The U.S. housing market is attempting to bounce again after a troublesome 2023 and the primary half of this yr. Homebuilder confidence rebounded in September after hitting a low previously 4 months. Additionally, housing begins and constructing permits rebounded, bringing a glimmer of hope to the housing sector.

The Federal Reserve’s fee lower goes to assist the sector within the close to time period as mortgage charges are more likely to decline additional. It will thus be prudent to put money into homebuilding shares. We’ve got narrowed our search to 4 homebuilding shares, comparable to PulteGroup PHM, Meritage Properties Company MTH, M/I Properties, Inc. MHO and Century Communities, Inc. CCS, with upside potential for 2024.

Every of those shares has a Zacks Rank #1 (Robust Purchase) or #2 (Purchase). You’ll be able to see the complete list of today’s Zacks #1 Rank stocks here.

Homebuilder Confidence Rebounds

In line with the Nationwide Affiliation of Dwelling Builders (NAHB)/Wells Fargo’s Housing Market Index (HMI), confidence amongst U.S. homebuilders for newly constructed single-family properties jumped to 41 in September from 39 within the earlier month.

Mortgage charges have fallen to their lowest degree since February, giving a lift to homebuilders’ sentiment. The 30-year mounted fee mortgage for the week ended Sept. 12 was 6.2% in contrast with 7.18% a yr in the past.

Mortgage charges hit their highest degree of seven.76% in October final yr. Nevertheless, mortgage charges have declined considerably since then.

Housing Begins, Constructing Permits Bounce

The Commerce Division reported on Wednesday that housing begins for privately owned properties elevated 9.6% to an annualized fee of 1.356 million in August, beating the consensus estimate of an increase of two.9%. The soar in August housing begins follows a 3.9% decline in July to a revised fee of 1.237 million models.

12 months over yr, housing begins jumped 3.9% in August. Single-family housing begins, representing the vast majority of the housing market, rose 15.8% in August in comparison with July, reaching 992,000 models.

Apart from, residential constructing permits for August — an indicator of building exercise — rose 4.9% from the prior month to an annualized fee of 1.475 million models. The August figures additionally got here in larger than the consensus estimate of an increase of 4.6% to 1.410 million models. Additionally, permits for single-family properties had been up 2.8% final month from July however down 0.5% yr over yr.

The figures had been launched on the day the Federal Reserve introduced its first fee lower since March 2020.

Charge Cuts to Enhance Homebuilder Shares

The Federal Reserve introduced a 50-basis level fee lower, its largest since 2008, a lot to the reduction of thousands and thousands of Individuals. The monetary neighborhood was assured a couple of 25-basis level fee lower, with some hopeful a couple of greater discount.

A 50-basis level fee lower is being seen as an aggressive step by the Federal Reserve to assist the economic system and make a softer touchdown. The massive fee lower is predicted to spice up the housing market, which accounts for 3.1% of the GDP.

Increased constructing prices have been a headwind for the development sector, which is posing a serious problem to housing affordability. Increased mortgage charges noticed consumers shying away from buying properties over the previous two years.

Nevertheless, with the Fed’s huge fee lower, mortgage charges are more likely to decline additional and assist the homebuilding market.

Homebuilder Shares With Development Potential

PulteGroup

PulteGroup engages in homebuilding and monetary providers companies, primarily in the US. PHM conducts operations by means of two major enterprise segments — Homebuilding (which accounted for 97.2% of 2021 whole revenues) and Monetary Companies (2.8%). PulteGroup’s Homebuilding section presents all kinds of residence designs, together with single-family indifferent, townhouses, condominiums and duplexes at completely different costs, with a wide range of choices and facilities to all main buyer segments: first-time, move-up and energetic grownup.

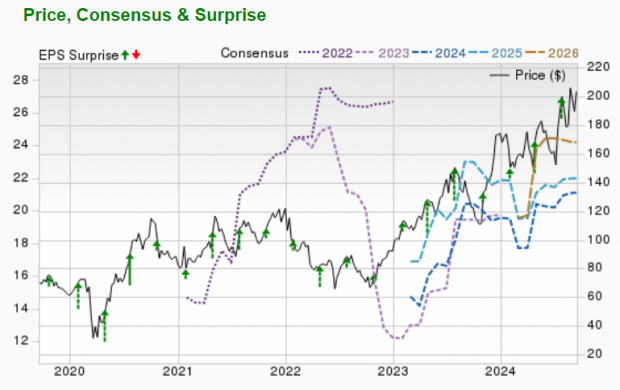

PulteGroup’s anticipated earnings development fee for the present yr is 14%. The Zacks Consensus Estimate for current-year earnings has improved 5.2% over the previous 60 days. PHM has a Zacks Rank #2.

Picture Supply: Zacks Funding Analysis

Meritage Properties

Meritage Properties is among the main designers and builders of single-family properties. The corporate primarily engages in constructing and promoting single-family properties for entry-level, first-time, move-up, luxurious and energetic grownup consumers in traditionally high-growth areas of the US.

Meritage Properties’ anticipated earnings development fee for the present yr is 6.1%. The Zacks Consensus Estimate for current-year earnings has improved 4% over the previous 60 days. MTH presently has a Zacks Rank #2.

Picture Supply: Zacks Funding Analysis

M/I Properties, Inc.

M/I Properties, Inc. is among the nation’s main builders of single-family properties. MHO has established an exemplary status based mostly on a robust dedication to superior customer support, modern design, high quality building and premium areas. M/I Properties serves a broad section of the housing market, together with first-time, move-up, luxurious and empty-nester consumers. MHO designs, markets, constructs and sells single-family properties and connected townhomes to first-time, move-up, empty-nester and luxurious consumers.

M/I Properties’ anticipated earnings development fee for the present yr is 21.9%. The Zacks Consensus Estimate for current-year earnings has improved 8.7% over the previous 60 days. MHO carries a Zacks Rank #2.

Picture Supply: Zacks Funding Analysis

Century Communities

Century Communities is a house constructing and building firm. CCS’ actions comprise land acquisition, growth and entitlements, and the acquisition, growth, building, advertising and marketing, and sale of assorted single-family indifferent and connected residential residence initiatives.

Century Communities’anticipated earnings development fee for the present yr is 32.5%. The Zacks Consensus Estimate for current-year earnings has improved 5.9% over the previous 60 days. CCS presently sports activities a Zacks Rank #1.

Picture Supply: Zacks Funding Analysis

5 Shares Set to Double

Every was handpicked by a Zacks knowledgeable because the #1 favourite inventory to achieve +100% or extra in 2024. Whereas not all picks will be winners, earlier suggestions have soared +143.0%, +175.9%, +498.3% and +673.0%.

Many of the shares on this report are flying underneath Wall Road radar, which offers an amazing alternative to get in on the bottom ground.

Today, See These 5 Potential Home Runs >>

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

Century Communities, Inc. (CCS) : Free Stock Analysis Report

M/I Homes, Inc. (MHO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.