Following their Q3 outcomes on Wednesday, Goal TGT and Nvidia NVDA are two trending shares that traders are actually taking note of.

Goal’s inventory has plunged over 20% since its lackluster Q3 report whereas Nvidia shares have been surprisingly flat regardless of topping estimates and posting one other quarterly file for income.

Picture Supply: Zacks Funding Analysis

Goal Misses Expectations

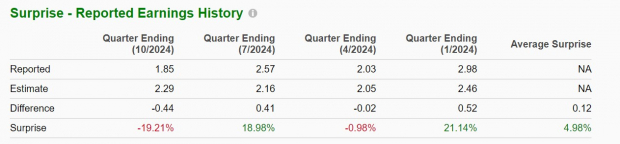

Goal highlighted strengths in site visitors and digital channels as a driver to Q3 gross sales of $25.66 billion which elevated 1% 12 months over 12 months however fell in need of estimates of $25.91 billion. Moreover, Goal CEO Brian Cornell talked about distinctive challenges and price pressures as a derailment to the corporate’s backside line with Q3 earnings of $1.85 per share falling 12% from the comparative quarter and lacking the Zacks EPS Consensus of $2.29 by -19%.

Inconsistency has had traders on the fence about Goal’s inventory with the omnichannel retailer beforehand exceeding Q2 EPS estimates by 19% in August with earnings at $2.57 per share versus expectations of $2.16.

Picture Supply: Zacks Funding Analysis

Nvidia’s Outcomes Beat Once more

Seeing continued demand for its synthetic intelligence chips, Nvidia’s Q3 gross sales spiked 93% to a file $35.08 billion in comparison with $18.12 billion a 12 months in the past. This additionally topped Q3 gross sales estimates of $33.32 billion by 5%. Extra spectacular, Q3 EPS of $0.81 doubled from $0.40 a share within the prior-year quarter and comfortably beat expectations of $0.75.

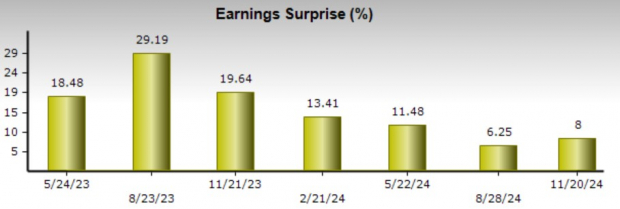

Nvidia has exceeded earnings expectations for eight straight quarters posting a median EPS shock of 9.79% in its final 4 quarterly experiences. Additional illustrating Nvidia’s dominance is that the chip big has overwhelmed prime line estimates for 23 consecutive quarters with a median gross sales shock of 6.7% in its final 4 quarterly experiences.

Picture Supply: Zacks Funding Analysis

Goal’s Steering

Offering EPS steerage for This autumn, Goal expects adjusted earnings of $1.85-$2.45 per share which is under the present Zacks Consensus of $2.62 or a 12% decline. For its full-year fiscal 2025, Goal now initiatives an adjusted EPS vary of $8.30-$8.90, under expectations of $9.54 or 7% development. Notably, Goal expects comparable This autumn gross sales to be flat and above Zacks estimates of $30.76 billion or a 3% decline.

Nvidia’s Steering & Blackwell Replace

Providing This autumn income steerage, Nvidia expects gross sales to be at $37.5 billion plus or minus 2% with Zacks estimates at $36.84 billion. Whereas Nvidia’s steerage might have underwhelmed traders, the chipmaker acknowledged its a lot anticipated Blackwell GPUs are already offered out for the following 12 months with shipments starting this quarter and manufacturing set to ramp up subsequent 12 months.

The Blackwell GPUs are anticipated to be the highest-performance AI chips in the marketplace, forward of its earlier H200 collection and AMD’s AMD MI300 collection.

Takeaway

Nvidia’s inventory at present sports activities a Zacks Rank #1 (Sturdy Purchase) with Goal shares touchdown a Zacks Rank #3 (Maintain). With Nvidia already benefiting from a optimistic pattern of earnings estimate revisions, the chipmaker’s strong quarterly development does recommend extra upside as effectively.

In the meantime, Goal shares are buying and selling at their least expensive P/E valuation in over a decade though there may nonetheless be higher shopping for alternatives forward contemplating the retailers subpar Q3 outcomes.

Analysis Chief Names “Single Finest Decide to Double”

From hundreds of shares, 5 Zacks specialists every have chosen their favourite to skyrocket +100% or extra in months to return. From these 5, Director of Analysis Sheraz Mian hand-picks one to have probably the most explosive upside of all.

This firm targets millennial and Gen Z audiences, producing practically $1 billion in income final quarter alone. A latest pullback makes now a really perfect time to leap aboard. In fact, all our elite picks aren’t winners however this one may far surpass earlier Zacks’ Shares Set to Double like Nano-X Imaging which shot up +129.6% in little greater than 9 months.

Free: See Our Top Stock And 4 Runners Up

Target Corporation (TGT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.