The FedEx FDX disappointment probably has some company-specific elements, however it’s affordable to see this report as offering a read-through for the broader economic system that has proven indicators of moderation these days. In actual fact, these indicators of macroeconomic softness prompted the U.S. Fed to return out with an even bigger rate of interest than many out there anticipated just some weeks in the past.

FedEx missed on the top- and bottom-lines and guided decrease, with a number of analysts masking the inventory skeptical of the corporate’s capability to satisfy even the lowered steerage. Margins have been underneath strain as FedEx’s earnings declined -23% from the year-earlier interval on -0.5% decrease revenues. The corporate cited weak demand as a key driver of the earnings miss, however this issue is probably going weighing on pricing traits as properly.

The FedEx report was for its fiscal first quarter that led to August, which we and different knowledge distributors take into account a part of the September-quarter tally. The leads to current days from Oracle ORCL and Lennar LEN have been additionally for the businesses’ fiscal quarters ending in August and, subsequently, get counted as a part of our general 2024 Q3 earnings season tally. Of those two, the Oracle report was actually spectacular, with the firm legitimately staking its declare as a notable participant within the rising synthetic intelligence (AI) wrestle.

Together with FedEx, Oracle, and Lennar, we have now seen such early Q3 earnings outcomes from 7 S&P 500 members, with one other 7 index members on deck to report outcomes this week. Costco, Micron, and Accenture are among the notable corporations reporting outcomes. By the point the Q3 earnings season actually takes the highlight when the massive banks begin reporting their quarterly outcomes from October 11th onwards, we can have such early outcomes from nearly two dozen index members.

The Earnings Huge Image

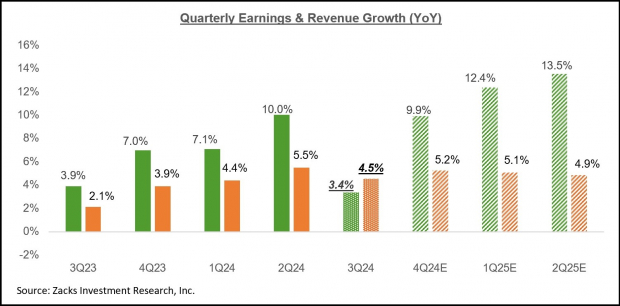

Whole Q3 earnings for the S&P 500 index are anticipated to be up +3.4% from the identical interval final yr on +4.5% larger revenues. This could comply with the +10% earnings development for the index within the previous interval on +5.5% larger revenues.

Common readers of our earnings commentary are accustomed to our sanguine view on company profitability; the earnings image isn’t nice, however it isn’t unhealthy both.

The one current detrimental improvement on this entrance is the reversal of the sooner favorable revisions development that we have now usually flagged in our commentary. This detrimental revisions development is especially notable with respect to expectations for 2024 Q3, with earnings estimates for the interval getting revised down much more than we had seen in different current durations. You may see this within the chart under that tracks the evolution of Q3 earnings development expectations during the last couple of months.

Picture Supply: Zacks Funding Analysis

Not solely is the magnitude of cuts to Q3 estimates larger than what we noticed within the comparable durations for the final three quarters, however additionally it is widespread and never concentrated in a single or just a few sectors.

Of the 16 Zacks sectors, estimates have been revised down for 14 sectors, with the Transportation, Power, Enterprise Providers, and Aerospace sectors struggling the most important declines. The Tech and Finance sectors are the one ones whose estimates have modestly risen because the interval started.

The chart under reveals the Q3 earnings and income development expectations within the context of what we noticed in precise outcomes over the previous 4 quarters and what’s anticipated over the next three quarters.

Picture Supply: Zacks Funding Analysis

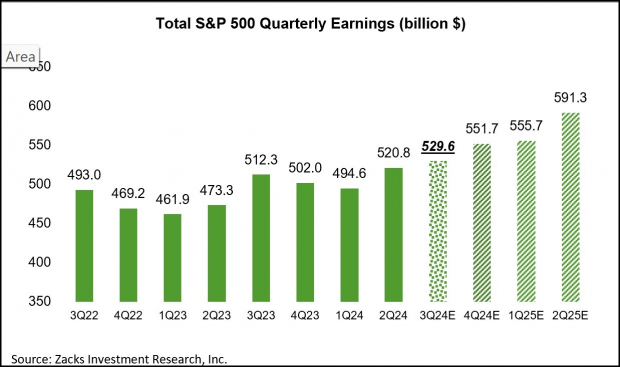

However the aforementioned detrimental revisions development, the expectation is for an accelerating development development over the approaching durations. Additionally, the combination earnings whole for the interval is predicted to be a brand new all-time quarterly file, because the chart under reveals.

Picture Supply: Zacks Funding Analysis

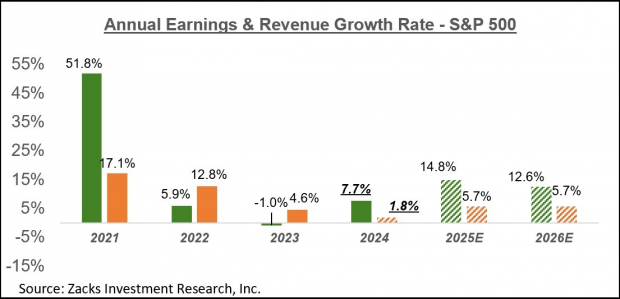

The chart under reveals the general earnings image on a calendar-year foundation, with the +7.7% earnings development this yr adopted by double-digit positive aspects in 2025 and 2026.

Picture Supply: Zacks Funding Analysis

Please notice that this yr’s +7.7% earnings development improves to +9.6% on an ex-Power foundation.

Expectations for the Magnificent 7 and the Tech Sector

Tesla would be the first Magazine 7 firm to report Q3 outcomes on October 16th, with most of its friends within the elite grouping reporting within the following two weeks.

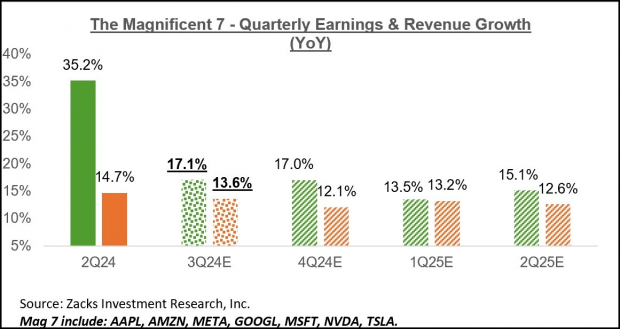

For Q3, Magazine 7 earnings are anticipated to be up +17.1% from the identical interval final yr on +13.6% larger revenues. The chart under reveals the group’s Q3 earnings and income development expectations within the context of what we noticed within the previous interval and what’s anticipated within the coming three quarters.

Picture Supply: Zacks Funding Analysis

Q3 earnings from the Magazine 7 will account for 21.4% of all S&P 500 earnings within the quarter. Excluding the Magazine 7 contribution, Q3 earnings for the remainder of the index could be basically flat (up +0.2%).

On an annual foundation, Magazine 7 earnings are anticipated to be up +30.7% this yr on +10% larger revenues, with earnings anticipated to be up +16.2% in 2025 and +17.4% in 2026.

Excluding the Magazine 7, 2024 earnings for the remainder of the S&P 500 index could be up +2.6% (+7.7% in any other case).

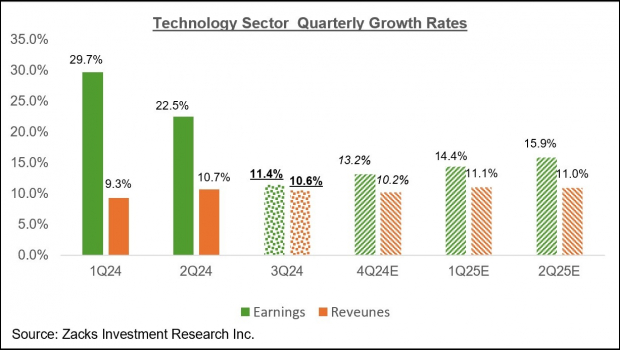

For the Zacks Tech sector, Q3 earnings are anticipated to be up +11.4% from the identical interval final yr on +10.6% larger revenues. The chart under reveals the sector’s earnings and income development expectations on a quarterly foundation.

Picture Supply: Zacks Funding Analysis

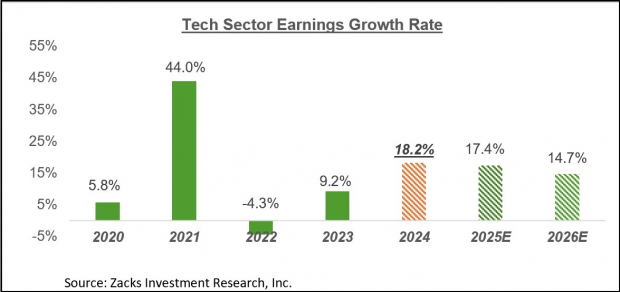

The chart under reveals the sector’s earnings development on an annual foundation.

Picture Supply: Zacks Funding Analysis

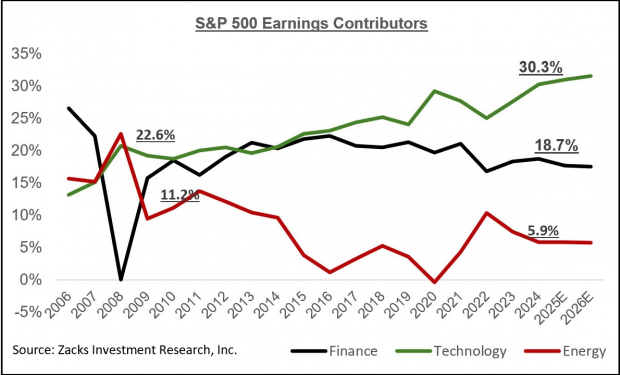

The U.S. inventory market is exclusive inside the OECD group, because the Tech sector accounts for 39.1% of the S&P 500 index (by market capitalization). The sector shouldn’t be solely very worthwhile but in addition having fun with strong and sustainable development momentum.

The chart under reveals the earnings contribution of the Zacks Tech sector relative to the identical by the Zacks Finance and Power sectors.

Picture Supply: Zacks Funding Analysis

For an in depth take a look at the general earnings image, together with expectations for the approaching durations, please take a look at our weekly Earnings Developments report >>>> The Q3 Earnings Season Gets Underway

5 Shares Set to Double

Every was handpicked by a Zacks professional because the #1 favourite inventory to achieve +100% or extra in 2024. Whereas not all picks might be winners, earlier suggestions have soared +143.0%, +175.9%, +498.3% and +673.0%.

A lot of the shares on this report are flying underneath Wall Road radar, which gives an important alternative to get in on the bottom flooring.

Today, See These 5 Potential Home Runs >>

Oracle Corporation (ORCL) : Free Stock Analysis Report

FedEx Corporation (FDX) : Free Stock Analysis Report

Lennar Corporation (LEN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.