Costco COST shares had been down following the corporate’s combined quarterly launch the place it narrowly missed on the top-line even because it handily beat bottom-line estimates. Aside from the modest income miss, there may be not an entire lot within the report that Costco shareholders can complain about, as the corporate continues to ship spectacular leads to a client spending backdrop that a lot of its friends are discovering difficult.

Costco’s quarterly earnings had been up +6.1% on +1% larger revenues, with comparable same-store gross sales up +5.3% and +5.5% within the U.S. and Canada, respectively. Costco continues to outperform with double-digit positive factors in discretionary classes like jewellery, furnishings, tires, and so forth., and is seeing robust momentum on the digital aspect the place comps had been up +19.5%.

The pullback in Costco shares following the discharge is primarily a operate of the inventory’s premium valuation following a formidable year-to-date run. The inventory has handily outperformed the Zacks Retail sector and the broader market within the year-to-date interval, up +34.7% vs. +20.3% for the Zacks Retail sector and +20.5% for the S&P 500 index.

Costco shares are buying and selling at 50.8X ahead 12-month consensus EPS estimates, which compares to a 5-year low of 29.5X, excessive of 55.8X, and median of 35.9X. Such a premium valuation may very well be justified given Costco’s high-income client base and working excellence, but it surely nonetheless requires spotless outcomes. Costco’s outcomes had been good, however they weren’t spotless, because the income miss exhibits.

The Costco report was for its fiscal fourth quarter that ended on September 1st, which we and different knowledge distributors contemplate a part of the Q3 tally. The leads to latest days from FedEx FDX, Oracle ORCL, and others had been additionally for the businesses’ fiscal quarters ending in August and, subsequently, get counted as a part of our general 2024 Q3 earnings season tally. As we’ve got famous on this area earlier than, the Oracle report was actually spectacular whereas the FedEx launch represented the alternative.

Together with Costco, FedEx, Oracle, and others, we now have such Q3 outcomes from 14 S&P 500 members, with one other 6 index members on deck to report outcomes this week. The notable corporations reporting this week embrace Nike, Conagra, Constellation Manufacturers, and others.

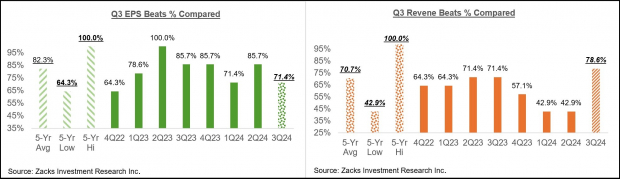

Whole Q3 earnings for these 14 index members which have reported already are up +26.8% from the identical interval final 12 months on +3.4% larger revenues, with 71.4% beating EPS estimates and 78.6% beating income estimates.

The comparability charts beneath put the Q3 earnings and income progress charges for these 14 index members in a historic context.

Picture Supply: Zacks Funding Analysis

The comparability charts beneath put the Q3 EPS and income beats percentages for these 14 index members in a historic context.

Picture Supply: Zacks Funding Analysis

Given how small and unrepresentative the pattern measurement is, it’s untimely to search for any traits at this early stage within the reporting cycle. However it’s nonetheless a ok begin.

The Earnings Large Image

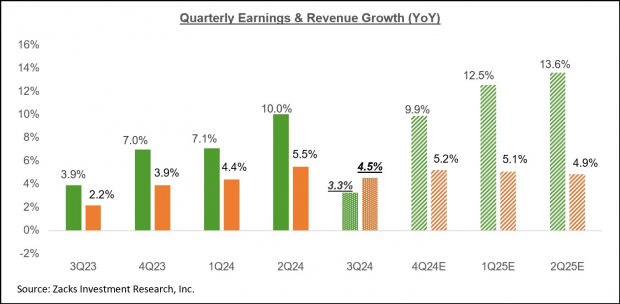

Whole Q3 earnings for the S&P 500 index are anticipated to be up +3.34% from the identical interval final 12 months on +4.5% larger revenues. This may observe the +10% earnings progress for the index within the previous interval on +5.5% larger revenues.

Common readers of our earnings commentary are conversant in our sanguine view on company profitability; the earnings image isn’t nice, however it isn’t dangerous both.

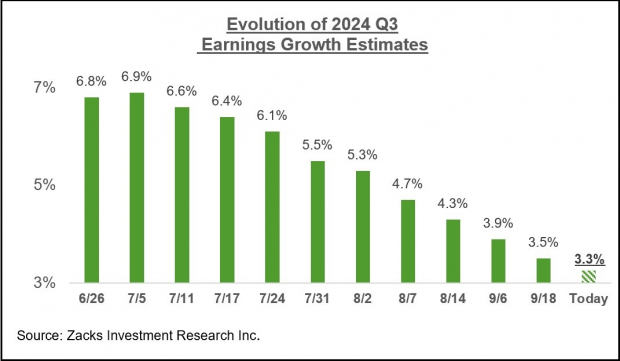

The one latest unfavorable improvement on this entrance is the reversal of the sooner favorable revisions pattern that we’ve got usually flagged in our commentary. This unfavorable revisions pattern is especially notable with respect to expectations for 2024 Q3, with earnings estimates for the interval getting revised down much more than we had seen in different latest intervals. You may see this within the chart beneath that tracks the evolution of Q3 earnings progress expectations over the past couple of months.

Picture Supply: Zacks Funding Analysis

Not solely is the magnitude of cuts to Q3 estimates larger than what we noticed within the comparable intervals for the final three quarters, however it’s also widespread and never concentrated in a single or a number of sectors.

Of the 16 Zacks sectors, estimates have been revised down for 14 sectors, with the Transportation, Power, Enterprise Providers, and Aerospace sectors struggling the most important declines. The Tech and Finance sectors are the one sectors whose estimates have modestly risen for the reason that interval received underway.

The chart beneath exhibits the Q3 earnings and income progress expectations within the context of what we noticed in precise outcomes over the previous 4 quarters and what’s anticipated over the next three quarters.

Picture Supply: Zacks Funding Analysis

However the aforementioned unfavorable revisions pattern, the expectation is for an accelerating progress pattern over the approaching intervals. Additionally, the combination earnings complete for the interval is anticipated to be a brand new all-time quarterly report, because the chart beneath exhibits.

Picture Supply: Zacks Funding Analysis

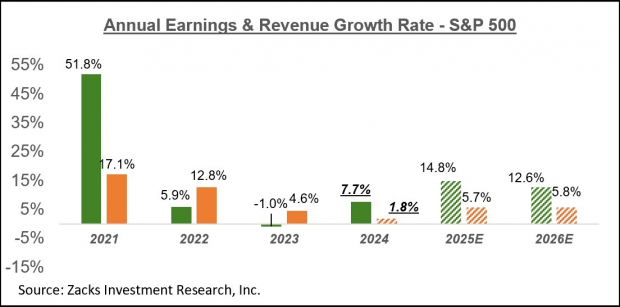

The chart beneath exhibits the general earnings image on a calendar-year foundation, with the +7.7% earnings progress this 12 months adopted by double-digit positive factors in 2025 and 2026.

Picture Supply: Zacks Funding Analysis

Please observe that this 12 months’s +7.7% earnings progress improves to +9.6% on an ex-Power foundation.

Expectations for the Magnificent 7 and the Tech Sector

Tesla would be the first Magazine 7 firm to report Q3 outcomes on October 16th, with most of its friends within the elite grouping reporting within the following two weeks.

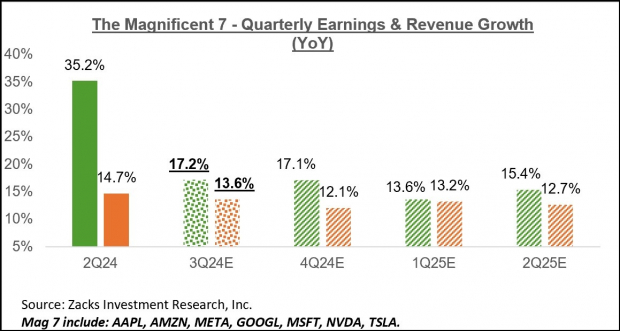

For Q3, Magazine 7 earnings are anticipated to be up +17.2% from the identical interval final 12 months on +13.6% larger revenues. The chart beneath exhibits the group’s Q3 earnings and income progress expectations within the context of what we noticed within the previous interval and what’s anticipated within the coming three quarters.

Picture Supply: Zacks Funding Analysis

Q3 earnings from the Magazine 7 will account for 21.4% of all S&P 500 earnings within the quarter. Excluding the Magazine 7 contribution, Q3 earnings for the remainder of the index can be basically flat from the year-earlier interval.

On an annual foundation, Magazine 7 earnings are anticipated to be up +30.7% this 12 months on +10% larger revenues, with earnings anticipated to be up +16.4% in 2025 and +17.9% in 2026.

Excluding the Magazine 7, 2024 earnings for the remainder of the S&P 500 index can be up +2.6% (+7.7% in any other case).

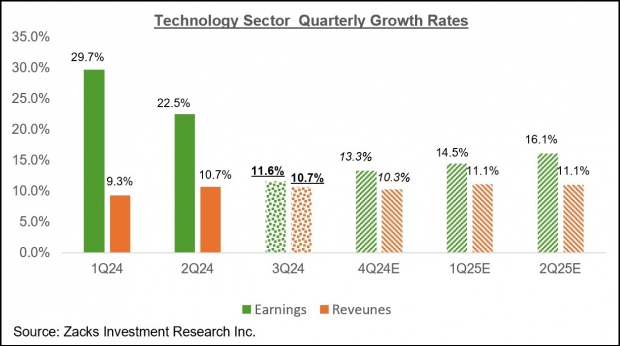

For the Zacks Tech sector, Q3 earnings are anticipated to be up +11.6% from the identical interval final 12 months on +10.7% larger revenues. The chart beneath exhibits the sector’s earnings and income progress expectations on a quarterly foundation.

Picture Supply: Zacks Funding Analysis

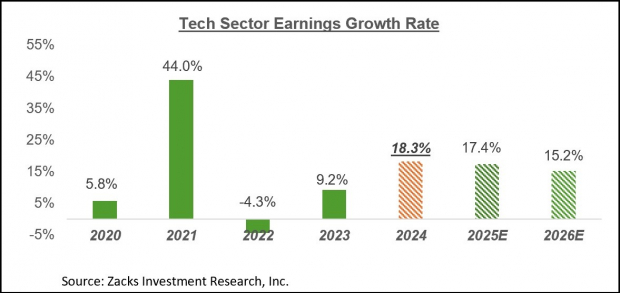

The chart beneath exhibits the sector’s earnings progress on an annual foundation.

Picture Supply: Zacks Funding Analysis

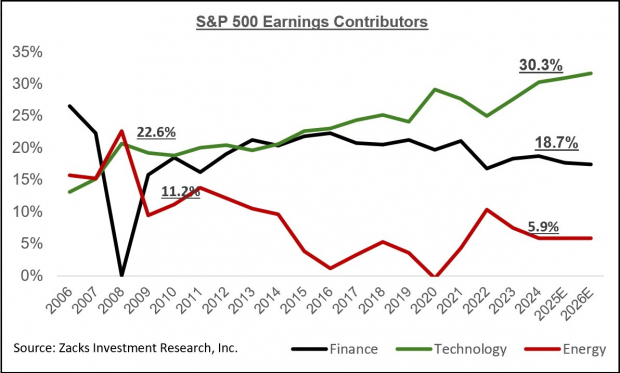

The U.S. inventory market is exclusive inside the OECD group, because the Tech sector accounts for 39.4% of the S&P 500 index (by market capitalization). The sector shouldn’t be solely very worthwhile but additionally having fun with strong and sustainable progress momentum.

The chart beneath exhibits the earnings contribution of the Zacks Tech sector relative to the identical by the Zacks Finance and Power sectors.

Picture Supply: Zacks Funding Analysis

For an in depth take a look at the general earnings image, together with expectations for the approaching intervals, please take a look at our weekly Earnings Tendencies report >>>> Q3 Earnings Season: A Look Ahead

5 Shares Set to Double

Every was handpicked by a Zacks professional because the #1 favourite inventory to realize +100% or extra in 2024. Whereas not all picks will be winners, earlier suggestions have soared +143.0%, +175.9%, +498.3% and +673.0%.

A lot of the shares on this report are flying below Wall Road radar, which supplies a fantastic alternative to get in on the bottom flooring.

Today, See These 5 Potential Home Runs >>

Oracle Corporation (ORCL) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

FedEx Corporation (FDX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.