The Q3 earnings season will take the highlight when the large banks begin reporting their quarterly outcomes from October 11th onwards. Nonetheless, we rely the ‘official’ begin of the Q3 reporting cycle a lot earlier, when corporations with fiscal quarters ending in August come out with quarterly outcomes.

The ends in latest days from Oracle ORCL and Adobe ADBE fall on this class and, subsequently, get counted as a part of the general 2024 Q3 earnings season tally. Of those two, the Oracle report was actually spectacular, with the firm legitimately staking its declare as a notable participant within the rising synthetic intelligence (AI) wrestle.

The Adobe outcomes have been additionally pretty robust, with earnings rising by +25.8% from the identical interval final 12 months on +6.9% greater revenues, however the inventory misplaced floor on the report as a result of underwhelming steering.

Adobe shares have been up huge following the final quarterly launch in June however have been down in response to every of the three quarterly studies earlier than that. Adobe shares are down -10.5% this 12 months, lagging the Zacks Tech sector’s +18.9% achieve and the S&P 500 index’s +17.1% achieve.

Oracle shares’ favorable response to the September 9th report builds on the inventory’s spectacular momentum this 12 months. The inventory is now up +55.4% this 12 months, handily outperforming the Tech sector and the broader market, with many out there seeing the inventory’s ongoing momentum as very a lot sustainable.

We’ve one other 5 S&P 500 members on deck to report such August-quarter outcomes this week, together with Lennar LEN and FedEx FDX after the market’s shut on Thursday, September 19th.

We talk about expectations for Lennar and the broader homebuilder area later on this be aware, however we first need to have a look at evolving earnings expectations for 2024 Q3 as a complete.

The Earnings Massive Image

Whole Q3 earnings for the S&P 500 index are anticipated to be up +3.8% from the identical interval final 12 months on +4.6% greater revenues. This might observe the +10% earnings progress for the index within the previous interval on +5.5% greater revenues.

Common readers of our earnings commentary are conversant in our sanguine view on company profitability – the earnings image isn’t nice, nevertheless it isn’t dangerous both.

The one latest unfavorable improvement on this entrance is the reversal of the sooner favorable revisions development that we now have usually flagged in our commentary. This unfavorable revisions development is especially notable regarding expectations for 2024 Q3, with earnings estimates for the interval getting revised down rather more than we had seen in different latest intervals. You may see this within the chart beneath that tracks the evolution of Q3 earnings progress expectations during the last couple of months.

Picture Supply: Zacks Funding Analysis

Not solely is the magnitude of cuts to Q3 estimates greater than what we noticed within the comparable intervals for the final three quarters, however additionally it is widespread and never concentrated in a single or just a few sectors.

Of the 16 Zacks sectors, estimates have been revised down for 14 sectors, with the Transportation, Power, Enterprise Providers, and Aerospace sectors struggling the largest declines. The Tech and Finance sectors are the one sectors whose estimates have modestly risen because the interval received underway.

The chart beneath exhibits the Q3 earnings and income progress expectations within the context of what we noticed in precise outcomes over the previous 4 quarters and what’s anticipated over the next three quarters.

Picture Supply: Zacks Funding Analysis

However the aforementioned unfavorable revisions development, the expectation is for an accelerating progress development over the approaching intervals. Additionally, the combination earnings whole for the interval is predicted to be a brand new all-time quarterly report, because the chart beneath exhibits.

Picture Supply: Zacks Funding Analysis

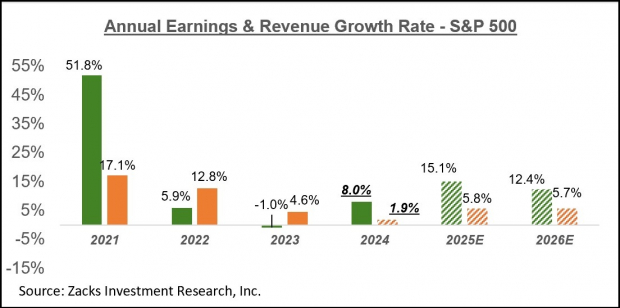

The chart beneath exhibits the general earnings image on a calendar-year foundation, with the +8% earnings progress this 12 months adopted by double-digit features in 2025 and 2026.

Picture Supply: Zacks Funding Analysis

Please be aware that this 12 months’s +8% earnings progress improves to +9.7% on an ex-Power foundation.

Expectations for LEN and the Development Sector

Lennar is predicted to usher in $3.62 per share in earnings on $9.29 billion in revenues, representing year-over-year adjustments of -7.4% and +6.4%, respectively. Estimates have been below strain currently, with the present $3.62 EPS estimate down -4% during the last three months.

Elevated rates of interest have been a big headwind for this interest-rate-sensitive enterprise. Because of this, the earnings outlook for Lennar and the broader homebuilder area has been below strain ever since mortgage charges rose in response to Fed tightening. However with the central financial institution on the cusp of beginning to ease coverage, the outlook for the group has been steadily bettering.

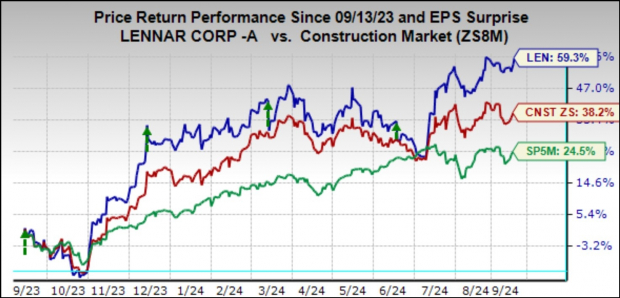

These hopes of a positive rate of interest backdrop within the days forward have been serving to Lennar and the shares of different homebuilders achieve floor currently. The chart beneath exhibits the efficiency of Lennar, the Zacks Development sector, and the S&P 500 index during the last 12 months.

Picture Supply: Zacks Funding Analysis

For 2024 Q3, whole earnings for the Zacks Development sector are anticipated to be down -3% on +3.7% greater revenues. This might observe the sector’s +5.6% earnings progress on +4.4% greater revenues.

For full-year 2024, whole earnings for the Zacks Development sector are anticipated to be up +1.1% from the 2023 degree on +4.6% income progress. Earnings for the sector have been down -6.5% in 2023, which adopted +21.5% earnings progress in 2022 and +45% in 2021.

The chart beneath exhibits the sector’s combination earnings on an annual foundation.

Picture Supply: Zacks Funding Analysis

As you may see above, the area’s profitability has bottomed already, with progress resuming from subsequent 12 months onwards.

For an in depth have a look at the general earnings image, together with expectations for the approaching intervals, please try our weekly Earnings Developments report >>>> What Will the Q3 Earnings Season Show?

Zacks Names #1 Semiconductor Inventory

It is only one/9,000th the dimensions of NVIDIA which skyrocketed greater than +800% since we beneficial it. NVIDIA remains to be robust, however our new high chip inventory has rather more room to growth.

With robust earnings progress and an increasing buyer base, it is positioned to feed the rampant demand for Synthetic Intelligence, Machine Studying, and Web of Issues. International semiconductor manufacturing is projected to blow up from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Oracle Corporation (ORCL) : Free Stock Analysis Report

Adobe Inc. (ADBE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.