The earnings focus continues to be on the retail house, with a number of bellwether operators on deck to report outcomes this week, together with Goal TGT, Finest Purchase BBY, Costco COST, Macy’s M, and others.

The earnings releases to date present a reassuring view of client spending, with broad spending traits largely secure and in-line with what we’ve got seen in latest quarters. Whereas the newest client confidence readings present a pullback on this key measure, the comparatively longer-run pattern stays favorable, reflecting the sturdy labor market and regular wage good points.

In latest quarters, we’ve got seen that gathered inflation has been a drag on client spending. This has been notably notable on the decrease finish of earnings distribution, however it has prompted most shoppers to be worth oriented and spend totally on necessities. Spending on client sturdy items and different discretionary items classes has been anemic in latest quarters, and we are going to see extra affirmation of that pattern on this week’s Goal and Finest Purchase outcomes.

The chart beneath reveals the one-year efficiency of Goal (blue line; down -19%), Finest Purchase (orange line; up +11.1%), Costco (crimson line; up +37.8%) and the S&P 500 index (inexperienced line; up +16.6%).

Picture Supply: Zacks Funding Analysis

As you may see above, Goal shares have been down massive following the final quarterly launch on November 20th when it missed all estimates, together with comps. Administration had indicated optimistic gross sales momentum throughout the first two months of the quarter on the mid-January replace. Nevertheless, demand traits softened in January, and that pattern seemingly continued in February.

The expectation is for Goal will report $2.24 per share in earnings on $30.77 billion in revenues, which characterize year-over-year modifications of -24.8% and -3.6%, respectively. Estimates had modestly inched up following the mid-January administration replace, however have remained unchanged since then. Comps are anticipated to be up +1.2%, which might observe the corporate’s disappointing exhibiting on this depend within the previous interval when it had come out with +0.30% comp progress vs. expectations of +1.53%.

With Goal shares buying and selling close to their 52-week lows, sentiment is probably going weak sufficient to restrict additional draw back dangers. Given the inventory’s historical past of massive strikes on quarterly releases, it seemingly wouldn’t take a lot to push the inventory increased following the Tuesday morning earnings print.

Finest Purchase is anticipated to return out with EPS of $2.39 on $13.65 billion in revenues Tuesday morning, representing year-over-year modifications of -12.1% and -6.8%, respectively. Regarding same-store gross sales, the expectation is for -1.54% decline, which is able to observe the -2.9% decline within the final quarterly launch on November 26th. The inventory was down following the November launch because the Q3 comp had missed expectations in an enormous method.

All indications are that Finest Purchase’s This autumn outcomes will characterize a sequential enchancment, with energetic promotions throughout the holidays juicing gross sales exercise. However there isn’t any escaping the general weak point in absolute phrases, with revenues in 2024 (fiscal yr resulted in January 2025) of $41.2 billion down -5.1% from the year-earlier stage. In actual fact, revenues have been a gentle downtrend for the reason that Covid peak of 2021 (fiscal yr that resulted in January 2022) of $51.76 billion. The revenues within the following years have been $46.3 billion in 2022 (fiscal yr that resulted in January 2023), $43.5 billion in 2023, and the aforementioned $41.2 billion anticipated in 2024.

The expectation is that revenues will begin rising this yr, with the present Zacks Consensus estimate of $41.76 billion representing a +1.3% achieve. Whereas demand for many of Finest Purchase’s equipment and different durables classes stays weak, the demand outlook for computer systems and smartphones stays favorable, reflecting new AI-centric choices and typical product replacements. We noticed a few of this within the previous interval already, and this quarter seemingly skilled an acceleration in that pattern. The inventory’s roughly in-line efficiency with the broader market displays this constructive view.

Costco has been a real class chief, with a higher-income buyer group that’s loyal to the corporate’s worth choices. This truth was reconfirmed by the corporate’s January same-store gross sales information, with company-wide comps for the month of +7.5%, representing +7.1% achieve in visitors and +0.4% achieve in common ticket value.

Costco is anticipated to report $4.09 per share in earnings on $63.2 billion in revenues, representing year-over-year modifications of +10.2% and +63.2%, respectively. Estimates have inched up for the reason that quarter obtained underway, with the present $4.09 estimate up from $4.06 a month again and $3.97 three months in the past. Costco’s earnings and revenues within the present fiscal yr (ends in August 2025) are anticipated to extend +11.9% and +7.4% from the previous yr’s stage, respectively. The corporate stays nicely positioned to maintain this progress momentum the next yr on the again of mid-single digit comp progress and progress in membership payment earnings in high-single digits.

With respect to the Retail sector’s 2024 This autumn earnings season scorecard, we now have outcomes from 26 of the 33 retailers within the S&P 500 index. Common readers know that Zacks has a devoted stand-alone financial sector for the retail house, which is not like the location of the house within the Shopper Staples and Shopper Discretionary sectors within the Commonplace & Poor’s normal trade classification. The Zacks Retail sector contains Goal, Finest Purchase, and different conventional retailers, on-line distributors like Amazon (AMZN), and restaurant gamers.

Whole This autumn earnings for these 26 retailers which have reported are up +32.2% from the identical interval final yr on +6.9% increased revenues, with 73.1% beating EPS estimates and an equal proportion beating income estimates.

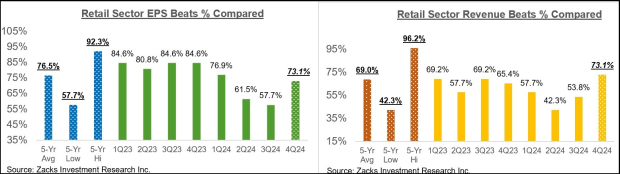

The comparability charts beneath put the This autumn beats percentages for these retailers in a historic context.

Picture Supply: Zacks Funding Analysis

As you may see above, the proportion of those firms beating consensus EPS estimates represents a notable enchancment over what we had seen from this group of Retail sector firms within the previous two quarters, however in any other case stays beneath the typical for the previous 20 quarters. The income beats share for this group of firms is monitoring above different latest intervals in addition to the historic common.

With respect to the elevated earnings progress fee at this stage, we like to point out the group’s efficiency with and with out Amazon, whose outcomes are among the many 26 firms which have reported already. As we all know, Amazon’s This autumn earnings have been up +86.9% on +10.5% increased revenues, because it beat EPS and income expectations.

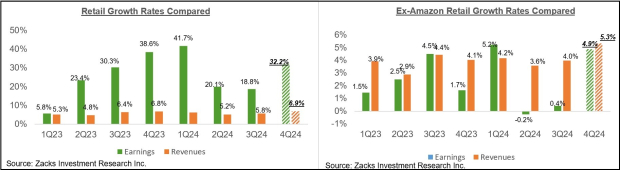

The 2 comparability charts beneath present the This autumn earnings and income progress relative to different latest intervals, each with Amazon’s outcomes (left aspect chart) and with out Amazon’s numbers (proper aspect chart)

Picture Supply: Zacks Funding Analysis

As you may see above, many of the earnings progress at this stage for the Retail sector is coming from Amazon, with This autumn earnings for the remainder of the group which have reported up solely +4.9% on +5.3% increased revenues. There may be first rate top-line progress even on an ex-Amazon foundation, successfully reflecting headline inflationary traits within the economic system.

This autumn Earnings Season Scorecard

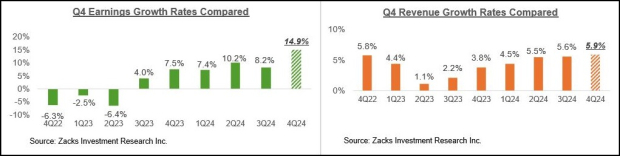

By means of Friday, February 28th, we’ve got seen This autumn outcomes from 485 S&P 500 members or 97% of the index’s complete membership. Whole earnings for these firms are up +14.9% from the identical interval final yr on +5.9% increased revenues, with 76.3% beating EPS estimates and 65.4% beating income estimates.

The comparability charts beneath put the This autumn earnings and income progress charges relative to different latest intervals for a similar group of index members.

Picture Supply: Zacks Funding Analysis

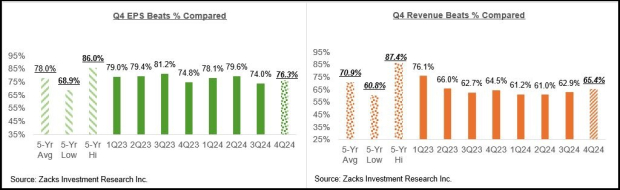

The comparability charts beneath put the This autumn EPS and income beats percentages relative to different latest intervals for a similar group of firms.

Picture Supply: Zacks Funding Analysis

The Earnings Massive Image

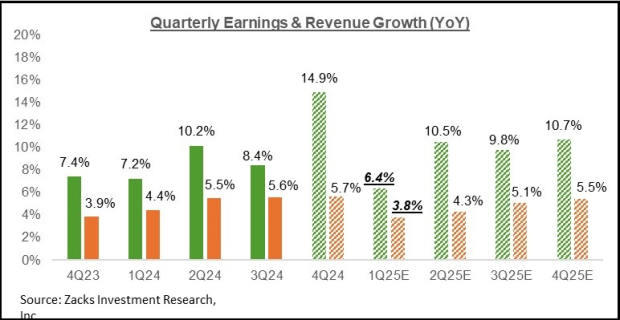

The chart beneath reveals the This autumn earnings and income progress expectations within the context of the place progress has been within the previous 4 quarters and what’s anticipated within the coming 4 quarters.

Picture Supply: Zacks Funding Analysis

Excluding the contribution from the Magazine 7 firms, This autumn earnings for the remainder of the S&P 500 index could be up +10.1% on +4.7% increased revenues.

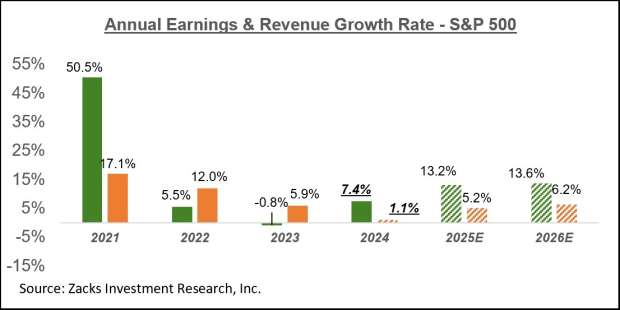

The chart beneath reveals the general earnings image on a calendar-year foundation, with double-digit earnings progress anticipated in 2025 and 2026.

Picture Supply: Zacks Funding Analysis

For an in depth take a look at the general earnings image, together with expectations for the approaching intervals, please try our weekly Earnings Developments report >>>> Retail Earnings: An In-Depth Analysis

7 Finest Shares for the Subsequent 30 Days

Simply launched: Consultants distill 7 elite shares from the present listing of 220 Zacks Rank #1 Robust Buys. They deem these tickers “Most Doubtless for Early Worth Pops.”

Since 1988, the complete listing has crushed the market greater than 2X over with a mean achieve of +24.3% per yr. So make sure you give these hand picked 7 your speedy consideration.

Macy’s, Inc. (M) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Best Buy Co., Inc. (BBY) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.