Alphabet is among the world’s largest corporations. With a market cap of $2 trillion, there are solely a handful of shares that can compete with its dimension.

Nevertheless, there are corporations that would develop even bigger than Alphabet inside the subsequent 5 years. Right here, I will cowl two that would pull off that feat: Meta Platforms (NASDAQ: META) and Amazon (NASDAQ: AMZN).

Picture supply: Getty Photos.

1. Meta Platforms

As of this writing, Meta Platforms’ market cap stands at about $1.5 trillion. That trails Alphabet by just a little greater than $500 billion.

But whereas Meta is barely 75% the dimensions of Alphabet, I feel it might overtake its rival within the very close to future. Here is why.

First, Meta is gigantic. The corporate can declare practically 3.3 billion each day energetic customers (DAUs) throughout its platforms, which embrace Fb and Instagram. Meaning greater than a 3rd of the worldwide inhabitants makes use of Meta’s platform frequently.

Accordingly, given the dimensions of its person base, the corporate reaps an unlimited windfall when it comes to advert income. In its most just lately reported quarter, Meta tallied $38.3 billion in advert income. That works out to about $425 million per day.

True, Alphabet makes much more in advert income proper now, however it’s dealing with some challenges in its key class of web search. That is to say nothing of the recent federal antitrust ruling that labeled the company a monopoly.

Briefly, Meta’s bread and butter is advert income, and it is an space that isn’t solely extremely profitable — Meta’s operating margin is a stout 38% — it is rising like a weed. The corporate’s total revenue grew by 22% in its most up-to-date quarter, regardless of its dimension.

In different phrases, Meta has loads of gasoline within the tank to catch Alphabet by 2029 — if not sooner.

2. Amazon

If Meta nonetheless has a large hole to overhaul Alphabet, Amazon has solely a tiny crack. As of this writing, Amazon’s market cap of $1.9 trillion trails Alphabet’s market cap by about $100 billion, or roughly 5%.

Certainly, throughout the previous 10 years, these two corporations have traded locations a number of occasions, with Alphabet holding a gradual lead from 2014-2018. Amazon edged forward from 2018-2022, solely to see Alphabet retake the lead lately.

Nevertheless, I feel Amazon will not solely retake the lead, however transfer considerably forward of Alphabet throughout the subsequent 5 years. The principle cause why is that Amazon is beginning to hit its stride beneath Chief Executive Officer Andy Jassy, who took over from Jeff Bezos in 2021.

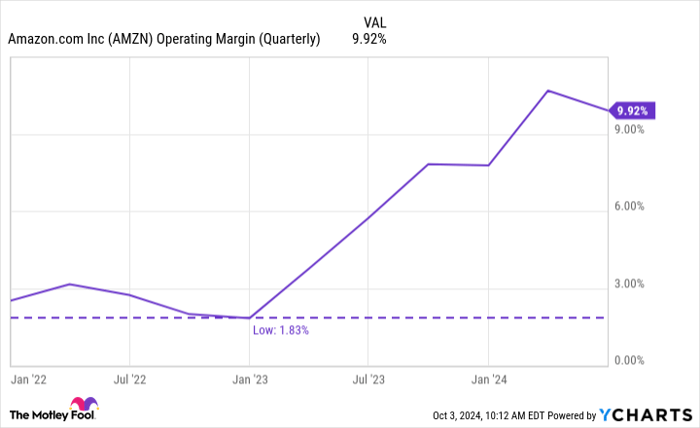

Three years into the job, Jassy is placing his personal mark on Amazon, beginning with the corporate’s elevated effectivity. As of its most just lately reported quarter, Amazon’s working margin climbed to nearly 10%. That is up considerably from its latest low of 1.8%, hit about one yr after Jassy took over from Bezos.

AMZN Operating Margin (Quarterly) knowledge by YCharts

Two corporations to observe

Each Amazon and Meta Platforms are gaining floor on Alphabet’s big market cap. Whereas I imagine all three shares stay stable long-term buy-and-hold candidates, buyers might wish to concentrate on Amazon and Meta, as these corporations seem higher positioned than Alphabet over the following few years.

Must you make investments $1,000 in Meta Platforms proper now?

Before you purchase inventory in Meta Platforms, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and Meta Platforms wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $765,523!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 30, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Jake Lerch has positions in Alphabet and Amazon. The Motley Idiot has positions in and recommends Alphabet, Amazon, and Meta Platforms. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.