in 2025, cementing its place because the European Union’s (EU) fastest-growing financial system.

Polish financial development is projected at 3.7% subsequent 12 months, supported by non-public consumption and investments, European Fee (EC) data confirmed. This expectation expands a powerful rebound from 0.2% in 2023 to only over 3% in 2024, based on the forecast on November 15.

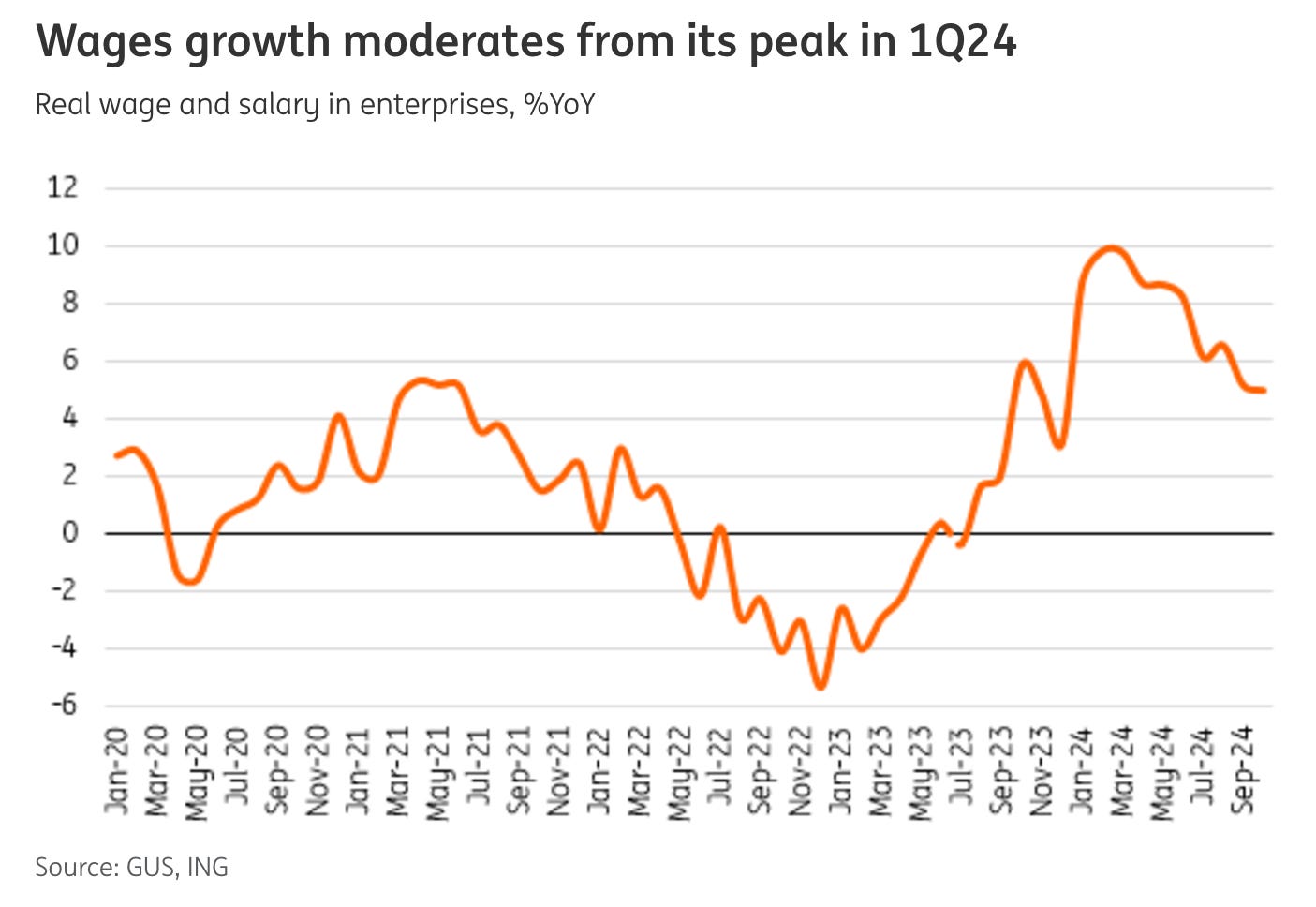

A robust monetary sector, paired with tight labor markets, has additionally resulted in vital wage development, driving elevated client spending.

“Poland is among the nice financial development success tales on this planet during the last 30 years,” Geoff Gottlieb, IMF senior regional consultant for Central, Japanese and South-Japanese Europe, said.

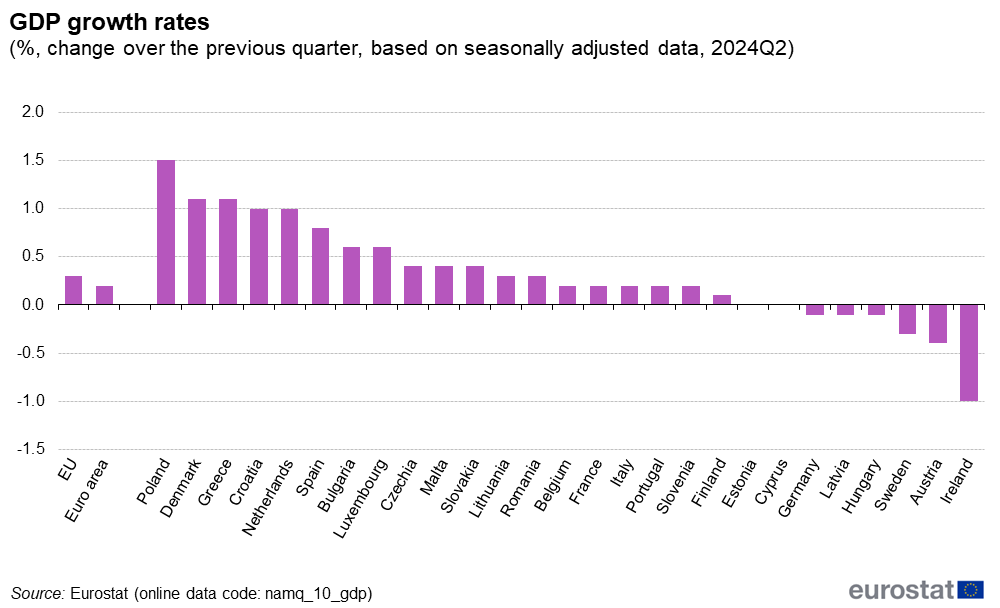

Poland’s GDP outperforms the EU and Germany, Europe’s largest financial system. The EC expects the EU GDP to grow by a mere 0.8% this 12 months and 1.5% in 2025. German GDP will contract by 0.1% in 2024 from a 0.1% enlargement beforehand, the second consecutive 12 months of damaging development, the EC mentioned.

Consumption-Led Restoration is Driving Poland’s GDP

The IMF workers wrote in a report revealed on October 17 that “a consumption-led restoration is underway” in Poland. It added that the “outlook is additional supported by just lately unlocked NextGen EU Funds (NGEU).”

NextGen EU is a monetary package deal allotted to Poland from the EU’s “NextGenerationEU” restoration plan to assist member states get better economically from the COVID-19 pandemic. The package deal funds investments in inexperienced vitality, digitalization, and social cohesion.

Within the second quarter of 2024, Poland recorded the EU’s largest GDP development at +1.5%.

Funding Key Driver of Poland’s GDP Development

Poland’s company sector wages elevated by 10.2% year-on-year (YoY) to $2,042 (PLN 8,316.57) in October 2024, following a ten.3% development within the earlier month and beating market expectations of a ten.1% enhance.

The common enterprise employment decreased by 0.5% YoY in October, the identical as in September. Regardless of this setback, Poland’s labor market stays stable, with unemployment remaining close to report lows.

In 2025, EU-funded public funding can also be forecasted to be a key driver of Poland’s GDP development. In February, the EU unblocked round $147 billion (PLN 600 billion) for Poland from the Cohesion Coverage and the Nationwide Restoration Plan. That is set to stimulate the Polish financial system and enhance investments.

The funds will assist speed up the inexperienced and digital transformation within the financial system, rising vitality safety and using trendy applied sciences.

Poland GDP Development Attracts Overseas Investments

Poland’s robust financial efficiency has attracted worldwide investments. Microsoft Corp. opened in 2023 a $1 billion cloud area round Warsaw. It consists of three bodily places with a number of knowledge facilities.

“Microsoft’s funding in Poland will speed up our nation’s transformation right into a know-how hub for the Central and Japanese European area,” Prime Minister Mateusz Morawiecki mentioned on the time.

Microsoft has also launched an in depth AI coaching program in Poland, which goals to equip a million people with important AI competencies by the tip of 2025.

“Poland discovered the proper mix of East and West,” Ole Lehmann, the founding father of The AI Solopreneur, wrote on X. “They mixed: Western innovation with out the paperwork” and “Japanese work ethic & conventional values with out authoritarianism.”

Challenges to Poland’s GDP Development

Polish industrial manufacturing remained near stagnant in Q3 (0.6percentYoY development after +0.8percentYoY in 2Q24) whereas development remained in a recession. A decline in home retail commerce added additional stress on the financial system.

Poland, although, has little room for vital rate of interest cuts subsequent 12 months, with wages and client costs buoying inflation and financial development accelerating, the nation’s deputy central financial institution chief, Marta Kightley, said. Polish inflation eased in November to 4.6% YoY from 5% YoY in October.

“The decline in inflation in November is a short lived phenomenon,” ING wrote on November 29. “We venture that it’s going to rise within the first quarter of 2025, which is able to forestall the Financial Coverage Council from starting its financial easing cycle till then.”

This has considerably slowed actual wage development, which dropped from 8.5% YoY to six.0%. Increased electrical energy and fuel payments could restrict assets accessible for different family expenditures.

What Future Holds for Poland’s GDP

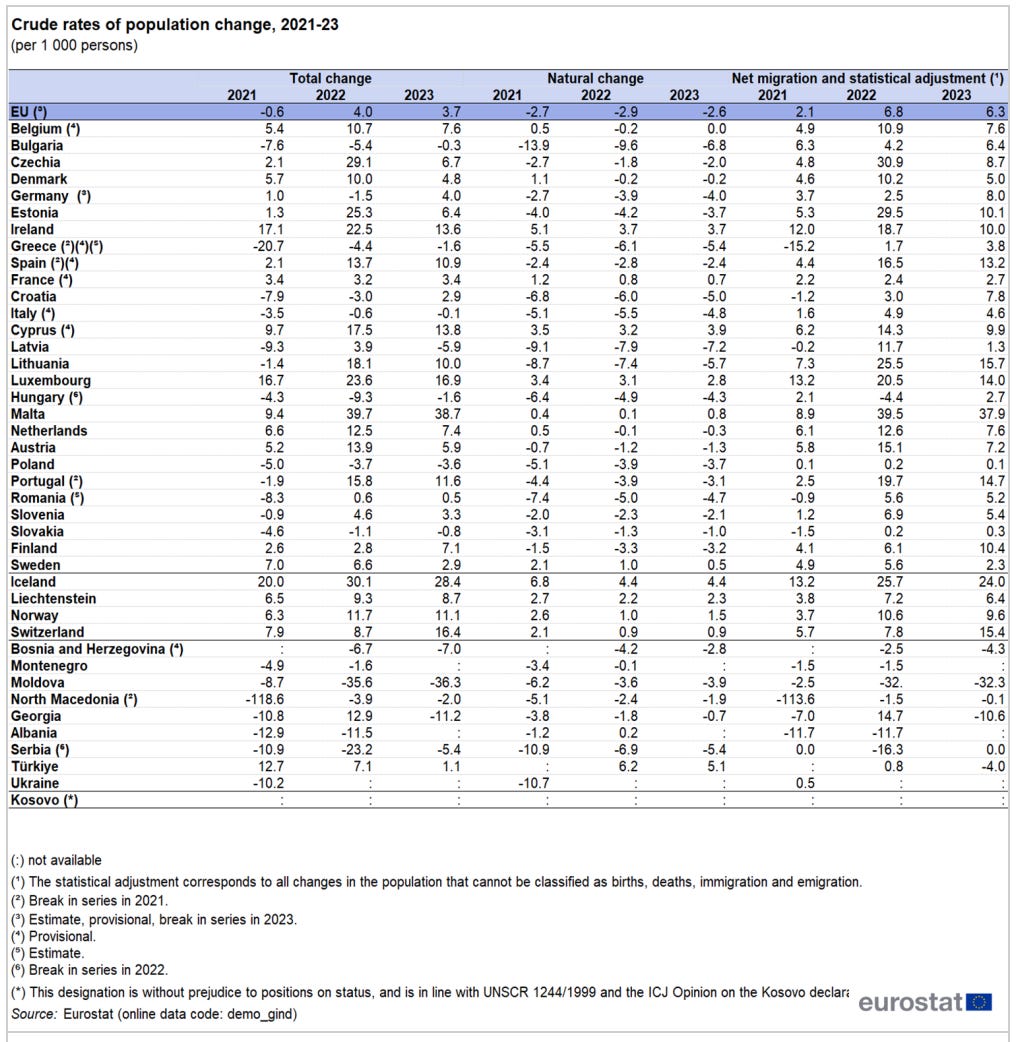

Regardless of recording the quickest GDP development within the EU and a record-low unemployment price, labor shortages paired with low fertility charges and an getting old inhabitants may pose a future menace to the Polish financial system. Up to now 30 years, Poland’s delivery price decreased by 40%, standing at 1.33 in 2024.

Whereas the whole EU inhabitants elevated in 2023, the inhabitants fell in 7 nations, Latvia (-5.9) and Poland (-3.6), recording among the highest decreases.

In response to labor market gaps and the necessity to appeal to international staff, Poland’s authorities introduced its first complete migration strategy in October, a step towards addressing demographic challenges.

Many entrepreneurs are involved that stricter immigration insurance policies will make it tougher to rent staff.

Disclaimer:

Any opinions expressed on this article are to not be thought-about funding recommendation and are solely these of the authors. European Capital Insights shouldn’t be answerable for any monetary choices made based mostly on the contents of this text. Readers could use this text for data and academic functions solely.

This text is from an unpaid exterior contributor. It doesn’t symbolize Benzinga’s reporting and has not been edited for content material or accuracy.

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.