Walmart WMT shares have actually delayed throughout the marketplace’s bounce off the October 2022 lows, yet have actually or else been solid entertainers in the more comprehensive market sell-off that obtained underway at the beginning of 2022. You can see this in the graph listed below that reveals the 1 year efficiency of Walmart about the S&P 500 index (environment-friendly line) as well as the Zacks Retail market (red line).

Considering that the October lows, Walmart shares are up +11.3% while the S&P 500 index has actually obtained +13.2%.

Photo Resource: Zacks Financial Investment Study

The security in Walmart shares makes instinctive feeling, as its core organization uses a high level of protection throughout durations of financial instability as well as unpredictability. Walmart’s ‘worth positioning’ enables it to acquire market share as reasonably better-off customers ‘trade down’ throughout times of ‘financial tension’. This practically ‘staple’ element of Walmart’s organization can additionally be seen in the current stock exchange habits of Costco ( EXPENSE) as well as others.

Target ( TGT) shares stand apart for their underperformance, yet that is a lot more reflective of administration’s bad moves in implementing in the post-Covid atmosphere. Additionally, about Walmart as well as Costco, Target has a reasonably smaller sized grocery store organization as well as has reasonably a lot more direct exposure to optional costs groups.

Walmart is anticipated to report basically level incomes on +4.4% greater profits in its quarterly record prior to the marketplace’s open on Tuesday, February 21 st The marketplace liked what it saw in the business’s last 2 quarterly records on November 15 th as well as August 16 th, 2022.

Target will certainly be launching its quarterly outcomes a week in the future February 28 th Target shares were down large in feedback per of the coming before 3 quarterly launches, with the May 2022 launch specifically noteworthy. Experts have actually typically decreased their Target approximates given that the business’s last quarterly record on November 16 th, while the very same for Walmart has actually been decently favorable.

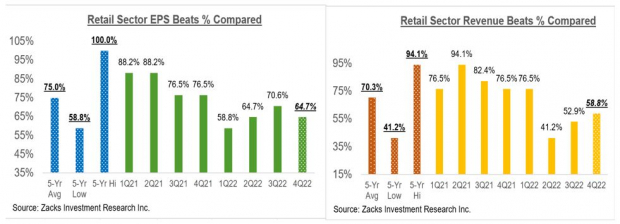

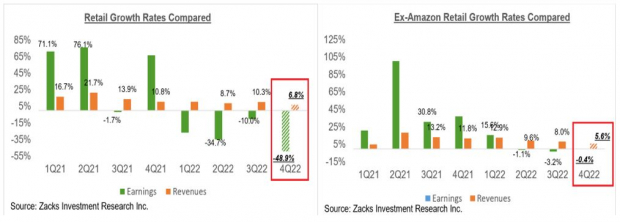

Relative to the Retail market 2022 Q4 incomes period scorecard, we currently have arise from 17 of the 33 sellers in the S&P 500 index. Complete Q4 incomes for these sellers are down -48.9% from the very same duration in 2014 on +6.8% greater profits, with 64.7% pounding EPS price quotes as well as 58.8% pounding income price quotes.

The contrast graphes listed below placed the Q4 defeats percents for these sellers in a historic context.

Photo Resource: Zacks Financial Investment Study

As you can see above, sellers have actually been battling ahead out with favorable shocks so far, with the variation about the historic arrays specifically noteworthy on the EPS side.

Relative to the incomes as well as income development prices, Amazon.com’s -85.4% incomes decrease plays a considerable duty in the team’s weak year-over-year development price for the market (Amazon.com becomes part of the Zacks Retail market, as well as not the Zacks Innovation market). A lot of the Retail market incomes records that have actually appeared currently remain in the electronic component of the area, with the a lot more standard sellers beginning to report outcomes today.

As most of us understand, the electronic as well as brick-and-mortar drivers have actually been assembling for a long time currently, with Amazon.com currently a good sized brick-and-mortar driver after Whole Foods as well as Walmart an expanding online supplier. This enduring fad obtained a big increase from the Covid lockdowns.

Both contrast graphes listed below reveal the Q4 incomes as well as income development about various other current durations, both with Amazon.com’s outcomes (left side graph) as well as without Amazon.com’s numbers (ideal side graph).

Photo Resource: Zacks Financial Investment Study

Today’s Coverage Docket

We have greater than 600 business on deck to report outcomes today, consisting of 60 S&P 500 participants. Significant business reporting today, in addition to the previously mentioned sellers consist of Nvidia, Alibaba, ebay.com, Residence Depot as well as others.

2022 Q4 Incomes Period Scorecard

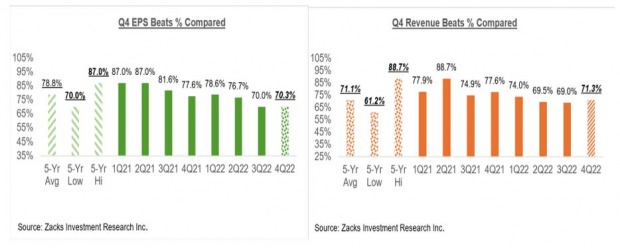

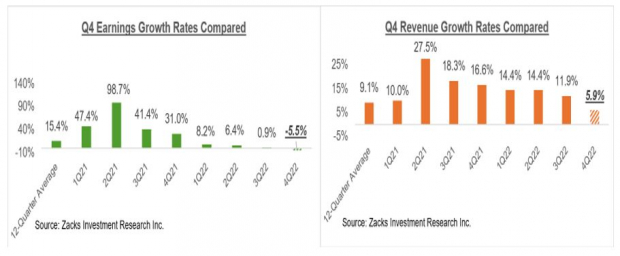

Since Friday, February 17th, we currently have Q4 arise from 407 S&P 500 participants or 81.4% of the index’s complete subscription. Complete incomes for these business are down -5.5% from the very same duration in 2014 on +5.9% greater profits, with 70.3% pounding EPS price quotes as well as 71.3% pounding income price quotes.

The contrast graphes listed below placed the EPS as well as income beats percents in Q4 in a historic context.

Photo Resource: Zacks Financial Investment Study

The contrast graphes listed below placed the incomes as well as income development prices in Q4 in a historic context.

Photo Resource: Zacks Financial Investment Study

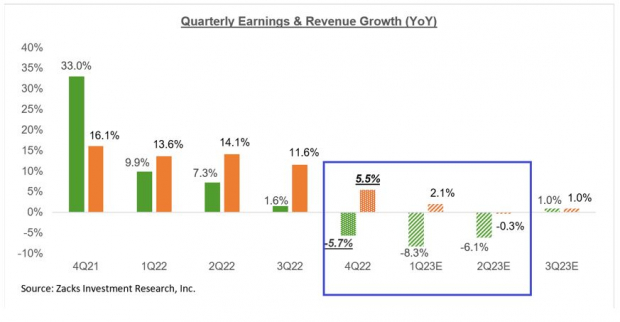

As you can see, there is a significant slowdown in the development trajectory, both for incomes in addition to profits. Please keep in mind that this slowing down development fad does not transform in any kind of significant method whether we consider it on an ex-Finance or ex-Tech bases.

The Incomes Broad View

We have actually the whole time been describing the general image that arised from the 2022 Q4 reporting cycle as sufficient; not wonderful, yet tolerable either.

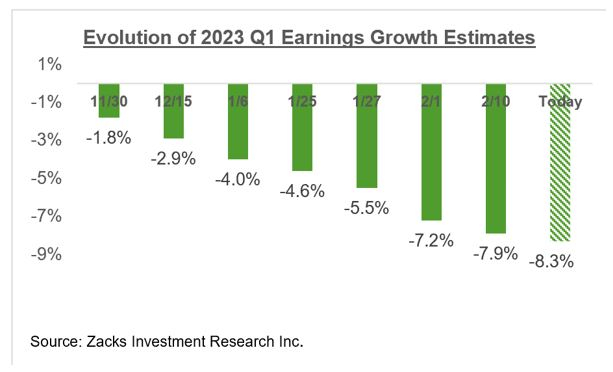

The alterations fad remains to be unfavorable, with the expectation for a variety of fields on the weak side. However it follows the advancing macroeconomic image as well as much from the alarming situation that numerous in the marketplace been afraid. You can see this in the graph listed below that demonstrates how price quotes for the present duration (2023 Q1) have actually progressed in current weeks.

Photo Resource: Zacks Financial Investment Study

Please keep in mind that while Q1 price quotes are boiling down, the rate as well as size of cuts is especially listed below what we had actually seen in advance of the beginning of the last number of incomes periods.

The graph listed below programs the accumulated incomes overall for the index given that the beginning of in 2014.

Photo Resource: Zacks Financial Investment Study

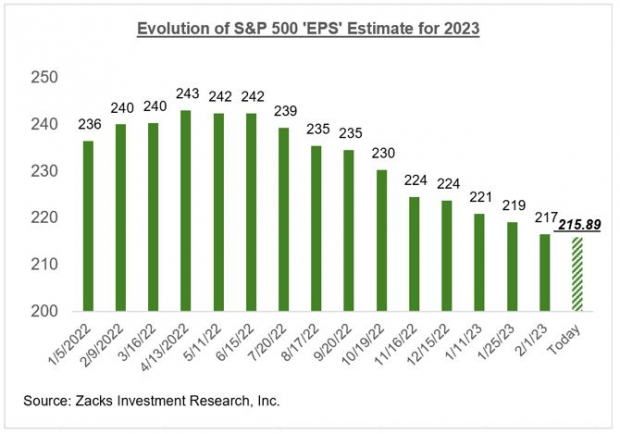

Please keep in mind that the $1.915 trillion in anticipated accumulated incomes for the index in 2023 approximate to an index ‘EPS’ of $215.89, below $216.09 recently as well as the $216.18 tally we get on track to have actually seen in 2022.

The graph listed below programs this 2023 index ‘EPS’ price quote has actually progressed given that the beginning of 2022.

Photo Resource: Zacks Financial Investment Study

With the mass of the 2022 Q4 reporting cycle currently behind us, alterations have actually mainly downplayed for the following couple of weeks though the Retail market outcomes will certainly have a bearing on exactly how assumptions for that area progress.

We remain to think that a conclusive keep reading the alterations front will just arise as soon as we have actually seen an end to the Fed’s tightening up cycle as well as the influence of the advancing tightening up on financial development.

That claimed, about pre-season doom-and-gloom fears, this is a rather comforting result.

The graph listed below programs the anticipated 2022 Q4 incomes as well as income development assumption in the context of where development has actually remained in current quarters as well as what is anticipated in the following couple of quarters.

Photo Resource: Zacks Financial Investment Study

The graph listed below programs the general incomes image on a yearly basis.

Photo Resource: Zacks Financial Investment Study

As you can see below, price quotes for 2023 are currently a hair listed below the 2022 degree.

For even more information concerning the advancing incomes image, please look into our regular Incomes Fads report below >>>> > > > > Making Sense of Earnings Estimate Revisions for Q1 FY23 and Beyond

4 Oil Supplies with Enormous Advantages

International need for oil is via the roofing system … as well as oil manufacturers are battling to maintain. So although oil rates are well off their current highs, you can anticipate large make money from the business that provide the globe with “black gold.”

Zacks Financial investment Study has actually simply launched an immediate unique record to aid you rely on this fad.

In Oil Market ablaze, you’ll uncover 4 unforeseen oil as well as gas supplies placed for large gains in the coming weeks as well as months. You do not wish to miss out on these referrals.

Download your free report now to see them.

Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints revealed here are the sights as well as viewpoints of the writer as well as do not always show those of Nasdaq, Inc.