The experts covering Nvidia NVDA are having a hard time ahead up with superlatives to explain the chipmaker’s hit quarterly outcomes. Entering Nvidia’s Might 26 th quarterly numbers, lots of experts saw some advantage to agreement price quotes, provided the firm’s AI take advantage of. Yet the supply had actually currently increased this year prior to the Wednesday launch on those AI hopes.

It is humbling to recognize that I believed the supply was ‘valued for excellence’ as well as was hesitant that Nvidia can do anything in the quarterly numbers that can please those soaring assumptions. Bear in mind that we drop in the Nvidia ‘follower club,’ having actually held the supply in the Zacks Focus List portfolio considering that Might 2019.

The supply’s efficiency considering that the quarterly launch remains in a course of its very own, as well as completely factors. In the existing unclear macroeconomic setting, Nvidia increased Q2 profits support by greater than +50% on the back of durable data-center need mirroring energy in generative AI as well as big language versions. Significantly, Nvidia showed a high level of presence in these need patterns over the coming quarters.

There are legit inquiries regarding exactly how lasting this development trajectory will certainly show to be as well as whether Nvidia will certainly have the ability to secure its first-mover benefit as the affordable landscape warms up gradually.

We have actually all glimpsed the capacity of generative AI by experimenting with ChatGPT as well as Google Poet, enabling us to visualize this modern technology’s capability to boost effectiveness. Yet it is practical to be hesitant of both the trillions of bucks in TAMs that the AI change will certainly let loose or the arising broach an ‘AI bubble.’

Nvidia is barely alone in riding the AI wave, with Microsoft MSFT as well as Alphabet GOOGL currently fighting for primacy. Alphabet’s earlier AI initiatives really did not excite the marketplace a lot, as well as lots of had actually begun assuming that Microsoft might have the ability to take advantage of AI to open Alphabet’s hang on the search market. Yet Alphabet shows up to have actually located its mojo back, as the supply’s current efficiency programs.

The graph listed below programs the year-to-date efficiency of Microsoft, Alphabet, as well as Nvidia.

Photo Resource: Zacks Financial Investment Study

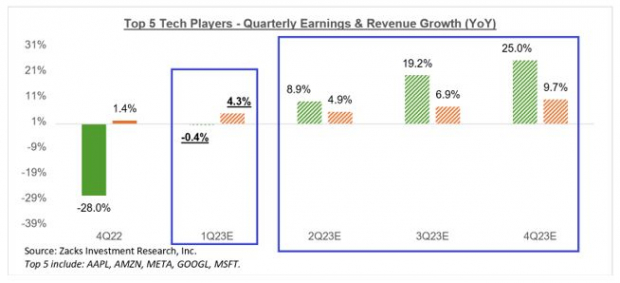

The incomes expectation for the ‘Huge 5 Technology Athletes’ that consists of Apple AAPL, Amazon.com AMZN, as well as Meta META, along with Microsoft as well as Alphabet, has actually gradually enhanced recently. Complete Q1 incomes for the team were basically level (down -0.4%) on +4.3% greater profits.

The development expectation begins enhancing from the existing duration (2023 Q2) onwards, with incomes anticipated to be up +8.9% on +4.9% greater profits.

The graph listed below programs the team’s incomes image on a quarterly basis.

Photo Resource: Zacks Financial Investment Study

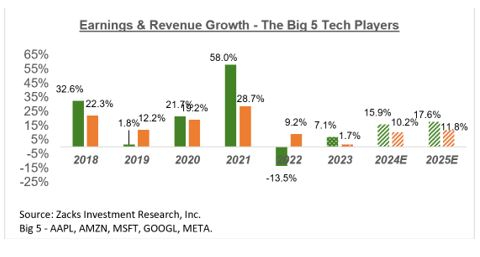

The graph listed below programs the team’s incomes image on a yearly basis.

Photo Resource: Zacks Financial Investment Study

Q1 Revenues Period Scorecard

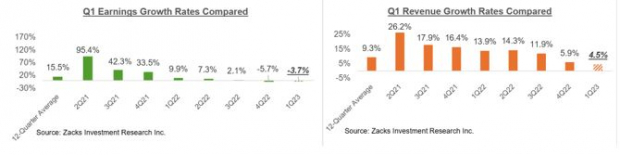

Consisting of all the quarterly records that appeared via Friday, Might 26 th, we currently have Q1 incomes from 486 S&P 500 participants, or 97.2% of the index’s overall subscription. Complete incomes for these business are down -3.7% from the exact same duration in 2014 on +4.5% greater profits, with 78.2% whipping EPS price quotes as well as 75.1% whipping profits price quotes.

The percentage of these business defeating both EPS as well as profits price quotes is 63.2%.

Routine visitors of our incomes discourse understand that we have actually been describing the total image arising from the Q1 incomes period as sufficient; not fantastic, however tolerable, either.

With this reporting cycle currently greatly behind us, we can with confidence state that business incomes aren’t headed in the direction of the ‘high cliff’ that market births cautioned us of.

The means we see it, the ‘better-than-feared’ sight of the Q1 incomes period at this phase might be a little bit unreasonable, provided exactly how resistant business earnings has actually ended up being. Yet the sight isn’t totally off the mark either.

We have concerning 100 business on deck to report outcomes, consisting of 9 S&P 500 participants. Today’s docket consists of Salesforce.com, Macy’s, Broadcom, Lululemon, Buck General, as well as others.

Listed below, we contrast the Q1 results so far from what we have actually seen from this exact same team of business in various other current durations.

The initial collection of graphes contrasts the incomes as well as profits development prices for the business that have actually reported with what we had actually seen from the team in various other current quarters.

Photo Resource: Zacks Financial Investment Study

The contrast graphes listed below placed the Q1 EPS as well as profits beats portions in a historic context.

Photo Resource: Zacks Financial Investment Study

The Revenues Broad View

To obtain a feeling of what is presently anticipated, have a look at the graph listed below that reveals existing incomes as well as profits development assumptions for the S&P 500 index for 2023 Q1 as well as the adhering to 3 quarters.

Photo Resource: Zacks Financial Investment Study

The graph listed below programs the incomes as well as profits development image on a yearly basis.

Photo Resource: Zacks Financial Investment Study

For an in-depth take a look at the total incomes image, consisting of assumptions for the coming durations, please take a look at our regular Revenues Fads report >>>> > > > > Earnings Outlook Reflects Stability

5 Supplies Ready To Dual

Each was handpicked by a Zacks professional as the # 1 preferred supply to acquire +100% or even more in 2021. Previous suggestions have actually risen +143.0%, +175.9%, +498.3% as well as +673.0%.

The majority of the supplies in this record are flying under Wall surface Road radar, which gives a fantastic chance to participate the very beginning.

Today, See These 5 Potential Home Runs >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views revealed here are the sights as well as point of views of the writer as well as do not always show those of Nasdaq, Inc.