The globe is progressively relocating far from nonrenewable fuel sources for numerous factors, driven by ecological, financial, as well as technical aspects. Secret factors behind the change consist of:

Environment as well as Ecological Problems: Despite what side of the aisle one gets on politically, it’s difficult to say that issues concerning greenhouse gases (mostly co2 (CARBON DIOXIDE)) drive the globe’s power program. To fulfill these issues, globally federal governments as well as business are pressing a “tidy power program.”

Technical Advancements: Though nonrenewable fuel sources are still one of the most affordable power resource, eco-friendly as well as alternate power prices have actually come to be a lot more affordable in recent times as innovation has actually boosted.

Health And Wellness Advantages: If you have actually been enjoying the information, you possibly became aware of the air high quality issues in New york city as a result of a large wildfire in Canada. While the air high quality concerns that have actually afflicted New york city are most likely short-lived, components of the globe, such as India as well as China, struggle with regularly bad air high quality. Alternate power fixes these concerns.

3 Industries to Profit

Uranium

Nuclear power usually obtains a bum rap as a result of be afraid over catastrophes such as Chernobyl as well as the 3 Mile Island mishap. Nonetheless, when you contrast the raw information versus various other power resources like coal, nuclear power is among the best methods of power on earth (also when you make up Chernobyl as well as various other catastrophes).

The very best wager for financiers that intend to lengthy nuclear is Cameco ( CCJ). The Canadian-based business is the biggest manufacturer of uranium worldwide. Last quarter, incomes fired greater by 575% while profits leapt 73% year-over-year. CCJ is additionally revealing stamina from a loved one stamina point of view. While the Worldwide Uranium ETF ( URA) is well off highs, CCJ is near 52-week highs as well as is established in a bull flag pattern.

Picture Resource: Zacks Financial Investment Study

Lithium

Electric lorries are using up a bigger piece of the worldwide vehicle market every year. If you’re a car manufacturer as well as intend to complete, you have to provide EVs. Also Italian mega-luxury car manufacturer Ferrari ( RACE) introduced that it would certainly be revealing an EV plant in 2024. On the other hand, charitable federal government motivations are increasing the relocate to an EV-centric market. For instance, a Tesla ( TSLA) Version 3 is currently more affordable (after tax obligation debts) than a Toyota ( TM) Camry in The Golden State.

Past tax obligation motivations as well as ecological kindness, the following substantial stimulant has actually gotten here– prevalent billing abilities. The absence of harmony in EV billing as well as the reasonably percentage of EV billing terminals offered has actually been a significant barrier to prevalent EV fostering. Nonetheless, lately, General Motors ( GM) as well as Ford ( F) tattooed billing handle Tesla. To put it simply, the concerns discussed above will likely be dealt with in the coming years.

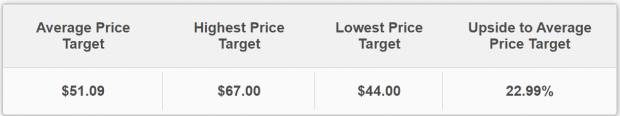

EV-makers are not the only recipients of additional EV fostering. Since EV batteries call for lithium, lithium miners such as Sigma Lithium ( SGML) will certainly profit substantially. Experts concur. Though SGML is presently selling the reduced $40’s, the typical cost target for the supplies is $51.09

Picture Resource: Zacks Financial Investment Study

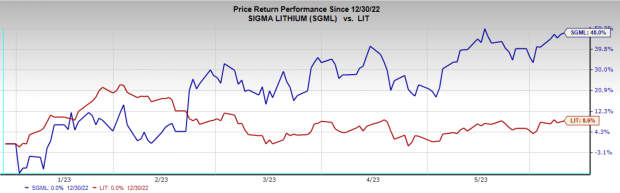

Like CCJ, SGML is additionally significantly outmatching its peers. The Lithium & & Battery ETF ( LIT) is up 8.6%, while SGML is up by 48% as well as intimidating to burst out.

Picture Resource: Zacks Financial Investment Study

Solar Companies

Solar business are frequently attempting to end up being much more reliable due to the fact that renewable resource services such as solar are not as reliable as conventional nonrenewable fuel sources. Current IPO Nextracker (NXT) is a cutting-edge solar software program service provider that assists its clients to boost manufacturing returns, safeguard themselves from risky climate occasions, as well as much more. NXT has actually created triple-digit incomes development for 2 straight quarters, as well as its favorable Profits ESP rating recommends that when it reports in August, it is most likely to create huge incomes once again.

Picture Resource: Zacks Financial Investment Study

Takeaway

Ecological issues, technical enhancements, as well as health and wellness understanding are 3 leading chauffeurs relocating the globe far from nonrenewable fuel sources. Lithium, solar, as well as uranium business are readied to profit considerably from this fad.

Simply Launched: Zacks Top 10 Supplies for 2023

Along with the financial investment concepts talked about over, would certainly you such as to understand about our 10 leading choices for 2023?

From beginning in 2012 via November, the Zacks Top 10 Supplies profile has actually tripled the marketplace, acquiring a remarkable +884.5% versus the S&P 500’s +287.4%. Our Supervisor of Study has actually currently brushed via 4,000 business covered by the Zacks Ranking as well as handpicked the very best 10 tickers to get as well as keep in 2023. Do not miss your opportunity to still be amongst the initial to participate these just-released supplies.

Ford Motor Company (F) : Free Stock Analysis Report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Cameco Corporation (CCJ) : Free Stock Analysis Report

Ferrari N.V. (RACE) : Free Stock Analysis Report

Global X Lithium & Battery Tech ETF (LIT): ETF Research Reports

Global X Uranium ETF (URA): ETF Research Reports

Sigma Lithium Corporation (SGML) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints shared here are the sights as well as viewpoints of the writer as well as do not always show those of Nasdaq, Inc.